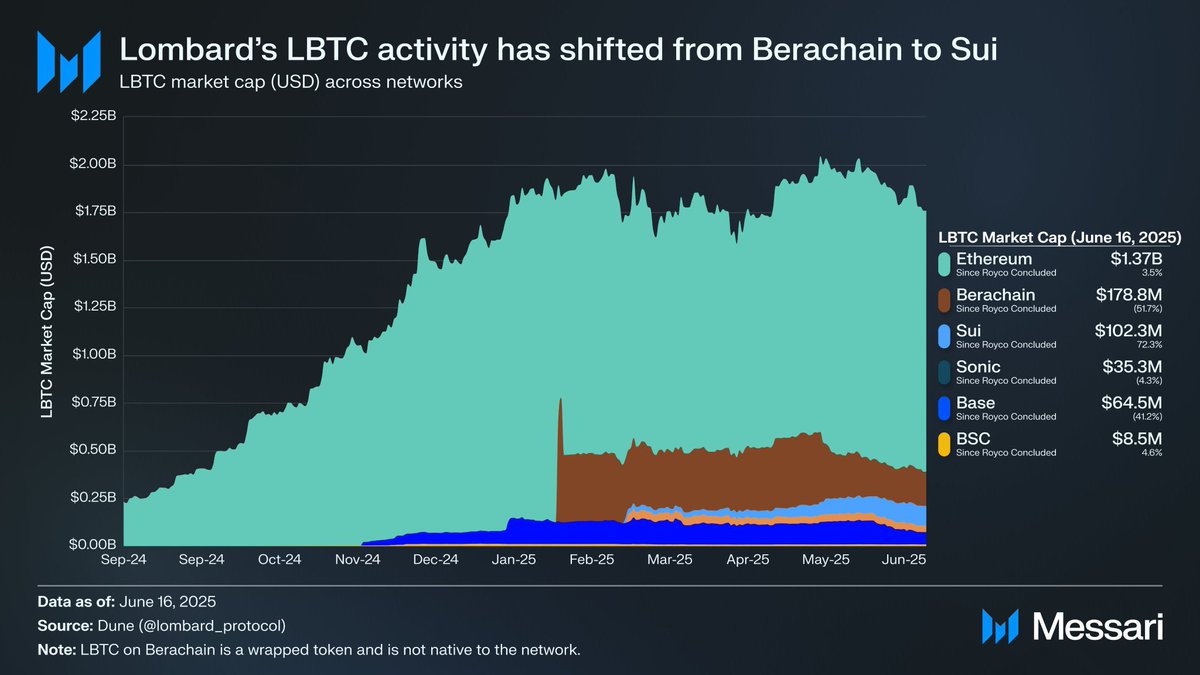

Recently, I've been observing the liquidity changes of Lombard Finance. Since the Royco Protocol opened withdrawals on May 6th, the flow of funds has been particularly rapid!

A quite obvious phenomenon:

The supply of LBTC on Berachain has been cut in half, dropping by 52%, while most of it has flowed to Sui, which has instead increased by 72%.

Interestingly, although many people think Sui might be a poor chain (with low TVL and a relatively young ecosystem), its DeFi yields are actually quite substantial. If you were already looking to earn Sats (Satlayer Points) and Lux (Lombard Points), Sui is basically the best place right now.

I am also researching a few strategies and have organized them simply for everyone:

If you want to earn Sats (Satlayer Points)

The current best route is:

🔻 Exchange SUI for xBTC

🔻 Deposit about half of the xBTC into the satlayer vault to get satXBTC

🔻 Then go to Bluefin and deposit satXBTC and xBTC into the LP pool

This way, you can earn Sats points and approximately 10% APR (annual percentage rate).

▰▰▰▰▰▰

If you want to earn Lombard's Lux Points

This is a bit more complicated, but the returns are also higher!

🔻 Exchange SUI for LBTC

🔻 Deposit LBTC into Suilend

🔻 Collateralize LBTC and borrow SUI (the interest rate is quite low)

🔻 Stake the borrowed SUI into Springsui to get sSUI

🔻 Deposit sSUI back into Suilend and stake again

You can loop this a few times, depending on your risk tolerance. This way, you can earn 3 times the Lux points and also make about 2.5%–4% APR!

▰▰▰▰▰▰

Why is everyone starting to flock to Sui?

In my opinion, whether the TVL is high or not is not the issue; the yield is what matters! Although there are some strategies on Berachain, from what I've seen, Sui offers the highest yield efficiency, and combined with the efficiency of point accumulation, it is definitely one of the best yield strategies right now!

#KaitoYap @KaitoAI @JacobPPhillips @Lombard_Finance #Yap

Show original

42.21K

232

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.