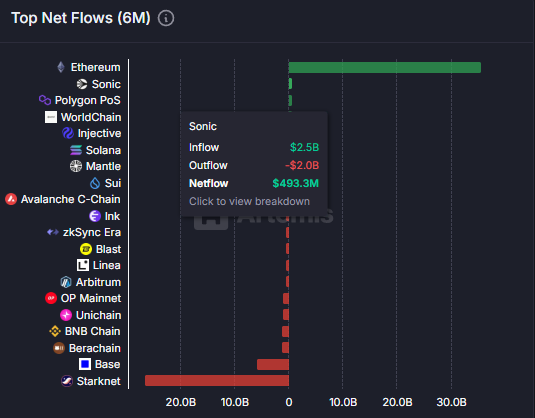

Sonic Chain’s TVL has plunged by -60.9% over the past three months, mainly due to large-scale capital outflows from lending protocols following disappointment with the airdrop

Notably, Silo Finance and Aave V3 accounted for 58% of the total outflows

@SiloFinance : $599m → $184m (-69.3%)

@ShadowOnSonic : $161m → $30m (-67%)

@aave : $540m → $175m (-64%)

-------------------

Interestingly, trading volume has remained resilient despite the decline in TVL

▸Shadow Exchange: $877.6M in the past 30 days

(2x its current TVL)

▸Chain-wide DEX volume: $325M weekly

(+2.8% growth)

This suggests that liquidity providers are recycling existing capital rather than adding new funds

I believe that if Airdrop Season 1 had been successful, @SonicLabs TVL would still be above $1B today....✿ܓ

Show original

9.79K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.