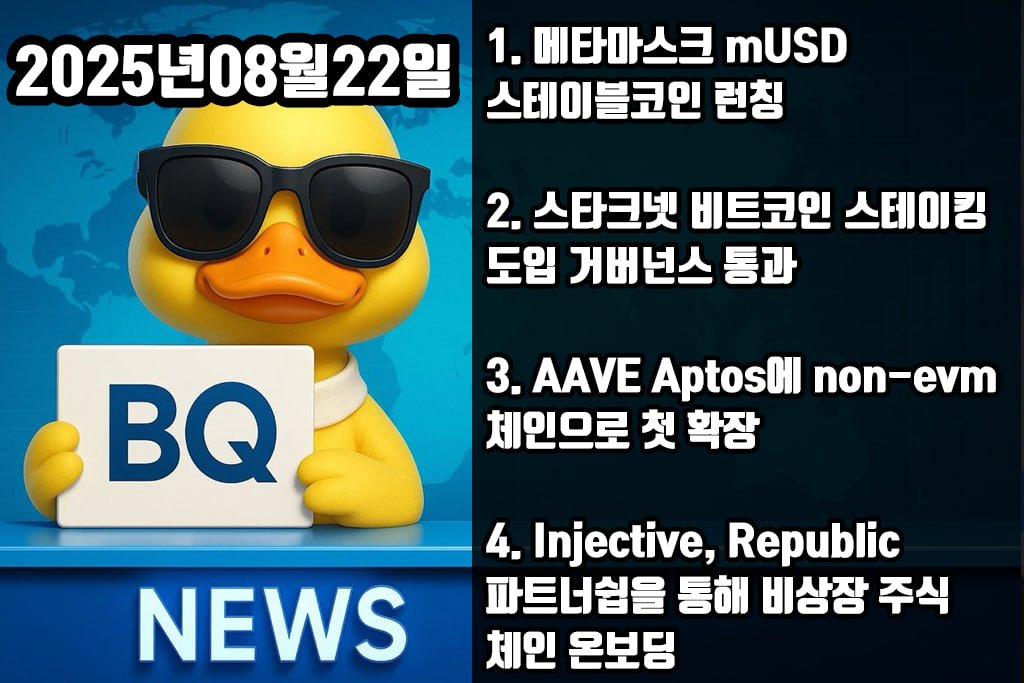

☀️ (2025.08.22) Summary and Comments on Major Cryptocurrency News

Have a great day today!

1️⃣ MetaMask Launches mUSD Stablecoin, Issued Through Stripe-Owned Platform

📌 (Summary)

-MetaMask reveals its own stablecoin, mUSD

- It will be issued through Bridge, a stablecoin issuance platform based on Stripe

- It is expected to be minted using M0

- The launch is scheduled for the end of this year, with the first launch on Ethereum and Linea chain

- It is expected to be used as a payment method on the MetaMask card

✏️ (Personal Comment)

- MetaMask is also launching a stablecoin

- But honestly, if it's issued through M0 and Stripe

- It feels more like a MetaMask-branded stablecoin rather than a true MetaMask stablecoin

- They seem to have ambitions to expand externally based on this stablecoin for payments and more

Original link (

2️⃣ StarkNet Passes Governance for Bitcoin Staking Introduction

📌(Summary)

- StarkNet SNIP-31 proposal has passed

- This will now support Bitcoin staking

- Bitcoin stakers will receive a 25% STRK staking reward

✏️ (Personal Comment)

- StarkNet is actively working on enhancing the Bitcoin ecosystem

- Personally, I see this as a quite significant update

- For Bitcoin holders, staking on StarkNet and earning STRK rewards is

- In a way, it could be seen as a very safe way to earn interest on Bitcoin

- If native Bitcoin starts appearing on StarkNet after OP_CAT, it might gain even more traction

Original link (

3️⃣ AAVE Expands to Aptos as First Non-EVM Chain

📌 (Summary)

- AAVE has launched on Aptos

- This is the first expansion of AAVE to a non-EVM chain

- The Aptos Foundation is expected to provide rewards for initial bootstrapping

- To facilitate this, AAVE v3 has been adapted to the MOVE version

✏️ (Personal Comment)

- AAVE expanding to Aptos, wow

- It seems like AAVE is really good at making money

- The development costs they receive for each chain expansion must be enormous

- On the other hand, Aptos is currently distributing significant grants

- I feel like it's time for outputs to start coming out, but will they?

- It seems there are no bootstrapping incentives yet

Original link (

4️⃣ Injective Partners with Republic to Promote Onboarding of Unlisted Stocks

📌 (Summary)

- Injective announced the introduction of a feature to purchase unlisted stocks through Republic

- This is a structure that reflects the price of those stocks as a kind of Mirror token

- Onboarding of stocks like OpenAI, SpaceX, Epic Games

- Various stocks, including DAT companies, are expected to be onboarded later

✏️ (Personal Comment)

- Injective is always serious about RWA

- Personally, I think expanding more is Bullish

- One downside is that liquidity is often lacking when expanding like this

- If they could make it easier to issue or redeem

- It would allow users to trade much more comfortably

Original link (

Hearts and likes are a great support for BQ content 🤩

#CryptocurrencyNews #CoinNews #Cryptonews #BTC #ETH

☀️ (2025.08.19) Summary and Comments on Major Cryptocurrency News

Have a great day today!

1️⃣ PermDotFun Solana Meme Coin Surges Back in the Runway War

📌 (Summary)

- PermDotFun's meme coin market share had dropped to 5%

- This time it surged back to 90%

- This occurred alongside the collapse of LetsBonk

- LetsBonk once had an 80% market share but is now at 3%

- PermDotFun's buyback is also believed to have had a significant impact

✏️ (Personal Comment)

- On the runway side, LetsBonk is just a complete collapse

- It seemed like it would shine for a moment

- But it seems that friends who play short-term ultimately don't change...

- Personally, I think if Bonk had been nurtured well, it could have grown much larger

- It's a bit disappointing

Original link (

2️⃣ Debate on ChaosLab USDe Risks

📌(Summary)

- DeFi lenders are warning about USDe

- Currently, there is $6.4b in USDe lending

- $4.2b is in Pendle

- The biggest risk is mentioned to be in looping

- Additionally, $580m has been deposited in Aave from Essena

- If a withdrawal rush occurs, there could be issues with collateral assets

✏️ (Personal Comment)

- Honestly, this is something that most DeFi users are aware of

- A significant portion of the stablecoin market cap is inflated by looping

- In fact, Aave has fixed the price of USDe to USDT

- Even if there is a de-pegging, the protocol itself wouldn't have issues

- However, a rapid increase in interest rates or user liquidations are certainly plausible scenarios

Original link (

3️⃣ Japan to Launch Its First Stablecoin This Fall

📌 (Summary)

- Japan plans to launch its stablecoin this fall

- The JPYC stablecoin will be backed by assets such as government bonds

- It is expected to be utilized in various ways in DeFi

✏️ (Personal Comment)

- Wow, Japan is always quick

- Even the mention of DeFi utilization suggests it might be a public chain

- It will be interesting to see which chain it is and what impact it will have on the Japanese stock market

- Personally, I feel Japan is always a step ahead of us in terms of crypto policy

- In five years, could Japan become the center of Asia?

Original link (

4️⃣ Gemini Files for IPO, Aiming to List GEMI on Nasdaq

📌 (Summary)

- Gemini's S-1 filing was announced on Friday

- It appears they have applied to list under the ticker GEMI on Nasdaq

- The IPO price has not yet been disclosed

- The due diligence report shows a loss of about $282.5m during Q2 2025

- If successful, it will be the third cryptocurrency exchange to go public after Coinbase and Bullish

✏️ (Personal Comment)

- Wait, with those earnings, they're going for an IPO...?

- Personally, I think the IPO trend for crypto companies

- With Gemini, it might be nearing the end of the trend

- The atmosphere was great until Bullish, but we'll see

Original link (

Hearts and likes are a great support for BQ content 🤩

#CryptocurrencyNews #CoinNews #Cryptonews #BTC #ETH

6.4K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.