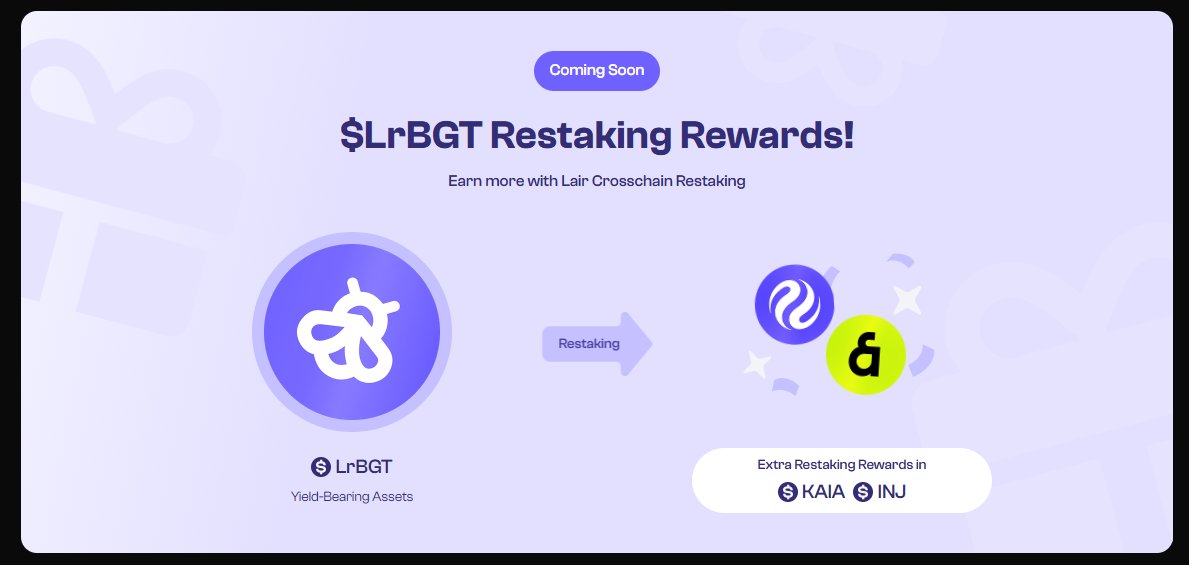

For reference, LrBGT might be an initiative to provide rewards not only for Vera but also for tokens like $INJ and Kaia?

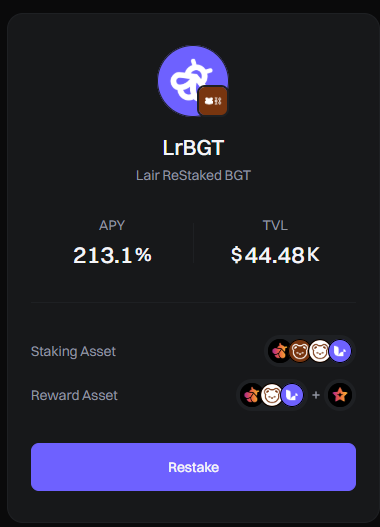

Currently, after minting LrBGT, the APY exceeds 200%, but it is still unclear where and what rewards are accumulating. The wallet only shows that I own LrBGT.

And if you go into the Earn section, you can see that the restaking rewards are also paid in Kaia and INJ.

First of all, while casually looking into @LairFinance, I saw that the INJ I hold and the Injective ecosystem will soon introduce restaking on the mainnet, so I plan to bookmark it and follow up.

Currently, I have liquidity provided through lending on Hydro, but if there is sufficient liquidity and the loss from restaking and market liquidity on Lair Finance is less than the profit margin, I predict that it will be sufficiently usable until the peak point I have in mind for Injective.

Of course, I could also create a scenario with a 50:50 split between liquidity and restaking, but for now, I think I need to watch how to structure the restaking. I heard it is currently running on the testnet, but I haven't been able to find information on where it's happening, so I haven't been able to check it out.

I usually have a personality that feels the need to try out a protocol directly once I start yapping about it.

Earlier, I wrote about @LairFinance, and in the case of Kaia, I have been using it frequently since the Klaytn days, so I'm familiar with it. However, I have been avoiding Bera Chain for a while.

But this time, with LairFinance, if I include Bera and restake it as lrBGT, it actually promises considerable rewards.

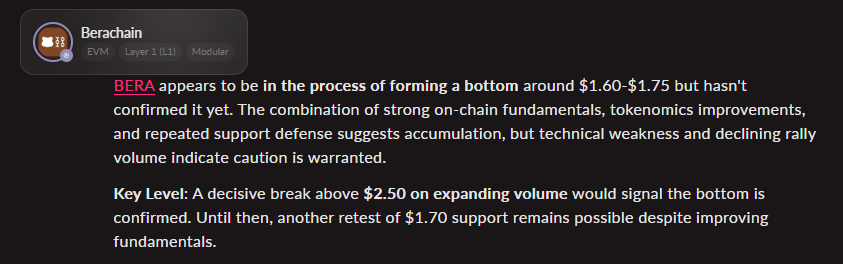

So, for the first time in my life, I thought about buying $BERA tokens. However, I had only heard that the ecosystem of BERA has been quite damaged, and I didn't know what the current price was, so I naturally inquired again with @Surf_Copilot to ask if the current price is at the bottom.

They quickly checked the chart and told me that the current price of $2 is not the bottom, and that the current bottom for Bera is forming around $1.6-$1.7. In other words, there is about a 20% downside risk.

The response strategy for this is to either hold a 3x or 10x short position, or if the APY remains the same, it can be calculated that it will be around 34% minted. However, since the APY is very likely to drop (the more funds come in, the lower it goes), it is better to respond with a short position.

This time, the amount I am participating with is not large, so I will not short but will just buy Bera tokens from the exchange, send them to the chain, and attempt to restake.

12.05K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.