When writing articles, it is necessary that the meanings of the words correspond to the historical context when referring back to them in the future; only then can they be considered correct.

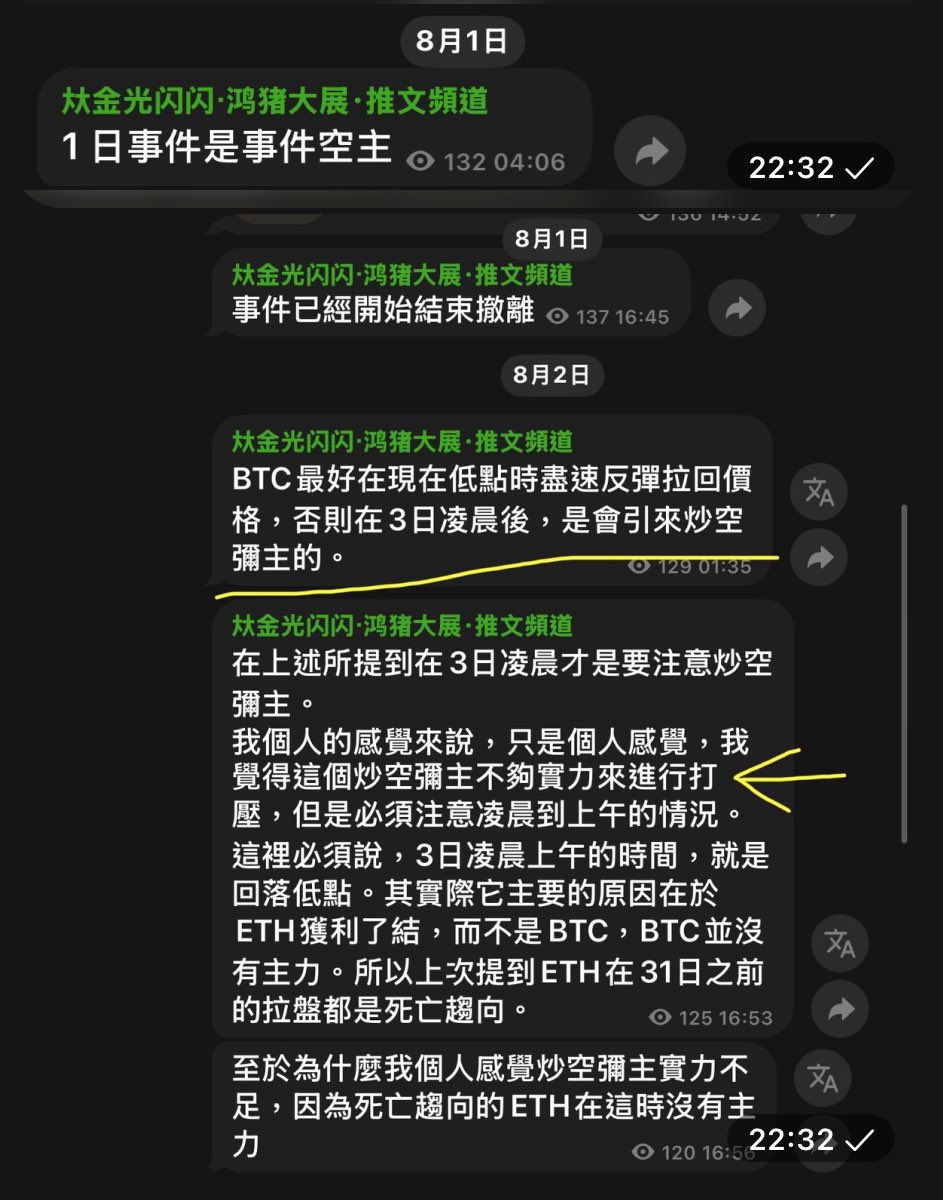

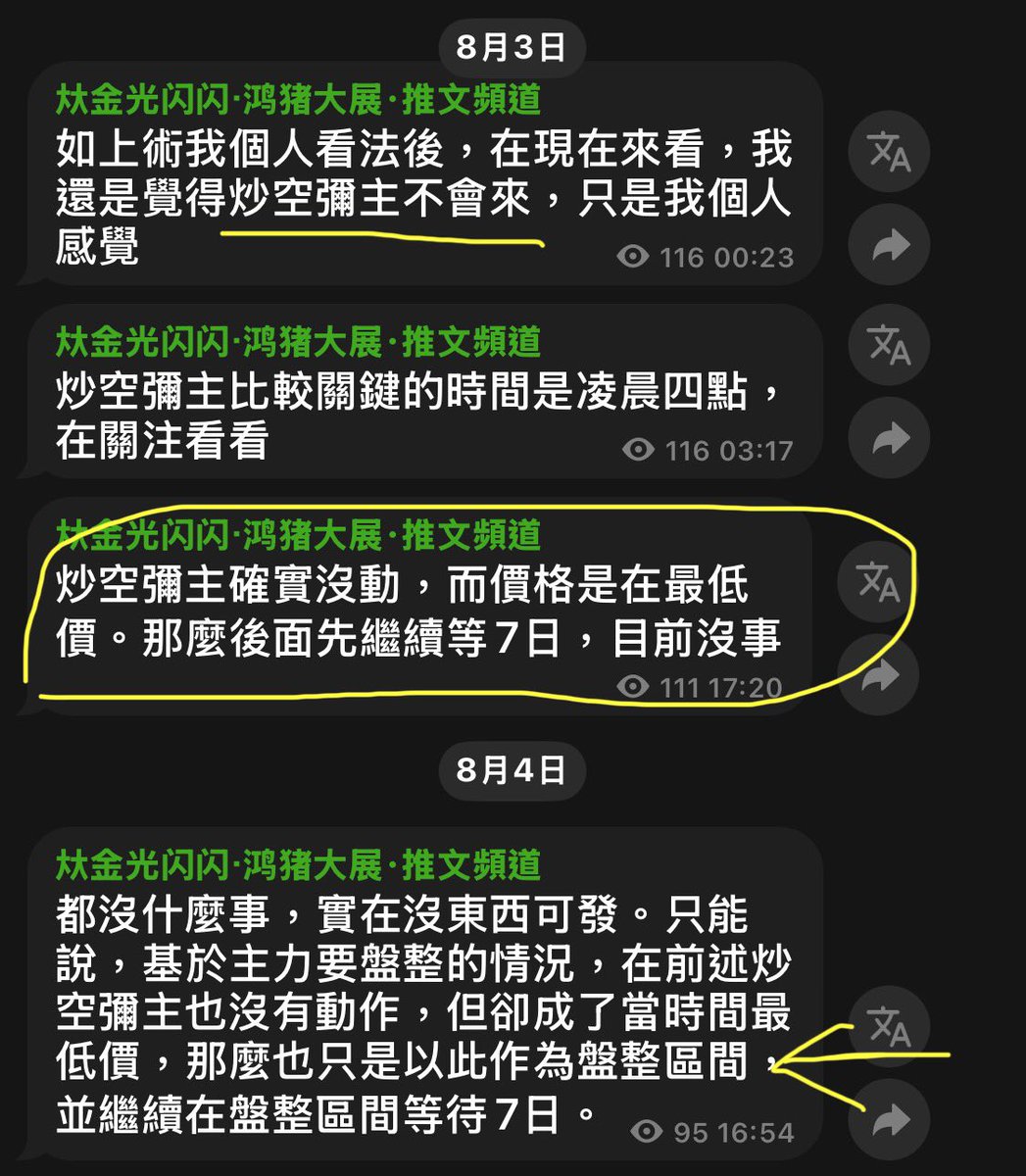

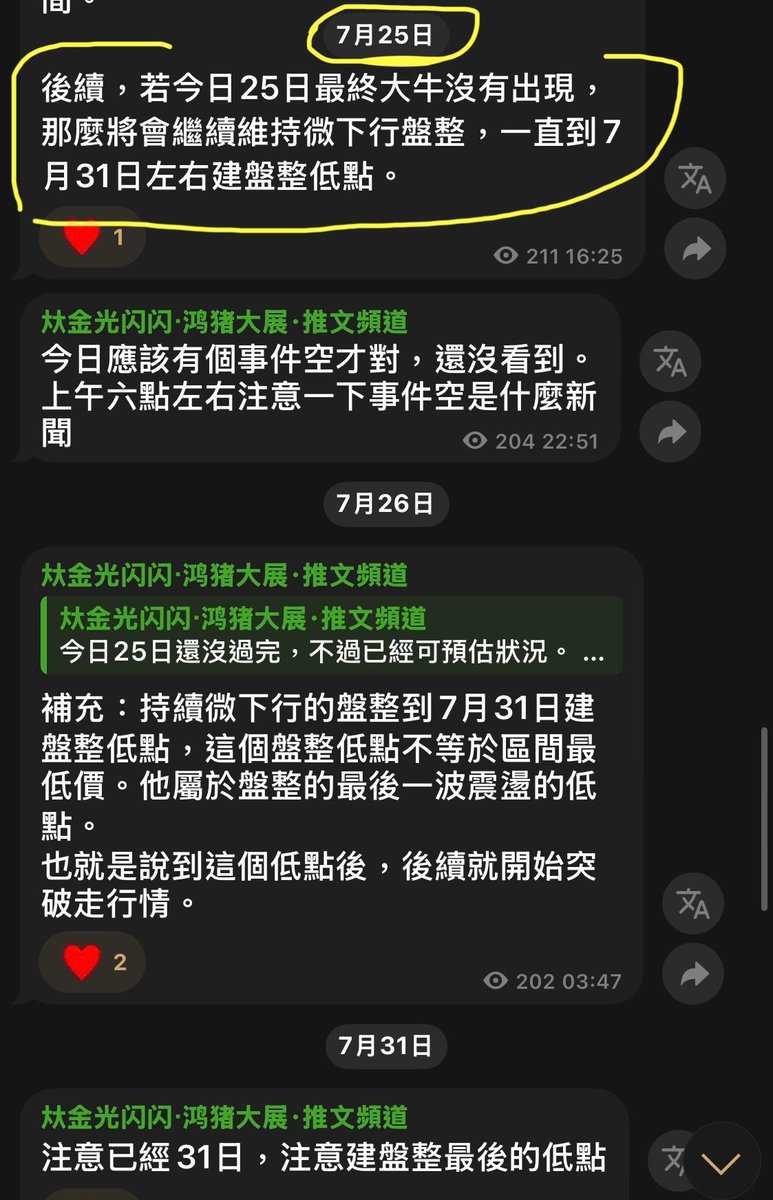

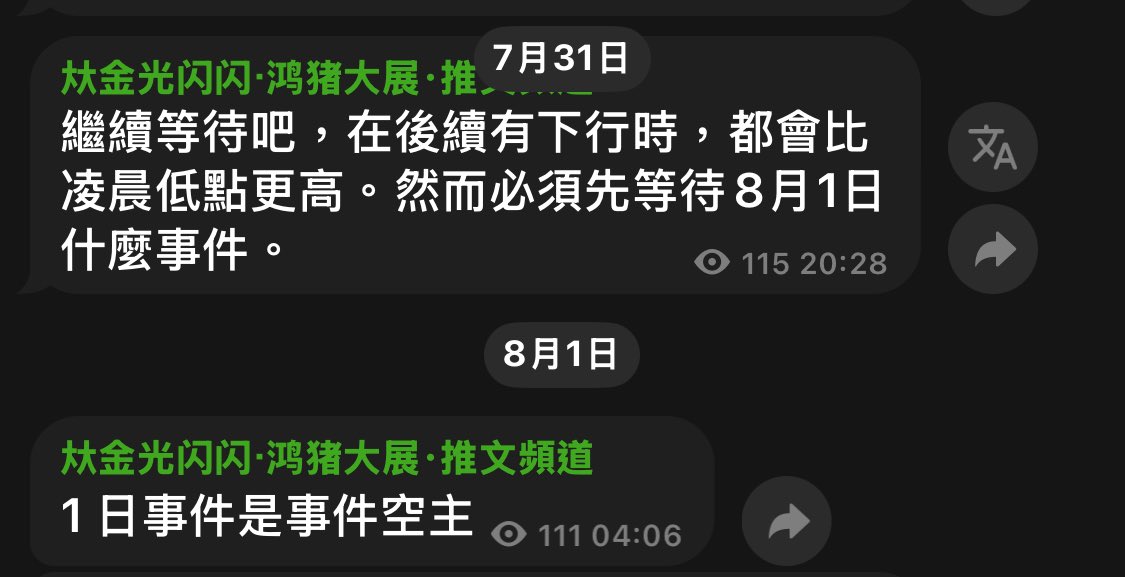

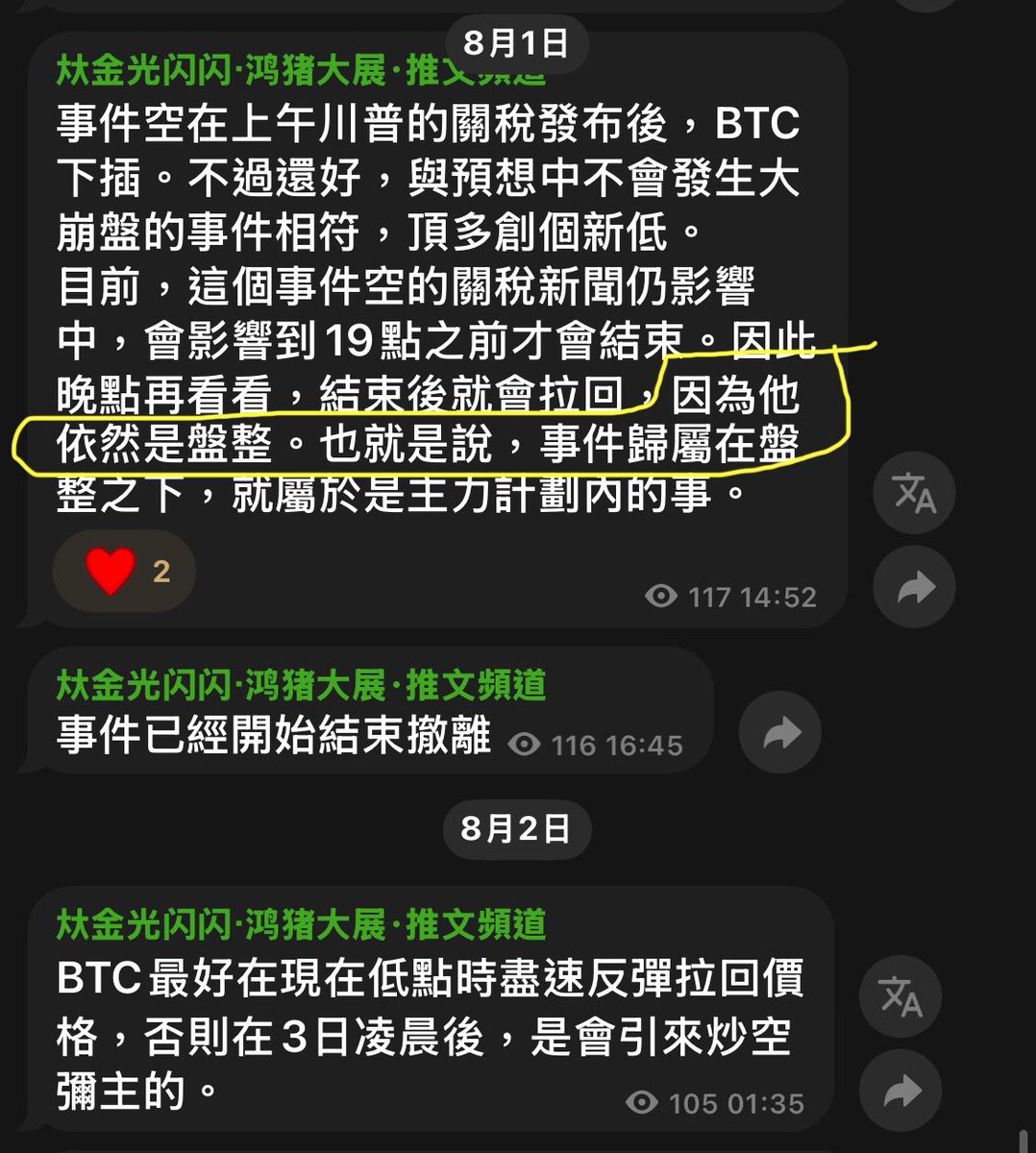

Regarding BTC, starting from July 31, it was mentioned that the event on the 1st caused a drop, and it was noted to establish a new consolidation range.

Looking back at historical articles and trends now, they completely align.

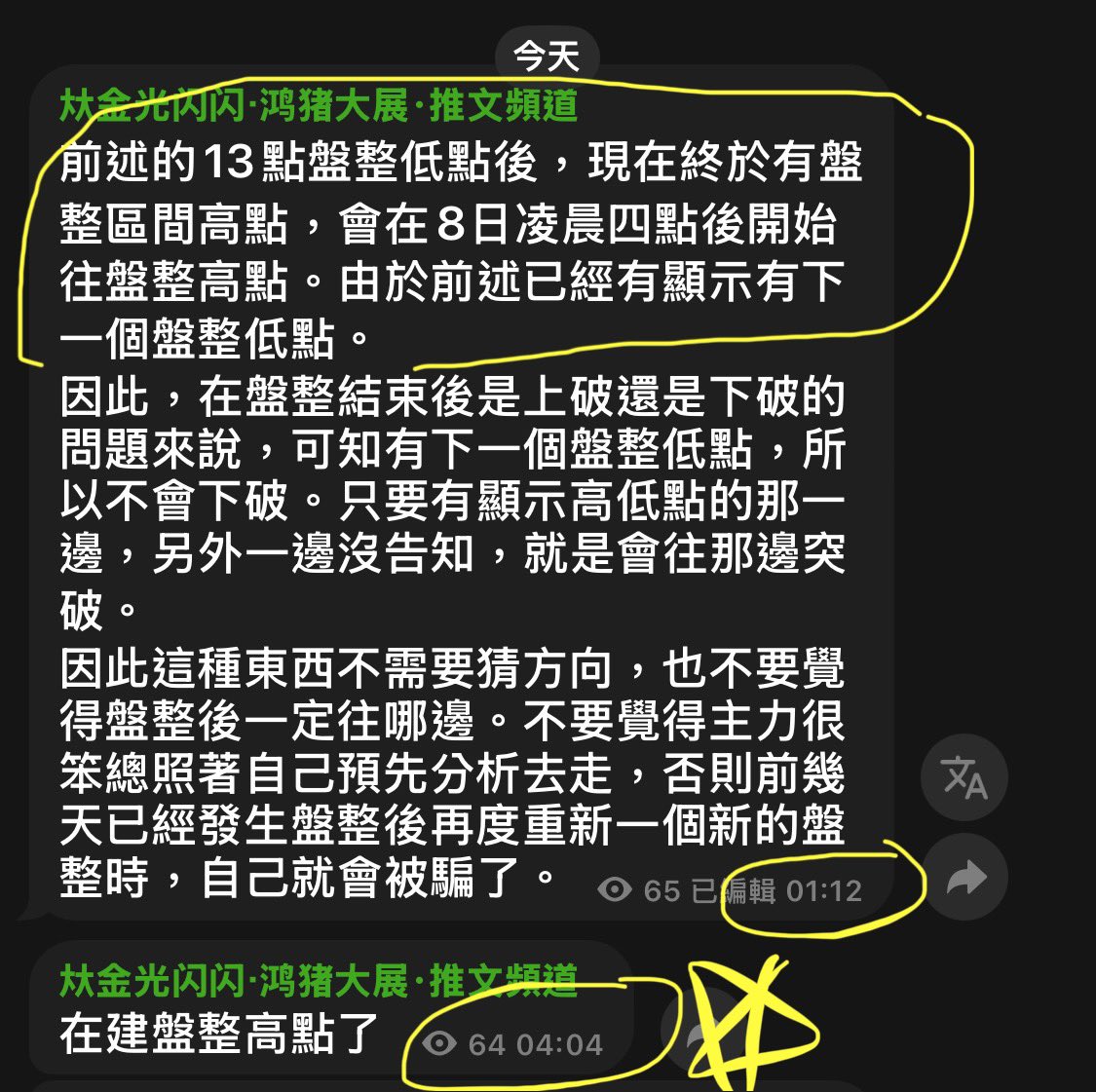

From the new consolidation range line chart, it can be seen that the lowest price point from the short selling on the 3rd, which did not come, marks the starting low point of the range up to the current range resistance line. It was mentioned in the early hours of the 8th that after four o'clock in the morning, a consolidation high point should be established. Now it can be seen that after four o'clock, the consolidation high point began to decline.

A: Why do my articles have to wait until events occur before most people can understand them?

Q: This is because most people use their own expectations of the market to interpret the text, rather than seeking the facts.

A: So why is it that I don't understand at the beginning of the article, but I understand after the event occurs?

Q: Clearly, the article hasn't changed, so it can be understood that what has changed is one's own thinking, sensory perception, and logic, which has become a double standard.

If one does not practice writing future articles, how can they discover that their thoughts are extremely out of touch with reality?

#BTC

Short-term traders in the BTC market who are actively trading and using high leverage, driven by their greed and desire for quick money, cannot accept a prolonged period of no market movement.

As a result, they are easily influenced by the bullish and bearish analyses found online. Every day, they either feel that the market is about to surge or that it is going to crash. Ultimately, very few people actually make money over a long period of time.

The historical market trends align perfectly with this article: starting from July 25, it mentioned consolidation until the 31st, and on the 31st, it referred to the event gap on the 1st, and after the event gap, it mentioned re-establishing a new consolidation zone.

However, investors are unwilling to accept that the market is consolidating; they always demand that the market must recognize their presence and provide immediate movement. The losses incurred are their own doing.

Now, we can see such a long period of consolidation, with prices still at 115,000. Yet, every day, the analyses written online make me think that yesterday it crashed to 80,000 and today it surged to 150,000.

Stay calm, look at what the article has already described, set aside your subjectivity, and accept the market leaders.

#BTC

3.72K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.