A comprehensive analysis of @FalconStable was done with @Surf_Copilot

Project Overview

Falcon Finance is a "universal collateral infrastructure" platform that transforms various liquid crypto assets and RWAs into two core products:

USDf - Overcollateralized synthetic USD stablecoin

sUSDf - the yield token obtained by staking USDf

Mechanism design

USDf stablecoin mechanism

Collateral assets: BTC, ETH, ETH-LST, large-cap altcoins, U.S. Treasury funds

Dynamic Collateral Ratio: Adjusts OCR buffers based on volatility and liquidity

KYC requirements: mandatory identity verification, positioning compliant DeFi

Redemption Mechanism: 1 USDf ≈ $1 equivalent of accepted collateral

sUSDf yield mechanism

Base Yield: 8-12% APY historical range

Income source: 44% basis trading + 34% arbitrage + 22% staking

Instant withdrawal: No lock-up period limit

Re-staking: Lock up for a fixed period to get higher yields

Differentiation

Overcollateralization + active management: Different from fiat currency support or delta hedging mode

Native yield: sUSDf eliminates the need for external staking wrapping

Compliance positioning: KYC requirements are easy for institutions to adopt

Falcon Finance has established itself as an important player in the stablecoin track with its innovative mechanism design and strong growth momentum

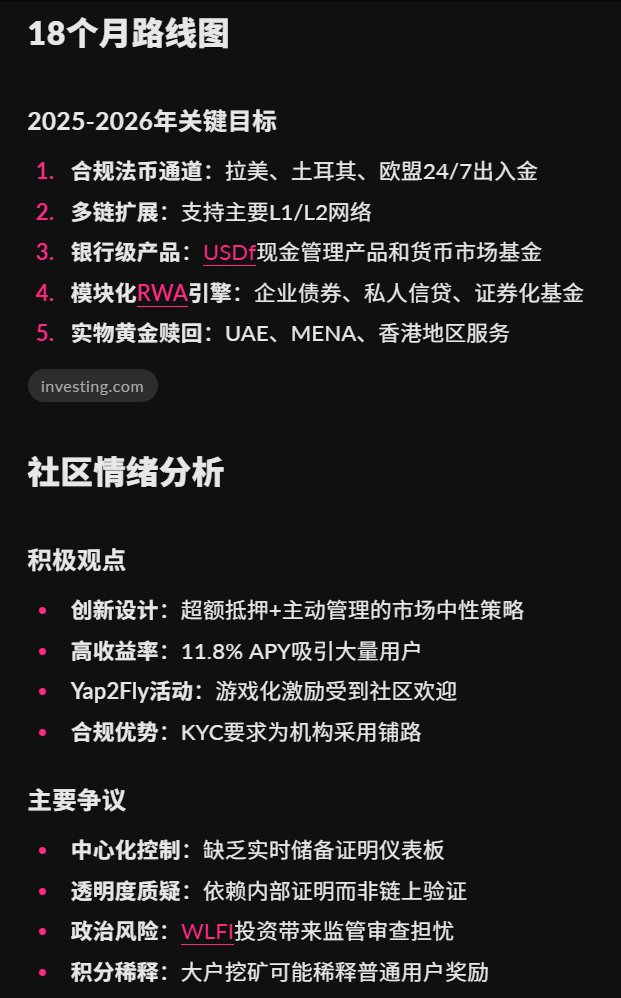

The next key test will be:

(1) Maintain high yields in an unfavorable basis market

(2) Prove anchoring stability in full crypto market declines

(3) Execute multi-chain and RWA scaling plans without diluting risk management discipline

Show original

23.82K

29

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.