Cross-chain liquidity still feels like a mess. Too many bridges, wraps, and random hops = wasted gas & extra risk.

@RiverdotInc's model is addressing this issue:

• Deposit collateral (BTC, ETH, BNB, LSTs) on Chain A

• Mint satUSD directly on Chain B

• No bridges, no wraps, full security preserved

👉 This is like a global on-chain account: provision capital once, deploy it anywhere.

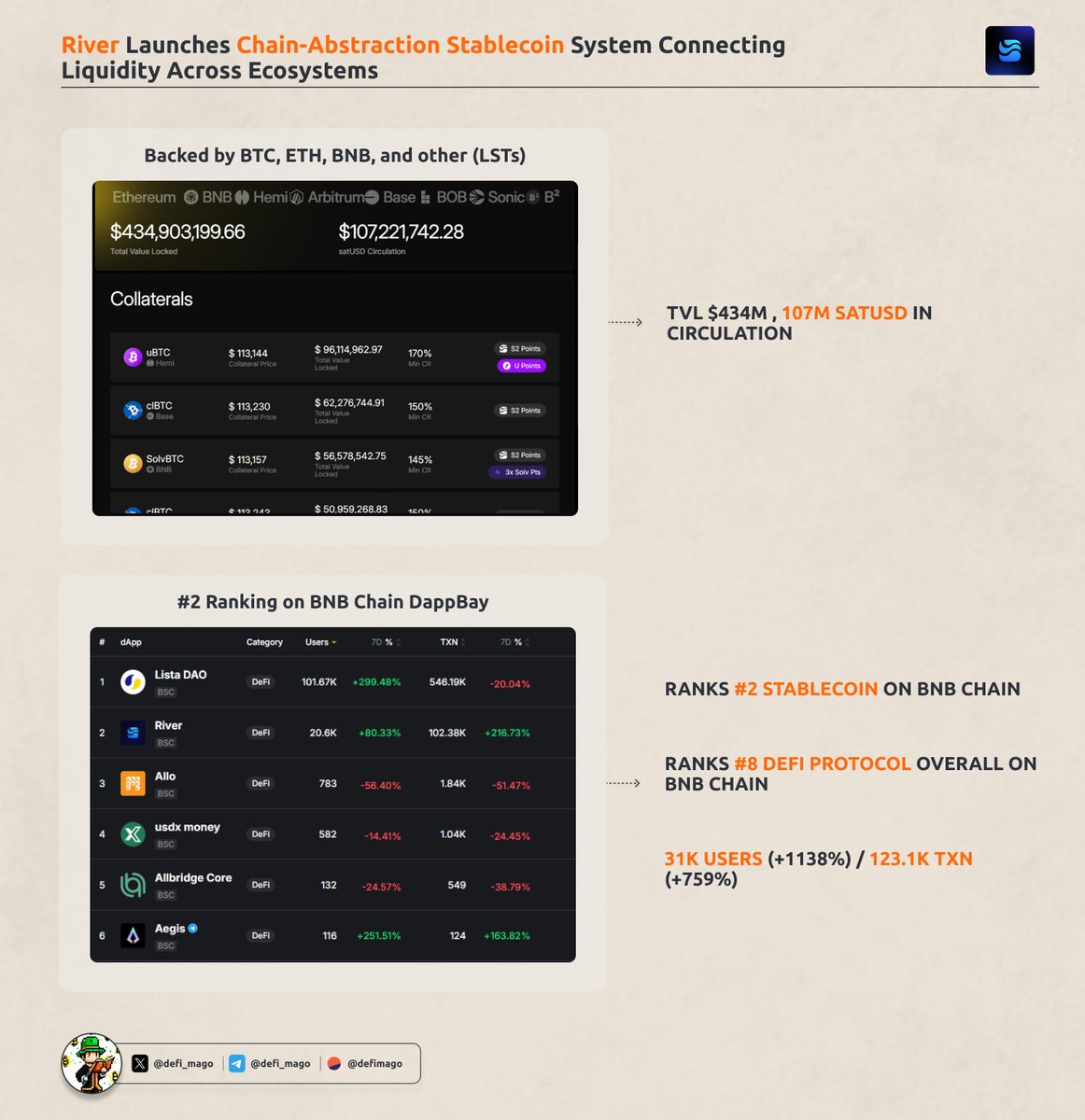

And the numbers are no joke:

• $400M+ TVL

• $100M+ satUSD in circulation

• Integrated with 30+ protocols ( @pendle_fi, @lista_dao, @SolvProtocol, etc.)

• #1 CDP stablecoin across @BNBCHAIN, @arbitrum, @hemi_xyz, @build_on_bob

• Ranked #4 overall / #1 DeFi on RootData

• Ranks #7 DeFi protocol overall on BNB Chain

• 31k (+1138%) users / 123.1k (+759%)

• 100k River Mart NFTs minted in 14 days

Just “another stable”? nah, satUSD is omnichain from day one, built with LayerZero + OFT. And it brings capital efficiency without bridges and liquidity that flows across ecosystems.

Flow with River 🌊

Show original

11.65K

42

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.