If @prjx_hl is the brain of @HyperliquidX DeFi, @ValantisLabs is its liquidity bloodstream.

A modular DEX purpose-built for liquid staking tokens, solving the biggest flaws in AMM models.

With $62M+ TVL & gaining 10x traction this month, here’s why it matters

A 🧵👇

Imagine a self-funded DEX on HyperEVM exploding to $50M+ TVL in <2 weeks

Zero VCs, 200%+ APYs from LP fees, points farming for massive airdrops, and now hiring 100+ interns to dominate partnerships

That's exactly what @Lamboland_ built & achieved through @prjx_hl

Let's explore what it's all about in this 🧵:

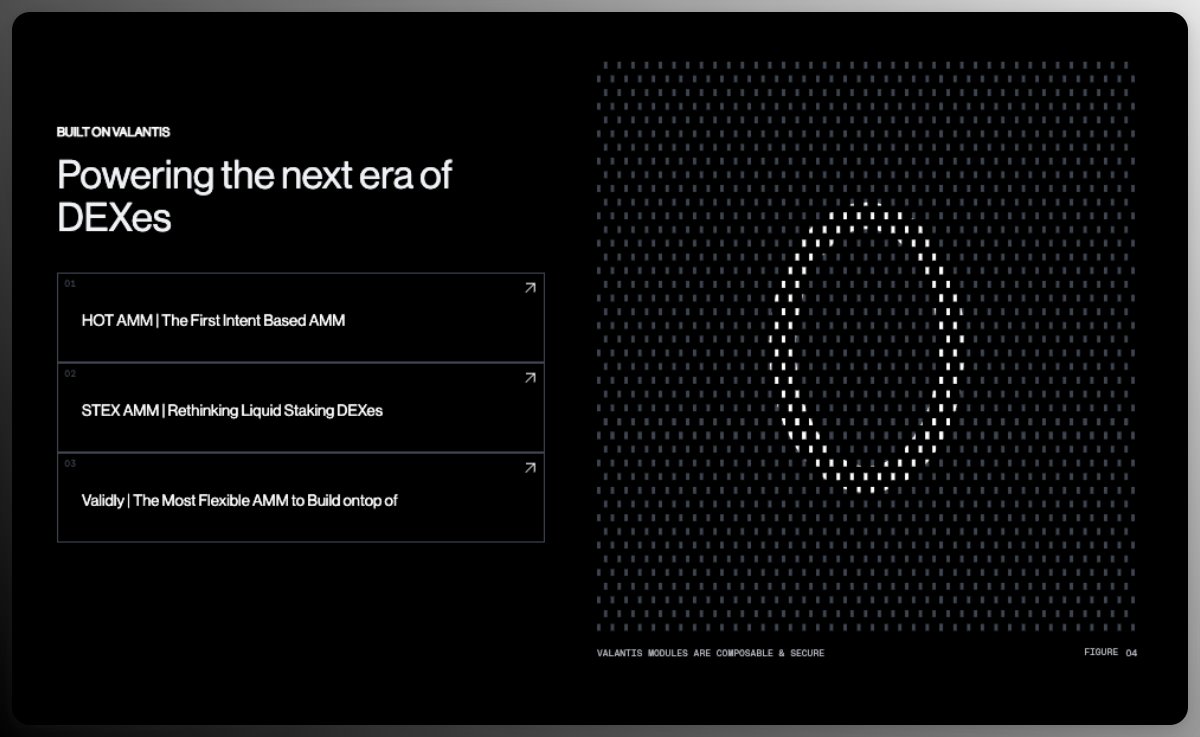

What exactly is @ValantisLabs?

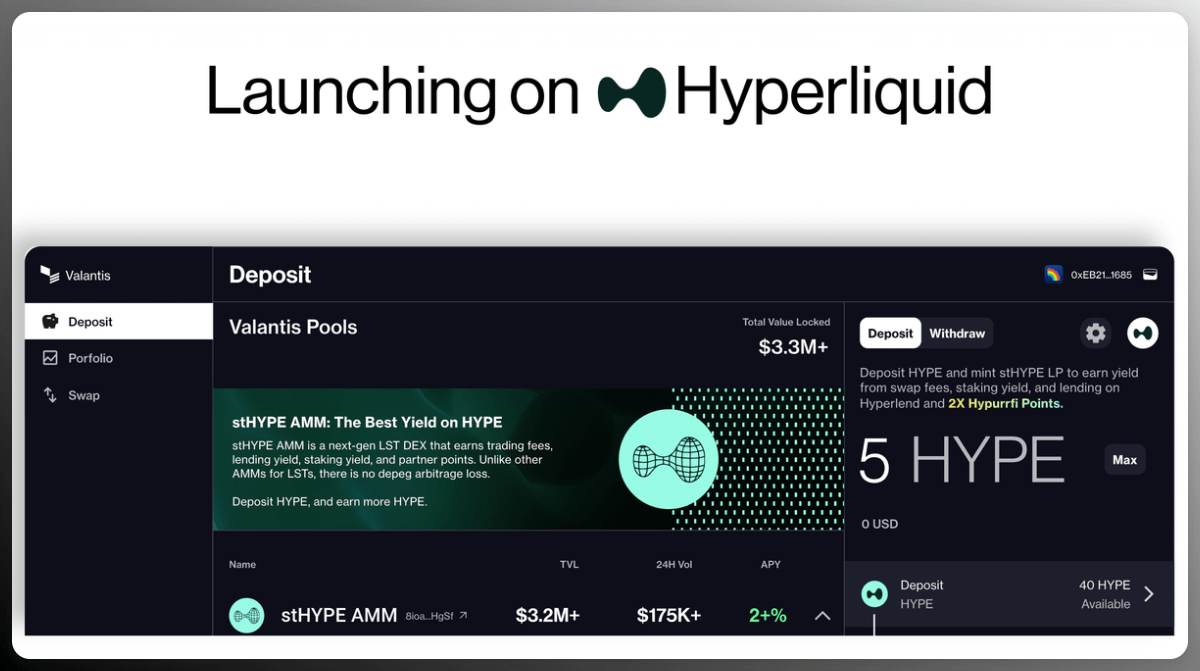

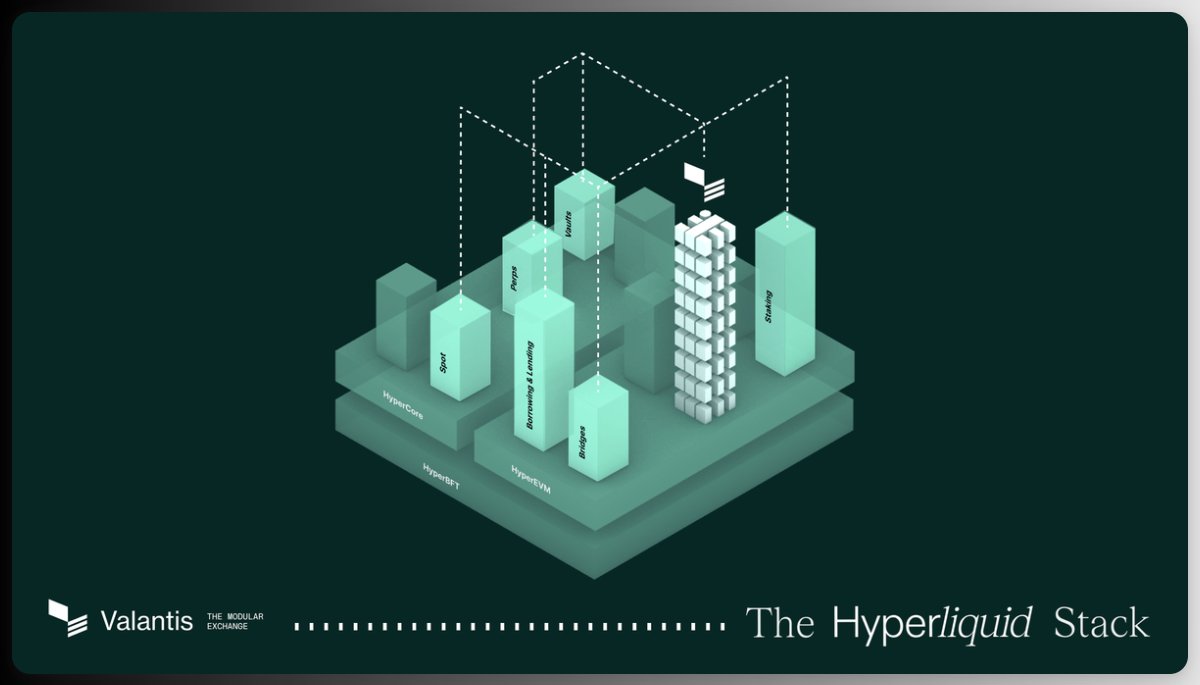

Valantis is a modular DEX protocol built on @HyperliquidX's HyperEVM, launched in 2023 by @Lamboland_.

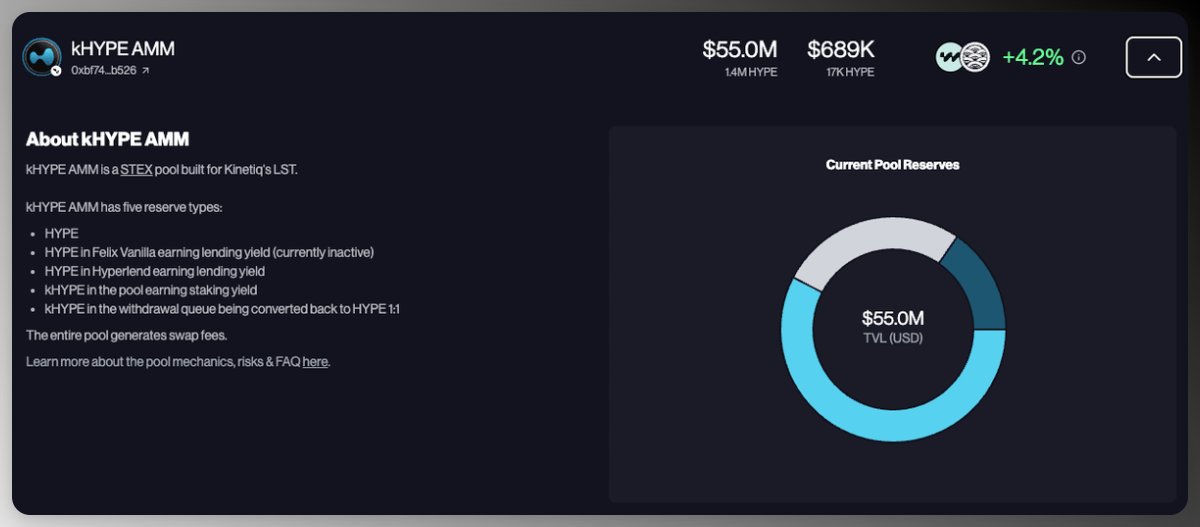

It enables the deployment of customizable AMMs for liquid staking tokens (LSTs) like $stHYPE & $kHYPE, focusing on efficient liquidity provision, programmable risk management, and sovereign liquidity.

Unlike traditional DEXs where liquidity is passive and prone to impermanent loss, Valantis allows users to "configure the odds" with custom pools that adapt to market conditions, such as depegs or volatility.

As of August 2025, it has over $61.33M in TVL on Hyperliquid, with rapid growth (e.g., 1,100% TVL increase in the past month), making it a key player in HyperEVM's DeFi ecosystem alongside protocols like @hyperlendx and @felixprotocol.

It's like @CurveFinance + @Uniswap v4 + LSTFi, built for DeFi 2.0.

Why it matters 👇

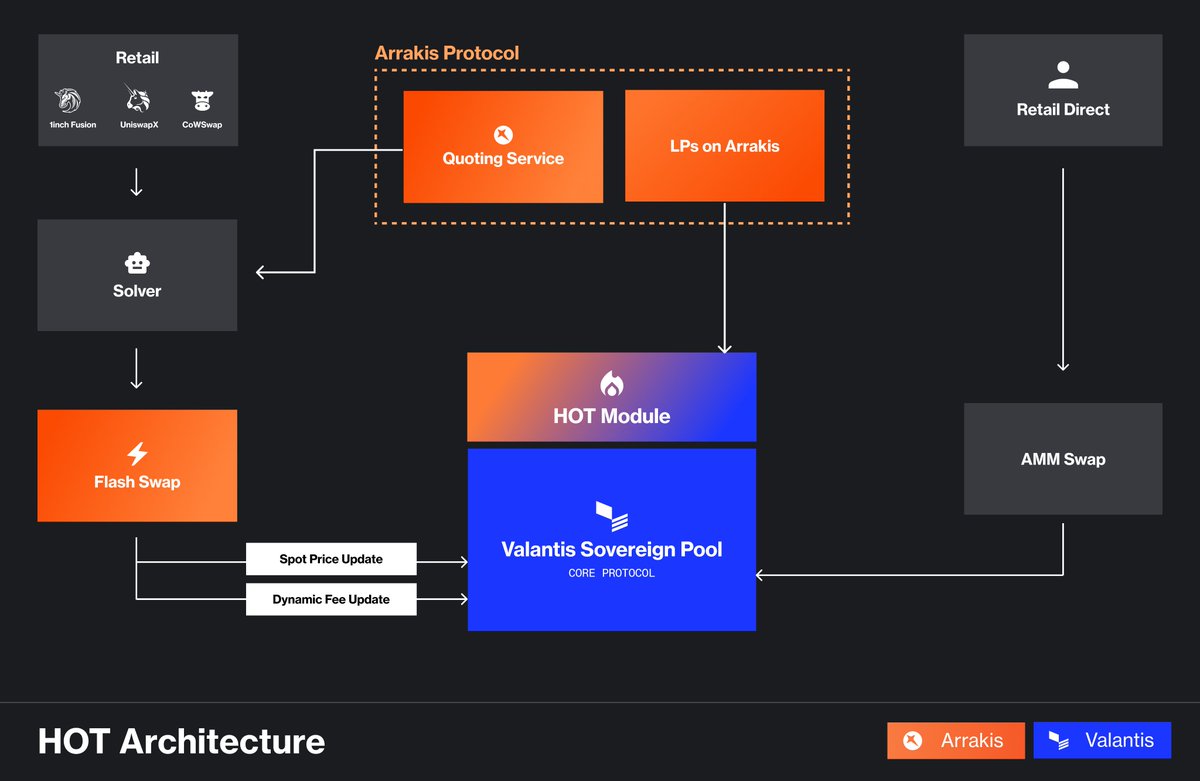

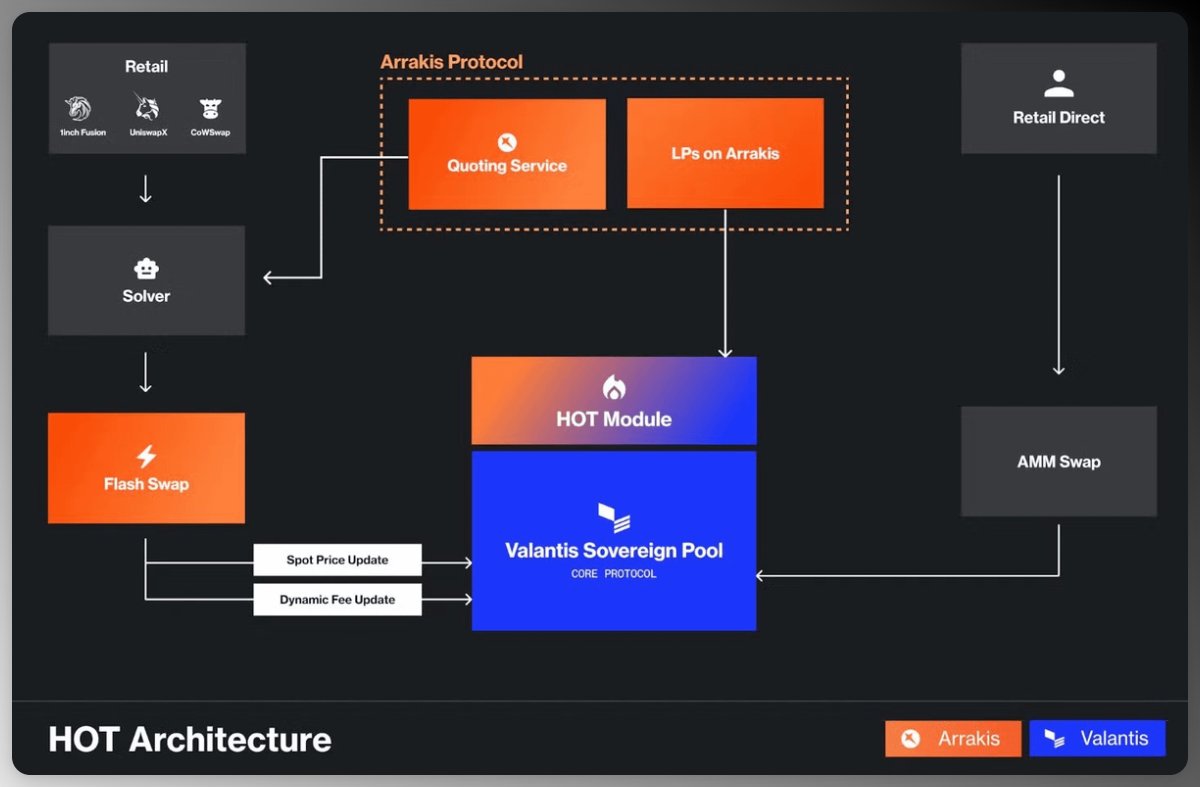

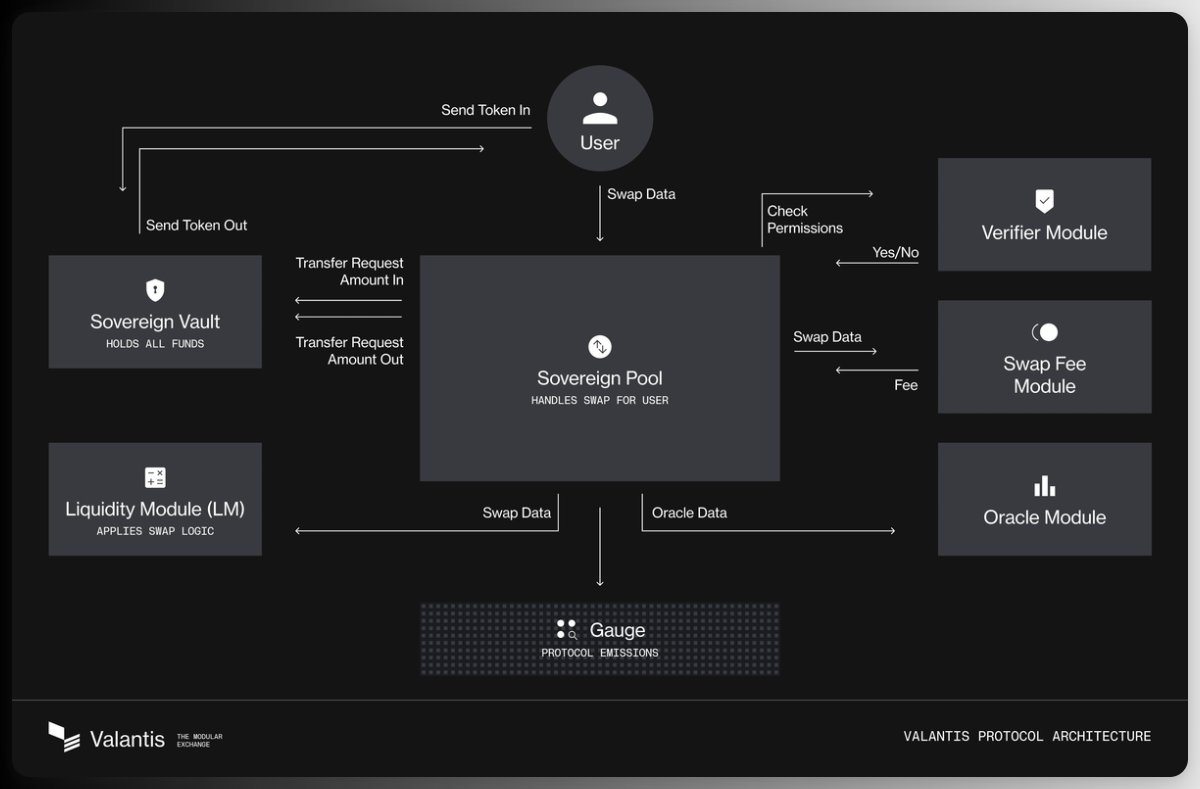

◆ Empower builders & liquidity providers (LPs) with modular tools for creating efficient, risk-optimized DEXs

◆ Integrates with Hyperliquid's native components for atomic composability, enabling seamless interactions with order books, staking, and lending

◆ Community-driven, emphasizing efficiency in LST trading (e.g., from HOT AMM to stHYPE AMM to kHYPE AMM) and providing extra yields during market dislocations like depegs

It's the missing puzzle piece for yield-rich, composable DeFi on @HyperliquidX

As for some of its core features 👇

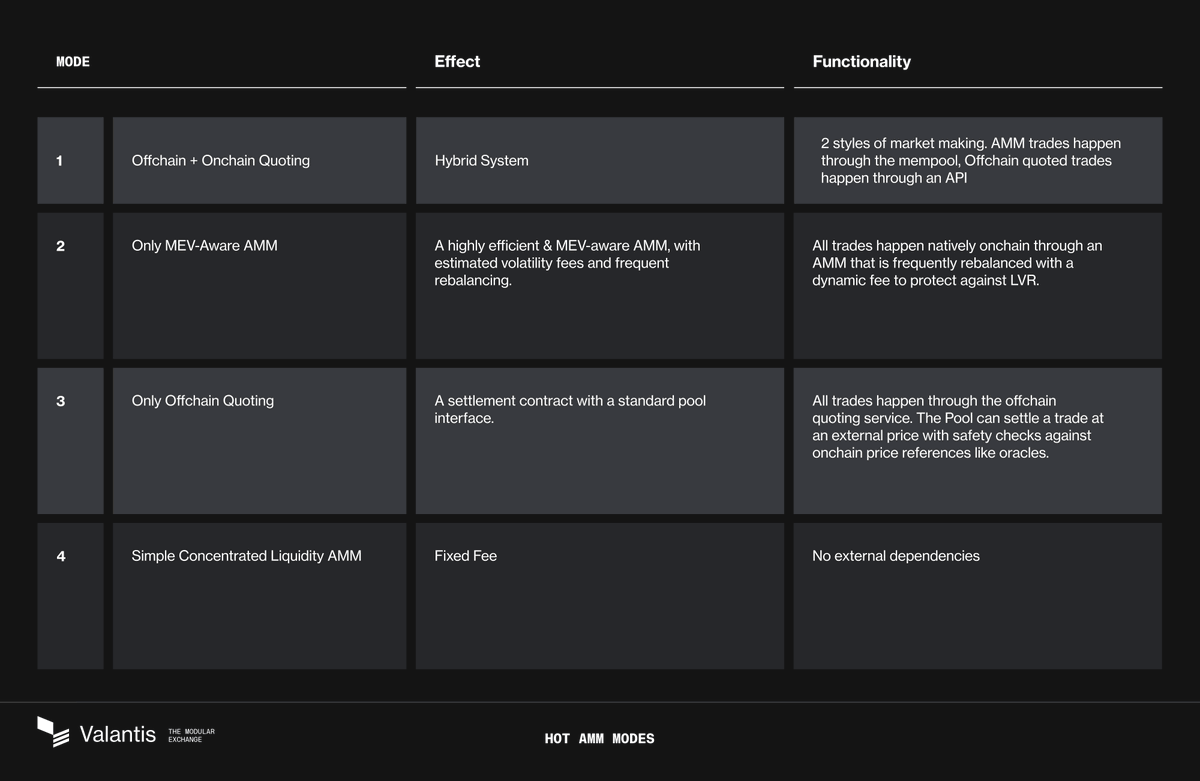

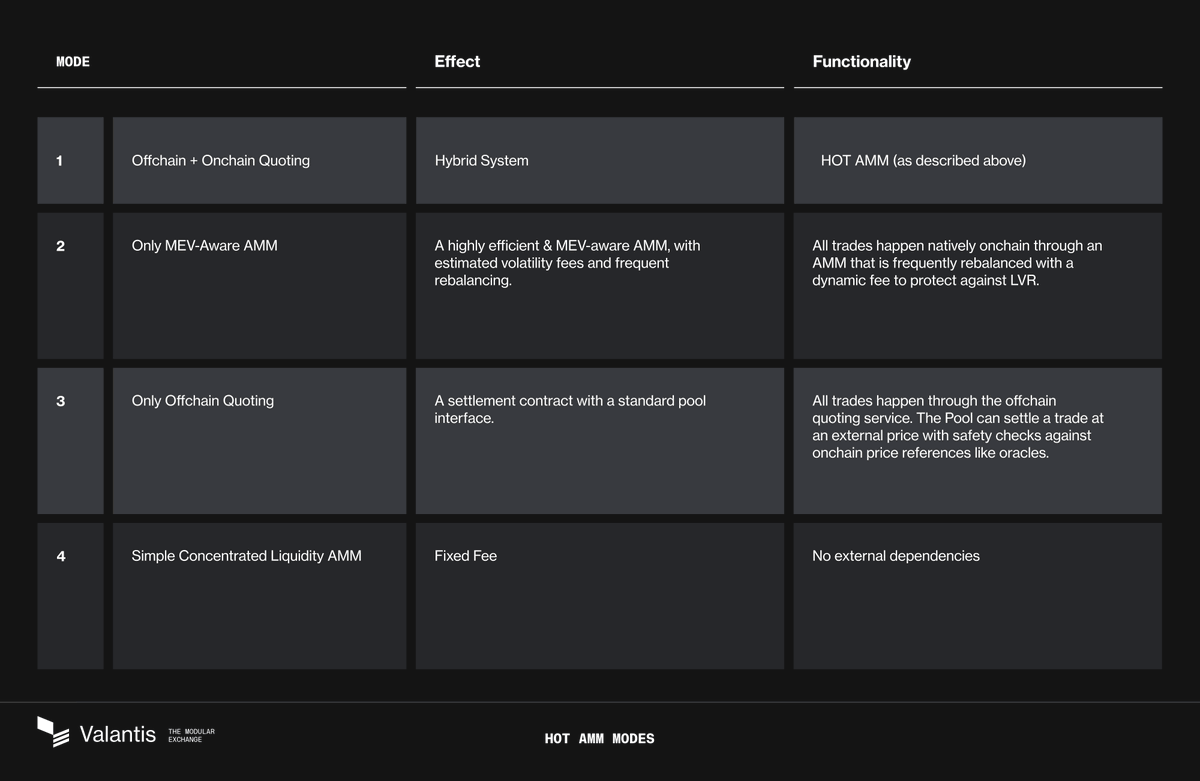

◆ Modula Pools & AMMs: customizable liquidity pools for LSTs with dynamic fees.

◆ LPing: deposit HYPE/LSTs for fee & arbitrage yields. integrates with @hyperlendx & @felixprotocol for auto-yields.

◆ Sovereign Liquidity: LPs can manage risks & avoid DEX "gambling." Supports swaps, deposits, and withdrawals with low slippage.

◆ Other Features: depeg arbitrage, HyperEVM integrations, LST pool expansions.

& More!

As for the real utility it brings for LSDs & LRTs 👇

@ValantisLabs lets protocols bootstrap liquidity for their LSDs/LRT with LPs that aren’t exposed to asymmetric IL.

This enables more resilient restaking ecosystems and composable LSTFi infra.

Now, taking a look at their recent performance & growth 👇

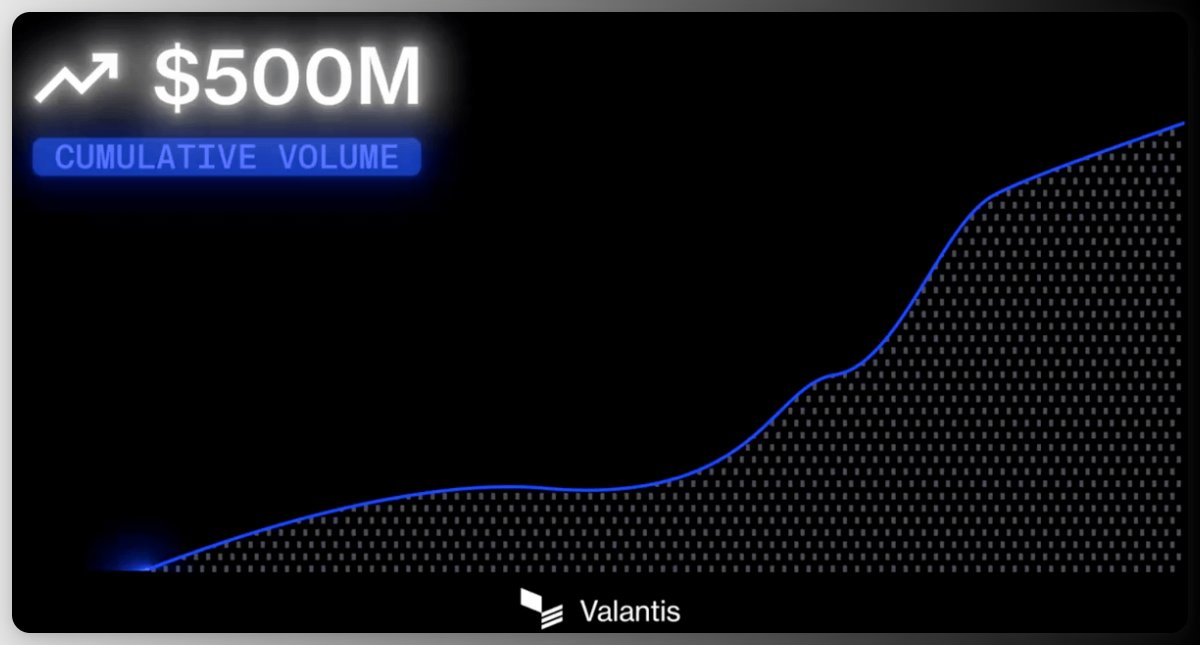

◆ Launched quietly, now $61M+ TVL, 10x since early July

◆ Most active LSD pairs now route through @ValantisLabs

◆ Capital-efficient volumes increasing week-on-week

◆ $520M+ in traded volume

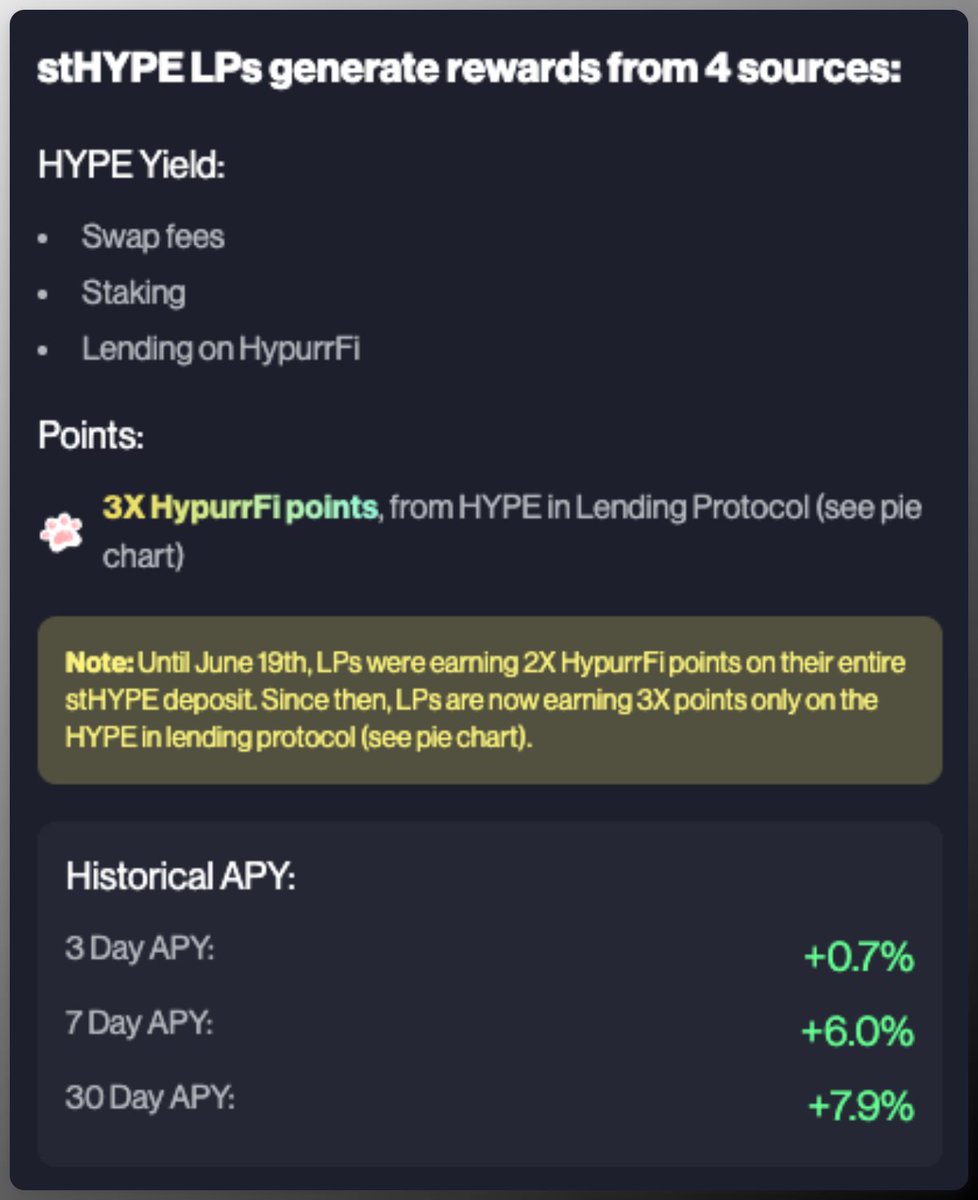

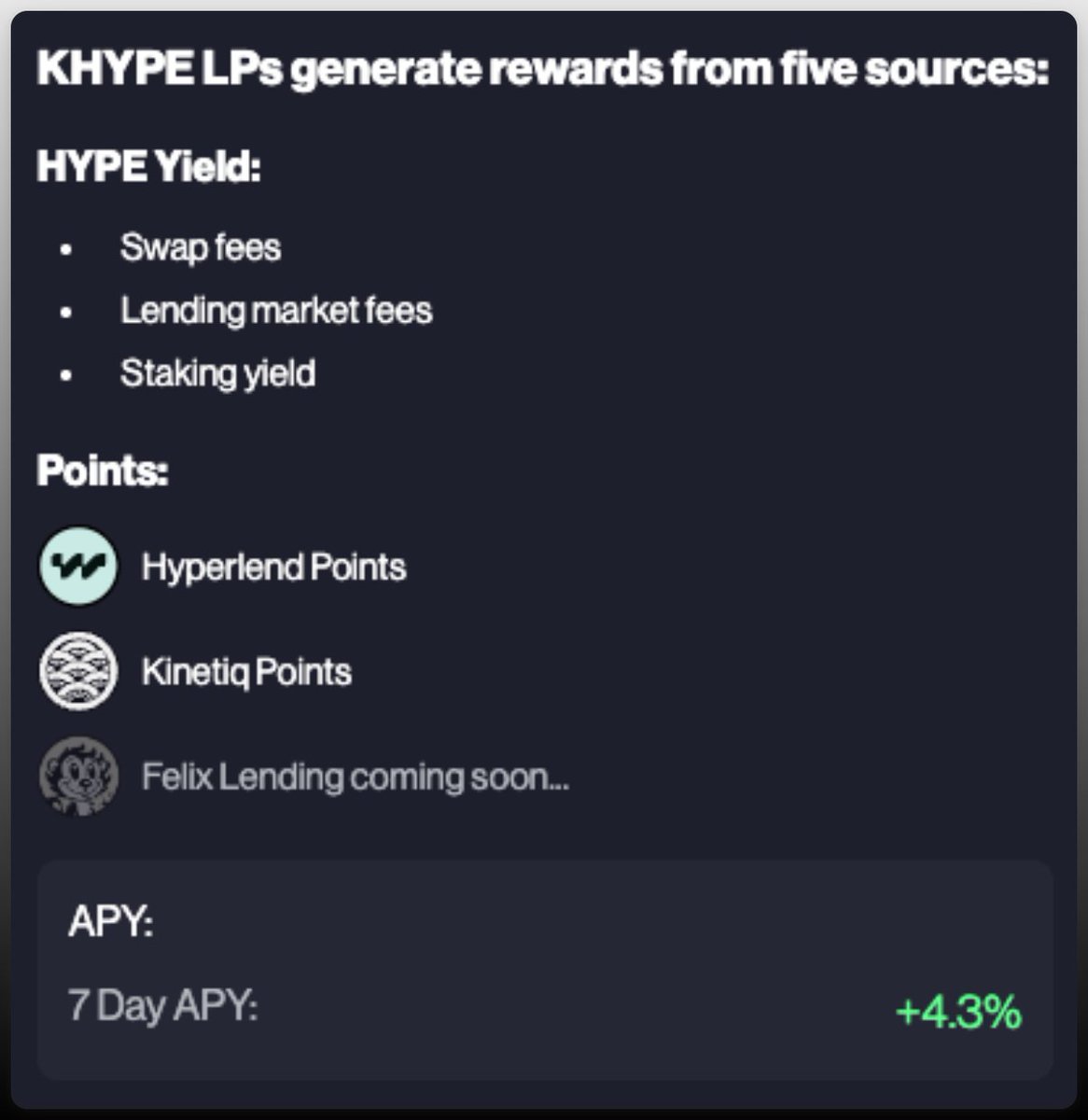

Regarding Points & PnL 👇

◆ LPs earn real yield from trading volume.

◆ Early pools qualify for @HypurrFi & potentially @HyperliquidX DeFi points.

◆ LSD protocols can create programmable pools with custom liquidity logic.

◆ Offers up to 5% APY for depositing $HYPE (plus HypurrFi Points) & 4%+ APY for depositing kHYPE (plus @hyperlendx & @kinetiq_xyz Points).

What’s next?

◆ Better LP interfaces & pool deployment tooling

◆ LRT-native support (EtherFi, Renzo, Kelp DAO, etc.)

◆ Composable staking vaults for native yield-on-yield

◆ Deep integrations with @prjx_hl, @marginfi, and future Hyper DeFi products

Lastly, why @ValantisLabs?

Valantis isn’t trying to outplay @Uniswap or @CurveFinance. it's rewriting the rules for how yield tokens trade.

◆ Native AMMs for yield tokens

◆ No IL for LPs

◆ Smart unstaking infra

◆ Fully integrated with Hyperliquid’s performance layer

With that, while we're about to wrap up this 🧵, here's how I'm interacting with @ValantisLabs 👇

◆ Buying $kHYPE against $HYPE

◆ Allocating some $kHYPE to @kinetiq_xyz earn vault

◆ Allocating some $kHYPE to @ValantisLabs $kHYPE pool

◆ Using rest to loop with other dApps

PS: Check out this 🧵 on kHYPE to find the whole loop:

With that, we finally wrap up this 🧵 on @ValantisLabs.

While this remains the last post in my series of HL dApps, make sure to drop your thoughts and projects you're farming in the comments 👇, and rest assured, I'll be covering the same in due time.

In the meantime, please L+RT this post if you found it useful or informative.

Signing out 🫡

18.01K

6

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.