【 $ETH's Strong Market, E Reserve Data Update 💡】

It has only been a month since the establishment of the ETH Maxi list, yet it feels like a lifetime ago.

$ETH has risen from $3000 to the current $4700 🚀🚀

New highs are not just casually mentioned; often, it feels like the crypto space still underestimates this institutional buying, even Tom Lee @fundstrat himself mentioned that the current speed at which Bitmine is purchasing $ETH is 12 times that of Strategy's purchases of $BTC.

By the way, it seems a new "Ethereum Foundation" has emerged in the market. Hashkey Capital transferred over 7000 ETH to exchanges today, selling off $34M 💀

From last night to today, it's clear that opinions in the market have diverged.

💡 BTC seems to have not sustained its new high.

💡 $ETH is astonishingly strong on its own, with $SOL following suit.

💡 Altcoins have not followed the rise.

The interest rate cut in September seems to be settled; as usual, we still need to watch the performance of Bitcoin. If Bitcoin does not break through this time, altcoins will continue to struggle.

I looked at the spot trading volume of mainstream coins, and it seems to have reached the previous high point again, which previously saw a short-term pullback ⚠️.

The spot trading volumes then and now are:

ETH: 4.2 billion, 4.3 billion

BTC: 2 billion, 3.1 billion

USDC: 2.4 billion, 3.6 billion

A few days ago, ETH was around 2 billion.

The $OTHERS indicator has also surpassed the previous high at the end of July (315B, 315 billion USD), peaking at 324B this morning before retreating to around 316B now.

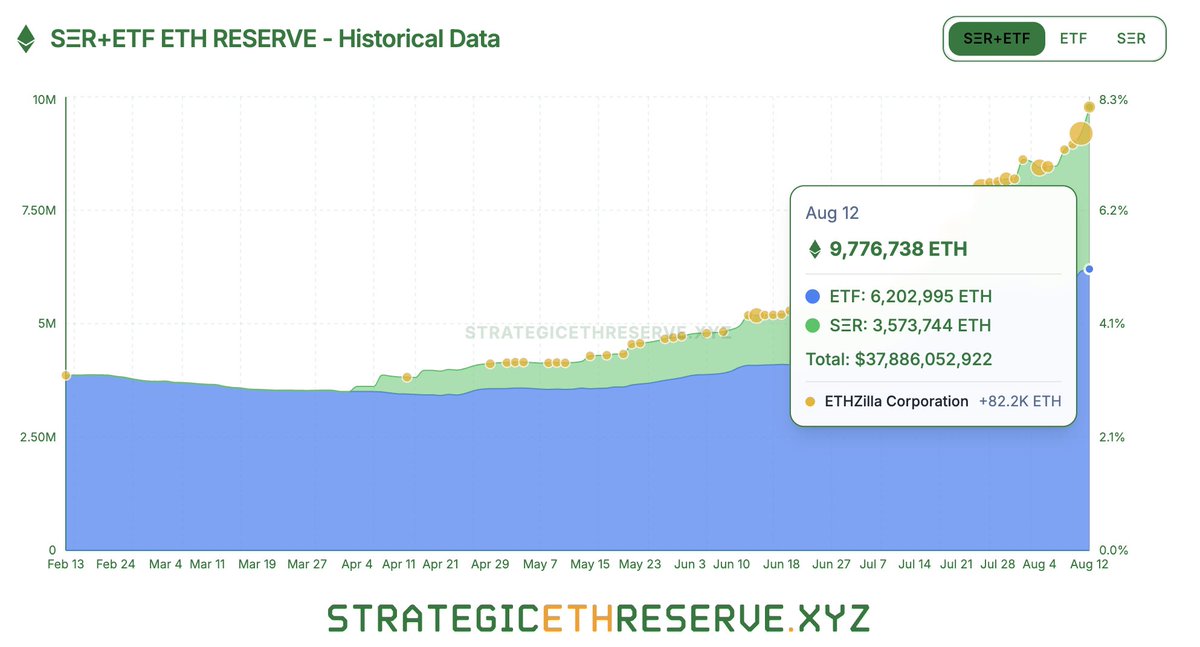

Looking back at the current purchasing data for ETH:

Since mid-July, the holdings of SΞR+ETF ETH have grown from 24M to the current 37M, a growth of 54% in one month.

The top 3 reserve companies currently hold 9.6B, which is nearly 10 billion USD of $ETH, while the Ethereum Foundation holds 1.07B, a difference of 9 times.

I believe we can monitor market changes on a weekly basis. Unless the growth rate slows significantly, there is no need to be overly pessimistic.

The current ETH/BTC exchange rate is also starting to show a turning point. $ETH remains strong and continues to surge ⚡️.

如果現在是 $ETH 的微策略時刻 , 那麼 $ETH 往上的空間有多高?🦇🔊

Strategy 早在 2020 年 9 月就宣布了儲備策略

這四年 $BTC 的價格從 15K 漲至目前的 117K , 漲幅為681.42% 📈

@SharpLinkGaming 可以說是帶入 ETH 儲備策略進入加速期的關鍵角色

📈當前以網站(strategicethreserve[dot]xyz)統計之數據顯示

目前總計有 1.3M $ETH , 將近 40 億美元的價值, 佔流通 1.11%

📈 該網站顯示, 三個月以來這些企業的持有量從 110K ETH 增長為 1.3M , 也就是有著 1200% 的增長

📈當前持有 100 ETH 以上的實體共有 48 間

這邊要注意的是先前提過的 @BitMNR 數量目前是 pending 中, 如按照新聞所說,即將推動 2.5 億美元規模的 $ETH 儲備, 用 2500 美元來計算持倉 100K , 排名會直接進入前十名

而現在入局的除了原先各大 DeFi 協議之外, 還有像是 BTC Digital 這樣的礦企

根據 6 月 26 日的消息指出, 他們打算將價值 $34M 的 $BTC 持倉全數轉為 $ETH

we're still early 🦇🔊

23.74K

38

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.