🚨#Ethereum Hits $4,300, Parabolic Run Next or Pullback Ahead?🚨

$ETH just ripped to $4,300. Is it too late to buy?

I’ve broken down price targets, key levels, ETF flows, and the ETH-linked alts most likely to move next.

Here’s my full game plan for ETH, altseason, and the key plays🧵👇

1/x $ETH is in its strongest uptrend vs $BTC since 2021.

We haven’t even touched the $4,850 ATH yet.

The question is: do we go parabolic now, or get a healthy pullback before the real breakout?

Let’s map both scenarios.

2/x Ethereum’s rally to $4,300 has opened the door for much higher prices into year-end.

If #Bitcoin pushes toward $150K and ETH/BTC climbs to 0.044, $ETH could hit $6,000–$7,000 this year. My conservative target? $6,600.

I’m positioning to capture that upside while protecting against a pullback.

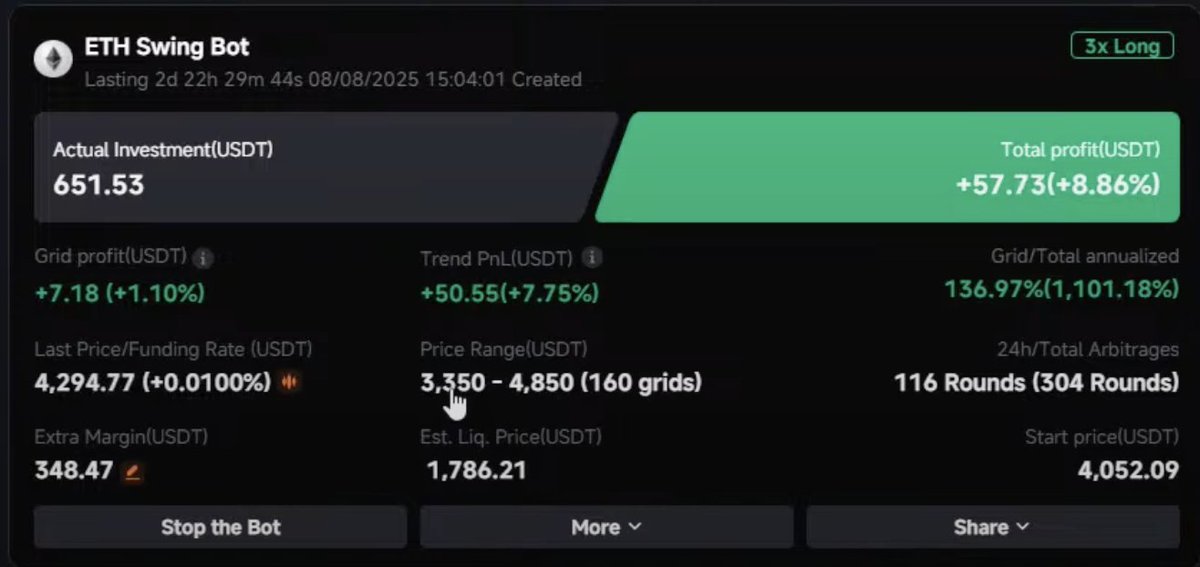

3/x My trading setup:

Swing bot range: $3,350-$4,850

🔹$3,350 - key higher low from July & uptrend support

🔹$4,850 - previous ATH

The bot buys dips, sells rips, and accumulates without you needing perfect timing.

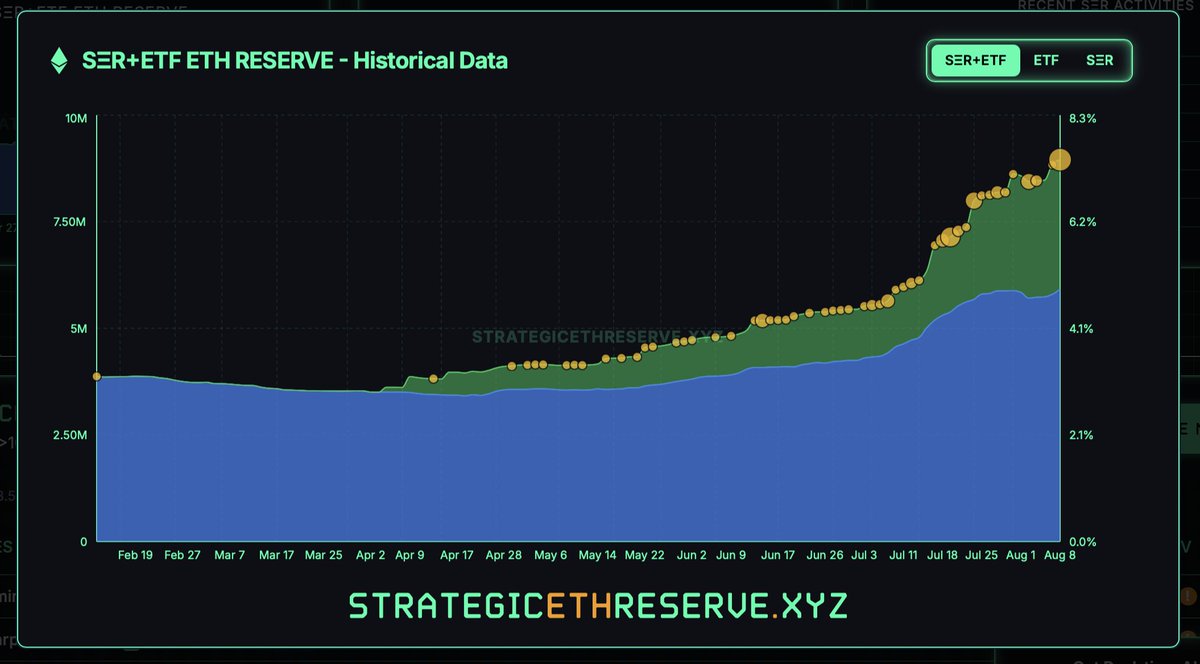

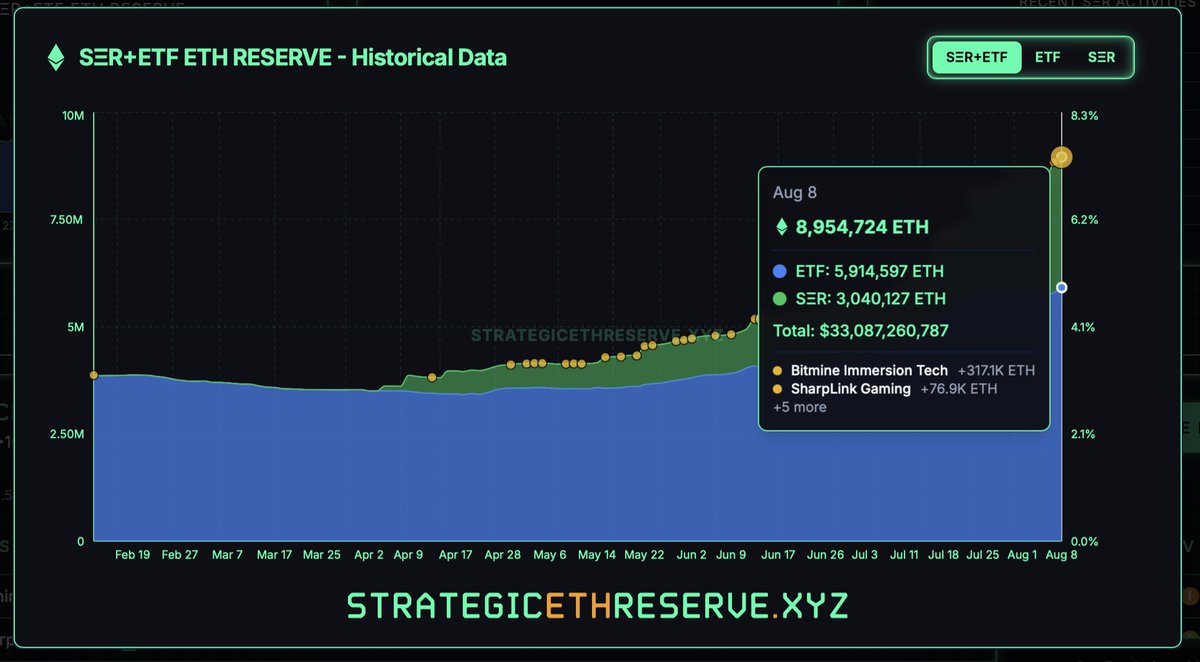

4/x Institutional flows are flipping bullish for $ETH.

In July, ETFs + treasuries held 7.1M ETH (~$24B).

Today, that’s $33B. On Aug 8th, ETH ETFs saw $460M inflows, more than BTC’s $400M that day.

5/x ETH’s smaller market cap means each institutional $ has more price impact than BTC.

I see $3,350 as the floor unless $BTC itself dumps hard.

The real battle: clearing $4,850. If that happens in Q4, $6K+ is in play fast.

6/x $BTC dominance tells us altseason is starting but not confirmed.

We dipped from 60.5% to 59.7%, the first sign of a possible downtrend since 2021.

Confirmation = weekly close < 60.5% & lower high under 62.5%.

Until then, patience is key.

7/x The $ETH linked alts I’m watching:

Core DeFi:

🔸 $UNI - flagship AMM, still flat.

🔸 $LINK - essential oracle, still cheap.

🔸 $CRV - stable swap king.

🔸 $COMP - OG lending market.

New DeFi:

🔸 $AERO - up 40% last week.

🔸 $PENDLE - yield trading for RWAs & stables.

🔸 $ENS - pure $ETH beta play.

🔸 $HOME - on-chain DeFi super app.

8/x I'm still avoiding most layer 2s & restaking

Adoption isn’t there yet. Institutions stick to #Ethereum mainnet and fork proven protocols.

A great example is World Liberty Financial forking Aave for its own lending & stablecoin platform.

9/x Stablecoins are ETH’s stealth bullish driver. Nearly all USDC/USDT supply sits on ETH.

Beyond those, I’m watching three plays:

🔸USD1 (World Liberty Financial) - Targets treasuries & sovereign funds. One deal could send supply from $2B → $100B.

🔸 @PlasmaFDN & @stable - Tether founder–backed chains with USDT as native gas. Gasless transfers, big Bitfinex support.

While valuations aren’t public yet, these have far greater upside than smaller-scale DeFi-native stables like USDE or DAI.

10/x The World Liberty ecosystem offers multiple ways to gain exposure:

🔸 $WLFI - governance token (TGE soon)

🔸 $BLOCK - led by WLFI’s CIO

🔸 $DOLO - founded by WLFI’s CTO

🔸 $ALTS stock - NASDAQ-listed, holds 7.5% of WLFI supply.

12/x So what is my game plan?

🔹Hold $ETH above $3,350 support.

🔹Focus on ETH-beta DeFi & stablecoin plays.

🔹Rotate into alts that have lagged when #Bitcoin dominance confirms breakdown.

🔹Stay patient, Q4 is when the big moves likely hit.

13/x $ETH is leading now. If BTC.D breaks down, altseason will follow.

Until then, hold strength, accumulate dips, and let institutions do the heavy lifting.

Make sure to keep an eye on my bots, I’ll be updating my $ETH swing bot ranges here:

258.14K

1.37K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.