Annual revenue of $500 million, the sudden commercialization explosion of AI Agents

In the stereotype, AI Agents have always been seen as a small business, or rather as "future technology." Recently, I noticed that the growth rate and profitability of AI-native companies are far higher than those of internet companies, and even higher than all crypto companies outside of Tether.

- Meitu: Transformed by AI, from an annual loss of $190 million to an annual profit of $590 million,

- Cursor (AI programming assistant): Achieved $500 million ARR (Annual Recurring Revenue) in just 2 years

- Perplexity (AI search engine): $120 million ARR

- GenSpark (AI search engine): Achieved $36 million ARR in just 45 days

The high valuation of AI hardware in the capital market is also shifting to the AI application layer:

- Meitu (Market cap $6.4 billion, PE 56x)

- Cursor (Valuation $18 billion, Premium rate 36x)

- Perplexity (Valuation $14 billion, Premium rate 117x)

ToB-led commercialization path

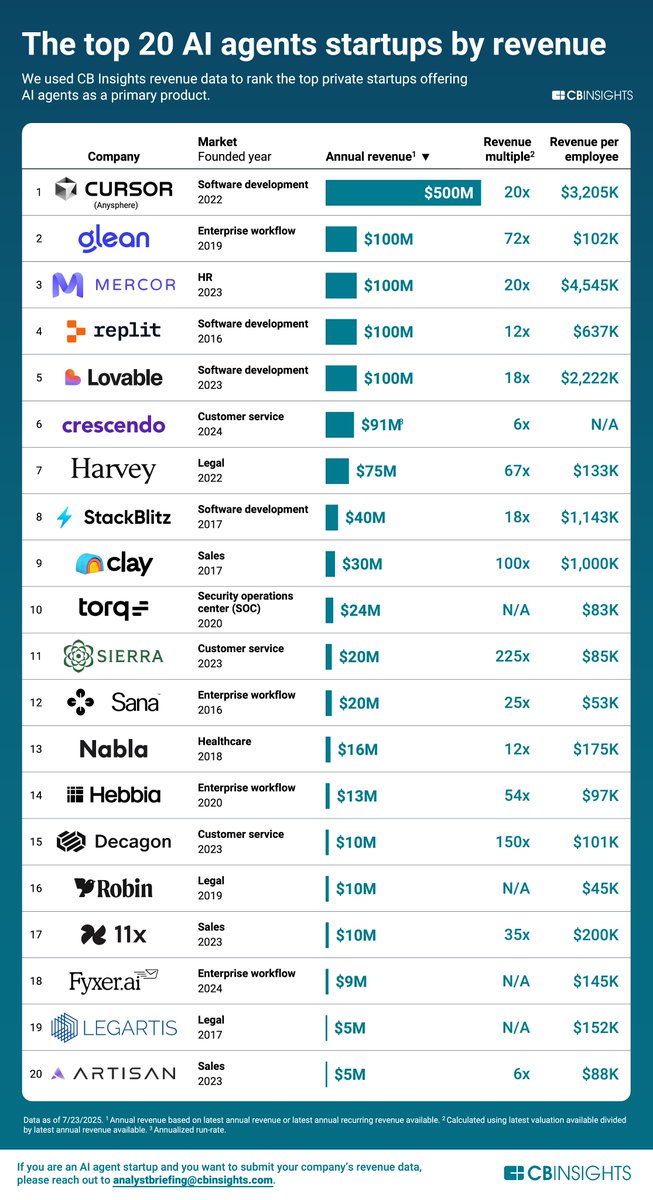

In a report published by @CBinsights, among the top 20 AI Agent companies ranked by revenue, all have chosen ToB as their main commercialization direction.

The common growth path chosen by leading companies:

- Scenario focus: Establishing a professional moat in vertical fields such as programming and law

- Integration with existing workflows: Achieving deep seamless integration with existing industry workflows to enhance user willingness to pay and reduce friction

- Value proof: Providing quantifiable ROI improvement solutions

Comparing actual revenue and PE ratios, it seems reasonable that the recent crash of altcoins occurred, but even now, crypto themes are still enjoying valuation dividends in the capital market (CRCL PE 2021x), while AI is still in a value gap compared to crypto.

Show original

1.53K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.