Plume Research Report: The New Cornerstone of RWA On-Chain

1. What is Plume?

Plume is a modular EVM public chain designed specifically for Real World Assets (RWAs). How to really move real estate, gold, carbon credits, bonds, and other things to the chain for circulation.

Unlike many projects that talk about the concept of RWA today, Plume does a full-stack infrastructure: from compliance launch, hosting, data standards, to on-chain transactions and cross-chain circulation, everything is taken care of. It claims to be the operating system of RWAfi.

Currently, the Plume ecosystem has settled in 180+ projects with a TVL of hundreds of millions of dollars, and has also cooperated with Tron to allow RWA income to circulate across chains. For a new chain that only received financing in 2024, this is not a low start.

2. Why is it like XRP, ADA, XLM?

Plume's positioning is actually a bit similar to what these old projects wanted to do back then.

➤XRP wanted to solve cross-border payments back then, and the logic was that the chain was faster than SWIFT;

➤ADA emphasizes compliance, governance and underlying architecture, and wants to become a financial-grade public chain;

➤XLM wants to be a global network for asset tokenization and micropayments.

Plume's entry point is right on this extension line: it is to build an on-chain foundation for real finance.

If XRP is an on-chain payment, XLM is an on-chain asset, and ADA is an on-chain governance, then Plume could be the operating system for on-chain finance.

3. Technical highlights

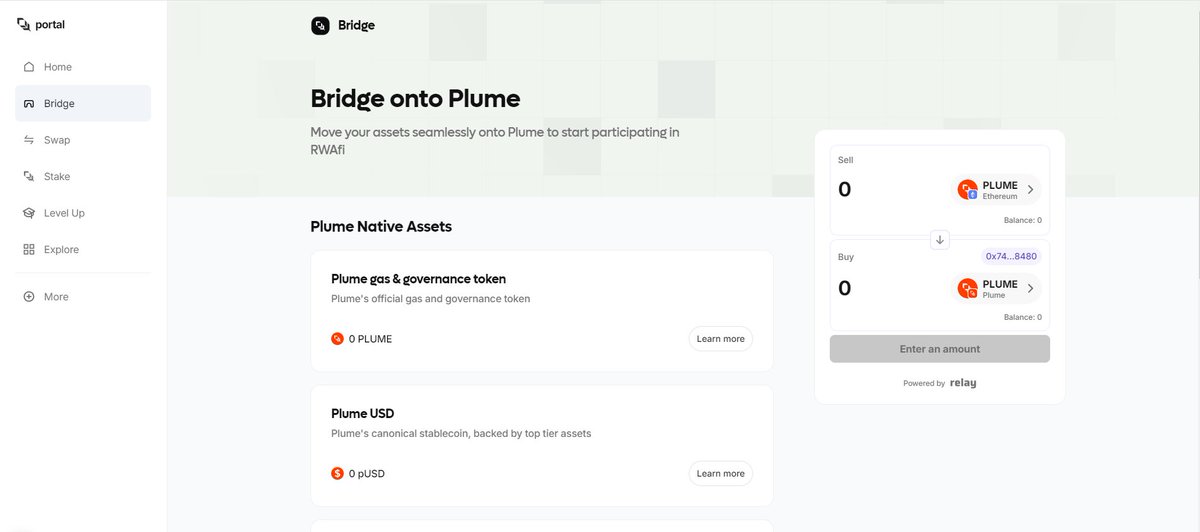

1. Rollup engine - allows project parties to build a customized high-performance chain in minutes.

2. Metalayer - Cross-chain interoperability framework, supporting asset on-chain and cross-chain execution.

➤Intent Engine: Developers don't need to write complex logic, just describe the intention of "I want to transfer assets across chains".

➤ Messaging protocol: Based on Hyperlane, ensure secure and reliable interchain communication.

3. Modular design - with alt-DA such as Celestia, the performance is not afraid of explosion.

Plume splits the RWA on-chain into standard modules and combines them into a complete ecosystem.

4. The role of token $PLUME

Gas fees: PLUME is required for cross-chain and execution.

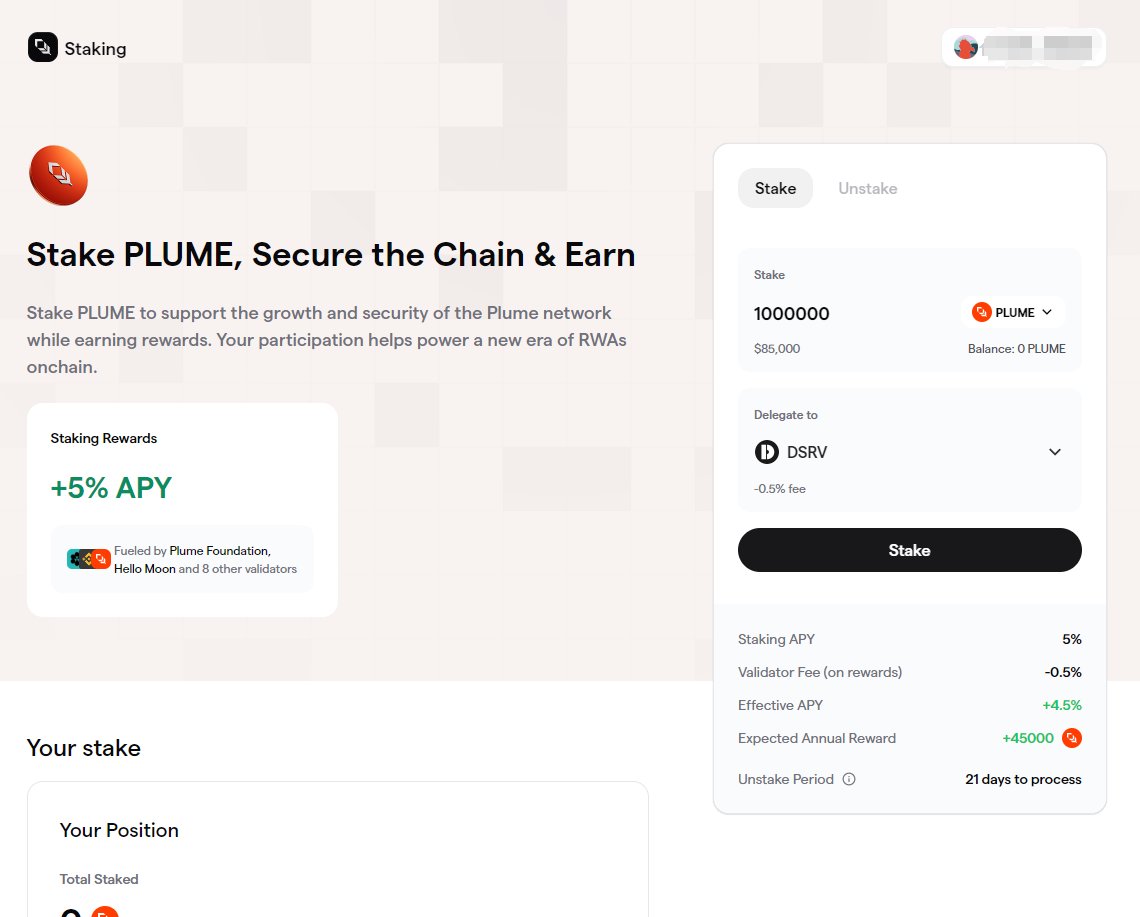

Staking: Used for network security and sub-chain security.

Governance: Holders can decide on protocol upgrades and funding direction.

Social coordination: This is relatively virtual, but the essence is to bind participants in the RWA ecosystem with tokens.

For investors: if RWAs really become the next multi-billion dollar track, $PLUME is the toll.

5. Risk points

Compliance issues: The most feared thing in the RWA field is compliance stepping on thunder. Plume must obtain a license or partner qualification, otherwise the asset on the chain may be empty talk.

Competitive pressure: The RWA track is not the only one. Like Ondo, etc. are running. Whether Plume's differentiation will be solid will take time.

Tokenomics: The current proportion of circulation is not high, and the pressure to unlock in the later stage is worth paying attention to.

6. Summary

The value of Plume is that it is the infrastructure that really lays an RWA on-chain. The reason why it is compared to XRP, ADA, XLM is because these old projects all captured a grand financial narrative back then: payment, governance, asset tokenization.

Plume combines all three and uses a more modern modular solution to undertake the entire RWAfi track.

In addition, the cliché hourly $BNB to be a holder and keep getting various new project tokens, which is also good.

More BNB uses ▶️

Show original

25.16K

26

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.