Scenario

A new dApp launches along a fancy L1 but is denominated in the chain’s native token or stable's (USDT0, USDC)

User wants exposure or capture an opportunity - but only holds $ETH on an L2 or mainnet

1. Swap ETH to stables or wrap via a third-party DEX

2. Bridge to the destination chain through bridging provider or aggregator

3. Swap again into the dApp’s native asset

Up to three steps. Multiple platforms. Multiple fees.

Value potentially leaks three times before you can even USE the dApp

This means

For you: friction, frustration, dropping of half way and missing the opportunity

For developers: lost volume, lost revenue, potentially lost another user

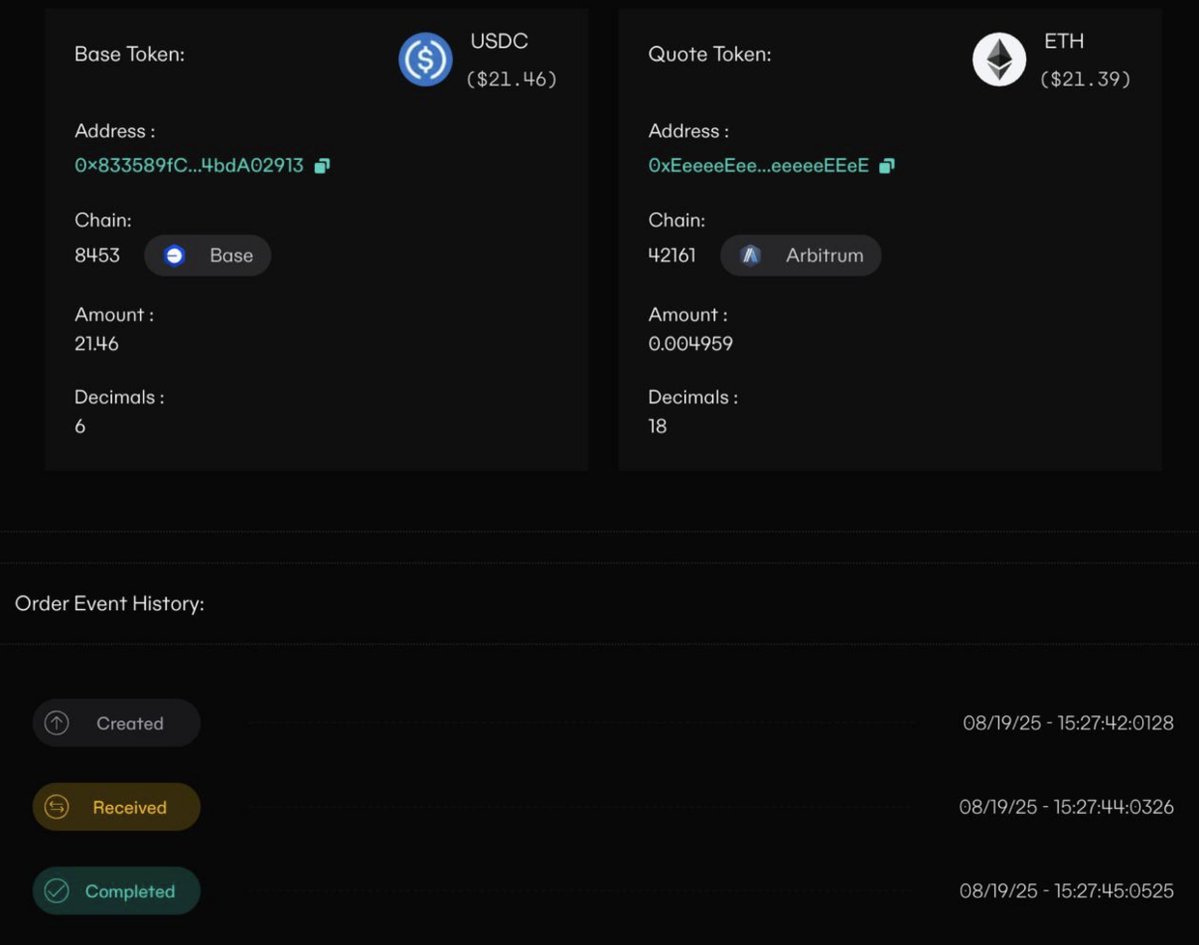

-> There’s never been a native way to go from any asset on any chain to the desired asset on another

Until now

Show original

4.03K

15

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.