From the perspective of mNAV, which is worth buying, $SBET or $BNMR?

Recently, with the rise in the price of $ETH, many friends have reported on two US stocks as strategic reserves, and both stocks have experienced increases of several times followed by significant drops. So, are these two stocks still worth buying?

The main reasons for the decline of SBET and BNMR were basically ATM (which can be simply understood as issuing more shares) and mNAV (which can be simply understood as the premium rate of the stock). Both of these reasons for decline were previously experienced by $MSTR. The significant drop of MSTR after it rose to $543 was largely due to the high premium rate of ATM + mNAV.

According to MSTR's approach, as long as mNAV is not excessively high, for investors, it is like a leveraged $BTC. Holding MSTR is equivalent to going long on BTC, and since MSTR is the only legitimate "Bitcoin" in US stocks, as long as the price of BTC rises, MSTR's performance should not be too poor.

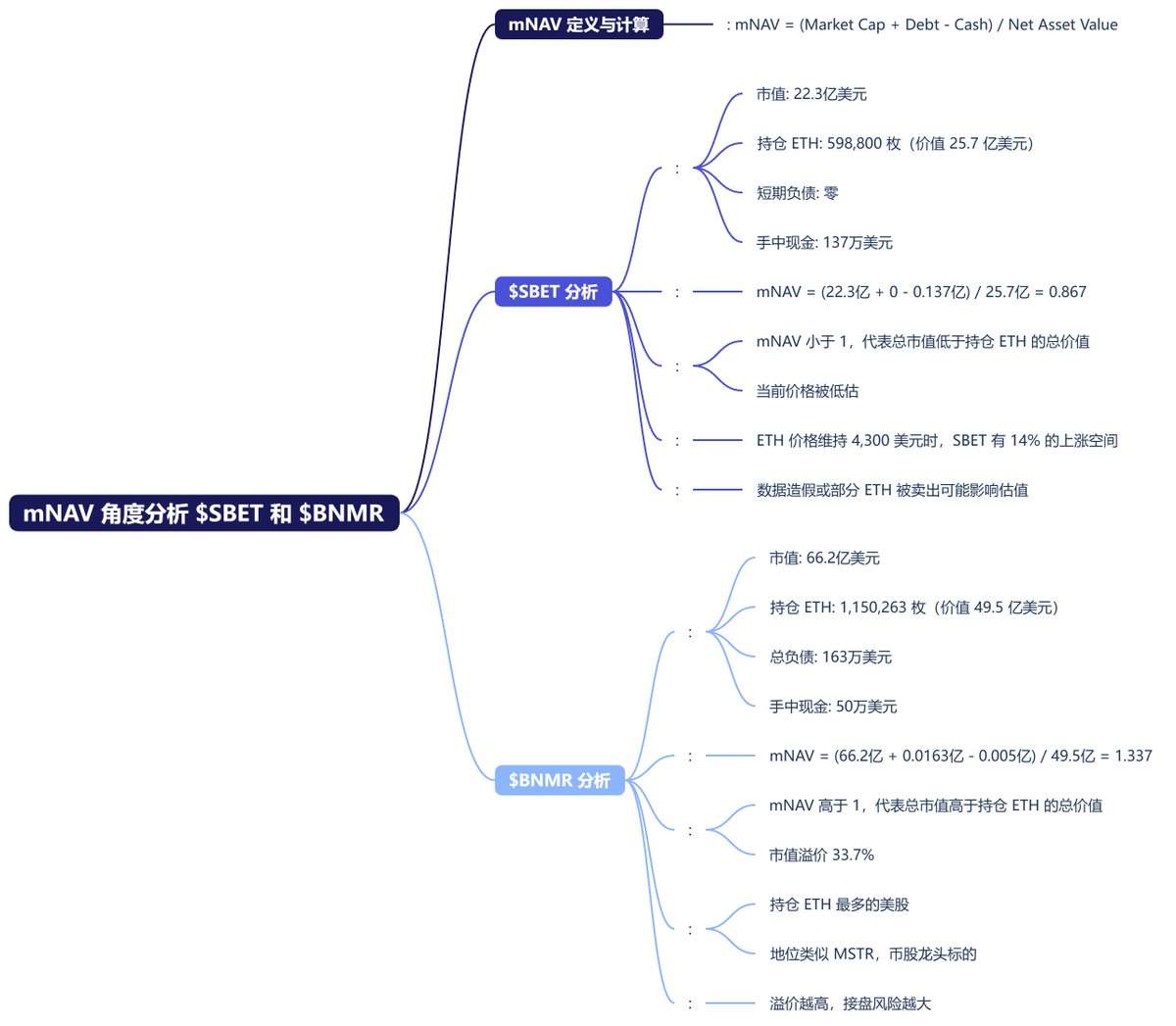

Before diving into the specifics, let's first determine the calculation method for mNAV. I would like to thank @jasonnotes0206 and @leechan1688 for their tips. Initially, I simply used:

mNAV = market price / Net Asset Value

But I didn't take into account debts and cash reserves, so the revised formula should be:

mNAV = (Market Cap + Debt - Cash) / Net Asset Value

As for the current mNAV of SBET, as of today, SBET's market cap is $2.23 billion, holding 598,800 ETH, which, based on the current price, is $2.57 billion. SBET has zero short-term liabilities and currently has $1.37 million in cash. Therefore, according to the formula, SBET's mNAV is less than 1, at only 0.867, which indicates that SBET is undervalued compared to the total value of its held ETH.

Of course, this is just part of the understanding. If SBET falsifies data or sells part of its ETH, that would be another matter. So, based on the current data, if the price of ETH maintains at $4,300, SBET should have a 14% upside potential.

Remember, the premise is that if the price of ETH stays at $4,300, SBET's market cap being equal to the total value of its held ETH is within a normal range.

Using the same method, let's look at BNMR. BNMR's total market cap is $6.62 billion, holding 1,150,263 ETH, with a total value of $4.95 billion. Its total liabilities are $1.63 million, and it has about $500,000 in cash. Similarly, according to the formula, BNMR's total market cap is higher than the total number of held ETH, so mNAV equals 1.337. Theoretically, if BNMR has no other business, its market cap is somewhat high, exceeding by 33.7%.

Of course, this cannot be calculated directly, as BNMR currently holds the most ETH among US stocks. Its position is similar to MSTR, both being leaders in the crypto stock sector, so a slight premium is also normal.

Therefore, my personal view is that SBET falling below its net asset value is an opportunity for me to buy ETH at a discount, roughly a 14% discount, which is equivalent to buying ETH at $3,700 when the current price is $4,300, making it a good value.

On the other hand, BNMR has a 1.33 times premium, indicating that funds are very optimistic about BNMR as a leading asset, but the higher the premium, the greater the risk of taking over.

In simple terms, SBET is cheap, BNMR is expensive. If you want to pick up a bargain, look at SBET; if you want to gamble on sentiment, look at BNMR.

This article is sponsored by #Bitget | @Bitget_zh.

Show original

110.95K

158

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.