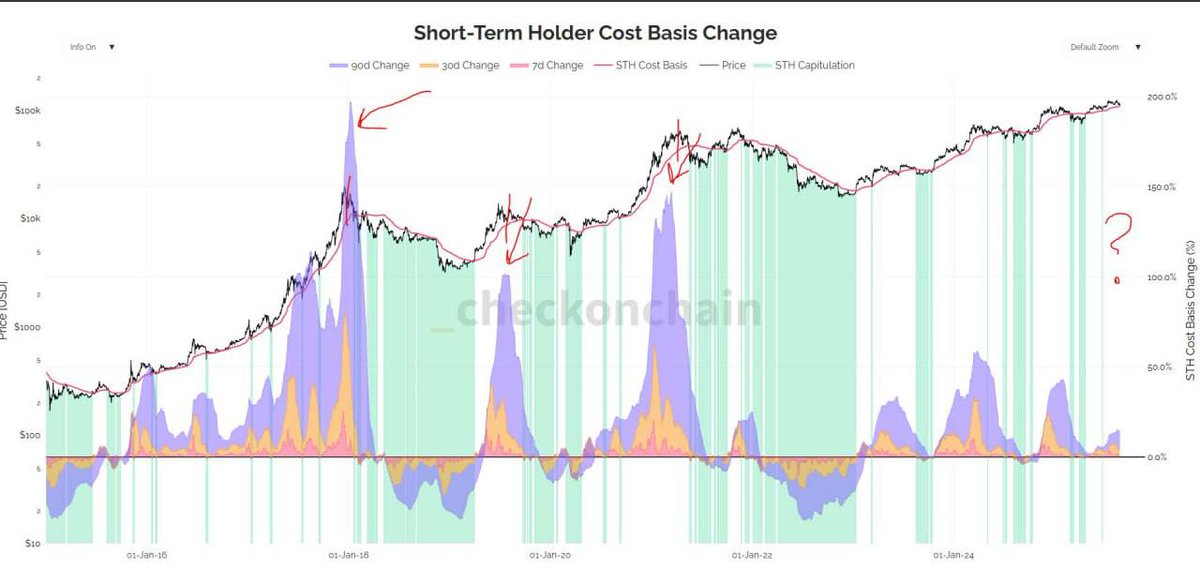

On-chain Short-Term Holders data shows that the market has not yet reached the peak of this cycle.

Comparing the % basis of Short-Term Holders at previous peaks:

Dec 2017: 7D: 23.5% | 30D: 79.1% | 90D: 197%

Mar 2021: 7D: 20.3% | 30D: 62.5% | 90D: 146%

Aug 2025: 7D: 2.7% | 30D: 6.9% | 90D: 15.2%

Looking at the chart "Short-Term Holder Cost Basis Change"

2017 & 2021 ATH:

Before the peaks, the STH basis index (7D/30D/90D change) rose sharply, reaching extremely high levels (100–200%). This is when short-term holders FOMO and inject new capital → the market heats up.

Currently in 2025: The 7D/30D/90D lines have only slightly increased (2.7% / 6.9% / 15.2%). There are no signs of a breakout → meaning no one has "dove in" strongly yet.

Main observations:

- It is not the peak of the cycle, as compared to history, the current indicators are still too low to be considered the final distribution phase.

- This also indicates that there is still a lot of room for growth, as the short-term holder basis does not yet reflect the massive FOMO from the crowd, meaning the market has not entered an overloaded state. Currently, this decline is just a pullback on the weekly frame.

$ETH IS KING

This Week in Crypto (08/24/25)

📊 Macro backdrop → Risk-On:

- Dollar Index (DXY) falls to 97 → weak USD signal.

- Gold peaks at $3,400+, 10Y yield holds at 4.3%, oil stabilizes around $64.

- This context often leads to a rotation into equities & crypto.

💰 Market overview:

- Market cap: $3.94T

- BTC: $112.8K, dominance 57% → making room for alt.

- ETF flows: BTC –$1.18B, ETH +$337.7M → clear rotation towards ETH + mid-caps.

- Stablecoin supply –$4.7B but USDe & DAI expand strongly while USDC contracts by ~–$5.2B.

🔗 On-chain & DEX:

- Ethereum, Solana, Base maintain central positions.

- Hyperliquid stands out: fees $25.2M/week, DEX vol $7B (+25.6%), TVL $2.3B (+9.5%) → despite the market stagnation.

- NFT volume cools down but Polygon & BNB gain market share.

💡 Prominent narratives:

- $ETH season is reinforced: ETF inflows, staking +279K ETH from whale OG.

- Hyperliquid breakout: fee +54% compared to 7D, ranking top revenue outside stablecoins.

- Stablecoins: FRNT (Wyoming state-backed) launches → a turning point for TradFi + DeFi.

- Web3 gaming: Football explodes with $440K/24h revenue, market cap quadruples in just one day.

- Solana SIMD-341: account compression reduces storage costs, scales up.

🚀 Outlook:

Base case: BTC sideways, rotation towards ETH + mid-caps.

If DXY remains weak, alt season could expand.

Risks: USD recovery or yield shock increase.

👉 Question: Will #ETH + mid-caps lead the next bull run, or will #BTC reclaim dominance?

5.26K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.