🟧Circle's goal with the launch of Layer1 - Arc: Is it simply to compete with Tether?

🔶Circle has just announced the launch of Arc - an EVM-compatible Layer 1 blockchain, where USDC officially becomes the gas token, integrating an FX engine system and near real-time settlement capabilities. USDC is set as the central currency, with all transactions, liquidity, and financial communications revolving around USDC.

🔶Q2 2025 Circle's financial results are boosted by the "tailwind" of the IPO:

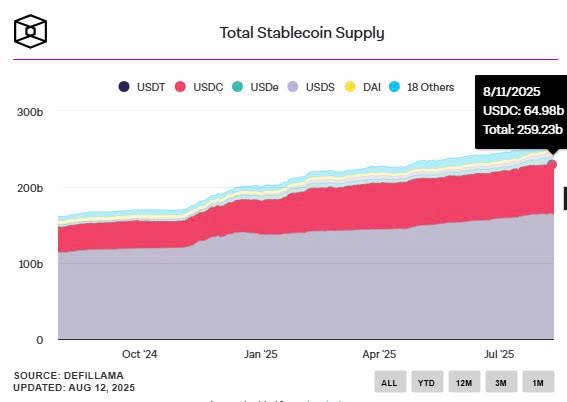

- Circulating supply increased by 90% YoY, reaching approximately $61–65B.

- Total revenue from reserves and services reached $658M, up 53% YoY; Circle retained $251M in profit after distribution costs.

- CRCL shares continue to rise after the financial report, with a current market capitalization of ~$39B (equivalent to ~63% of the circulating USDC value).

🔶Arc launches as an open payment infrastructure under the guise of Layer-1, with USDC becoming the gas for the blockchain as transaction fees, fx swaps, and settlements all use USDC, providing a boost to USDC demand.

-> When Arc's mainnet goes live, cross-border settlements, payment rails, and stablecoin infrastructure (entirely controlled by Circle) will mean that $USDC will not need to go through any dapp or third-party company, creating a closed ecosystem.

🔶USDC supply increases by 90%, revenue rises by 53%, and the company's market cap approaches $40B -> Circle is creating a super attractive datasphere for Arc. It must be acknowledged that while Circle's business performance is poor, they know how to seize opportunities for an exit.

Show original

5.75K

41

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.