Sold 80,000 BTC for a fossil hand who has held a position for 14 years

The main OTC trading channel for ETH microstrategies to buy ETH

The founders invested in BTC back in 13 at a cost of just $100

Galaxy Digital is undoubtedly the center of recent conversations, what is the origin of this institution known as "Wall Street's most crypto-savvy institution"?

Five minutes to take you through its main business / founder saga / iconic events and on-chain data 🧵👇

1/ Main Business

Galaxy Digital (@galaxyhq) is a crypto financial services and asset management company established at the end of 2017, currently having five main business lines: trading, investment, asset management, consulting, and mining, and is hailed as "the institution on Wall Street that understands cryptocurrency the most."

The core profit department is the trading and investment business, where the trading business primarily provides over-the-counter spot trading 💁♀️ — this has also become Galaxy's most frequently appearing role recently; the OTC business partners include traditional financial institutions (such as Goldman Sachs, State Street), digital asset management companies, custody and staking service providers (such as Fireblocks / BitGo), and technology companies.

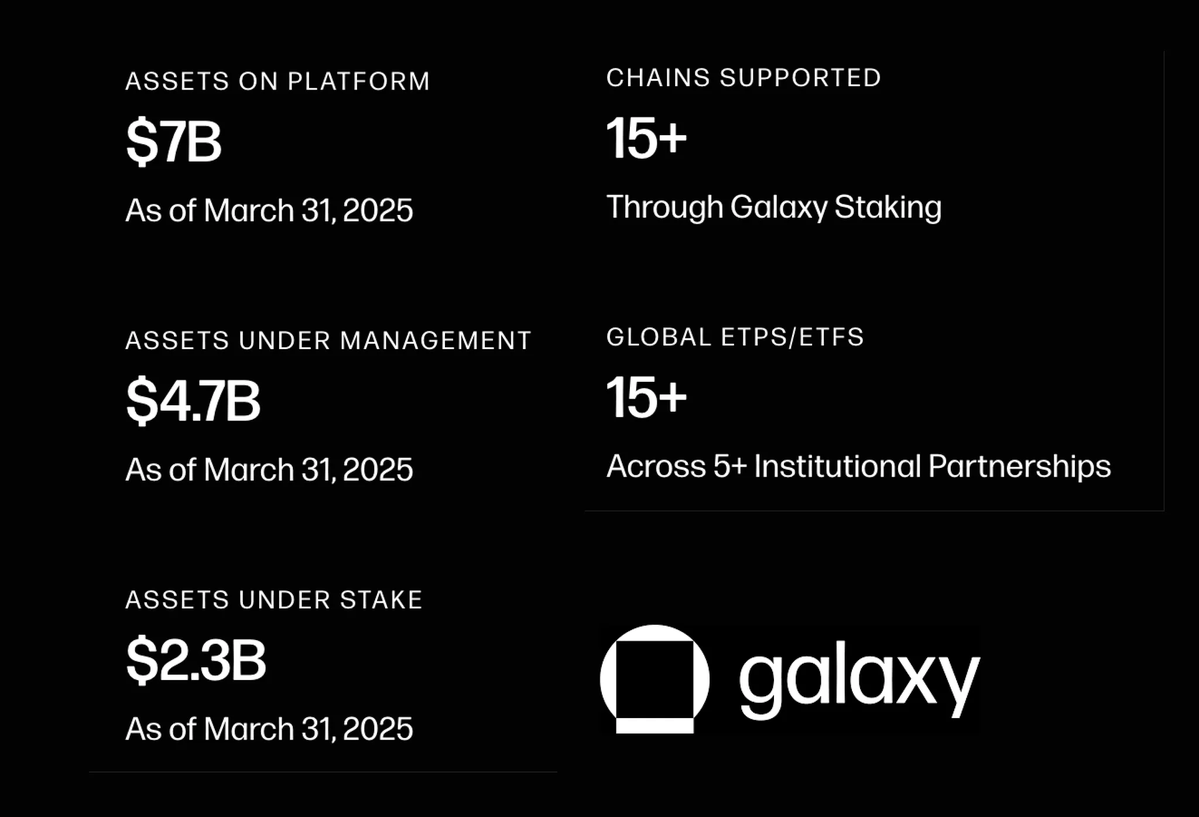

According to the official website, the current platform asset scale reaches $7 billion, asset management scale is $4.7 billion, staking assets are $2.3 billion, supporting 15 public chains and networks, and has established partnerships with 15 ETPs and ETFs.

2/ The Legendary Story of the Founder

Mike Novogratz (@novogratz) founded Galaxy Digital when he was over fifty. This super-rich individual, who made it onto the Forbes Billionaires List in 2008, started investing in BTC as early as 2013 and is now one of the wealthiest people in the cryptocurrency space.

In just 8 years, Galaxy has become one of the most well-known service providers and asset management companies in the blockchain sector. Here are his legendary experiences:

♦︎ Worked at Goldman Sachs for 11 years, rising from hedge fund manager to partner.

♦︎ Partner at Fortress Investment Group, where he was exposed to cryptocurrency.

♦︎ In 2013, when BTC was only $100, he invested a whopping $7 million.

♦︎ Served as a member of the Investment Advisory Committee at the New York Federal Reserve Bank.

♦︎ Left Wall Street in 2015 after suffering huge losses due to a miscalculation on Brazilian interest rates.

♦︎ Publicly stated in 2017 that he made over $250 million in profits from cryptocurrency investments over two years (mainly in BTC & ETH).

♦︎ Founded Galaxy Digital at the end of 2017, aiming to attract traditional investors and institutions into the crypto space.

"Financial mogul + over 20 years of Wall Street experience + extremely high investment returns in the crypto field"—seeing this, you might understand why Mike Novogratz is so passionate about the crypto industry and stands out among institutions with his resources.

3/ Landmark Events

1️⃣ Helped the ancient giant whale sell 80,000 BTC

This is one of the largest nominal Bitcoin transactions in history that everyone is familiar with. With a market value exceeding $9 billion, the Q3 financial report data should look very impressive after this event, and Galaxy's OTC clients are probably no longer worried about finding buyers, haha.

2️⃣ ETH Microstrategy SharpLink Gaming's main OTC trading channel

Since June 2025, multiple large ETH transactions have been completed, and part of the purchased ETH is managed through Galaxy Digital's custody services and is also staked for yield.

4/ Landmark Events

The two events above have recently occurred, and here are a few interesting "fun facts" to add.

3️⃣ Galaxy is the largest buyer of 41 million SOL from the FTX bankruptcy auction.

They purchased 25.52 million tokens at a price of $64; if they haven't sold, the current return rate is 154%. In April this year, Lookonchain also reported that Galaxy Digital allegedly swapped ETH for SOL, selling 65,600 ETH to increase their holdings by 752,240 SOL, when ETH was only $1579.8 and SOL was $136.7. If true, they missed out on ETH's subsequent more than double increase.

4️⃣ Galaxy made over a billion dollars in profit through $LUNA.

They bought 18.51 million LUNA at a discounted price of $0.22 each (LUNA peaked at nearly $120), but after the collapse, they were fined for alleged market manipulation, paying a $200 million settlement.

5️⃣ In May of this year, Galaxy moved from the Toronto Stock Exchange to list on NASDAQ.

As of Q1 2025, Galaxy Digital officially disclosed holding $1.1 billion in cash and stablecoins, as well as $1.9 billion in equity.

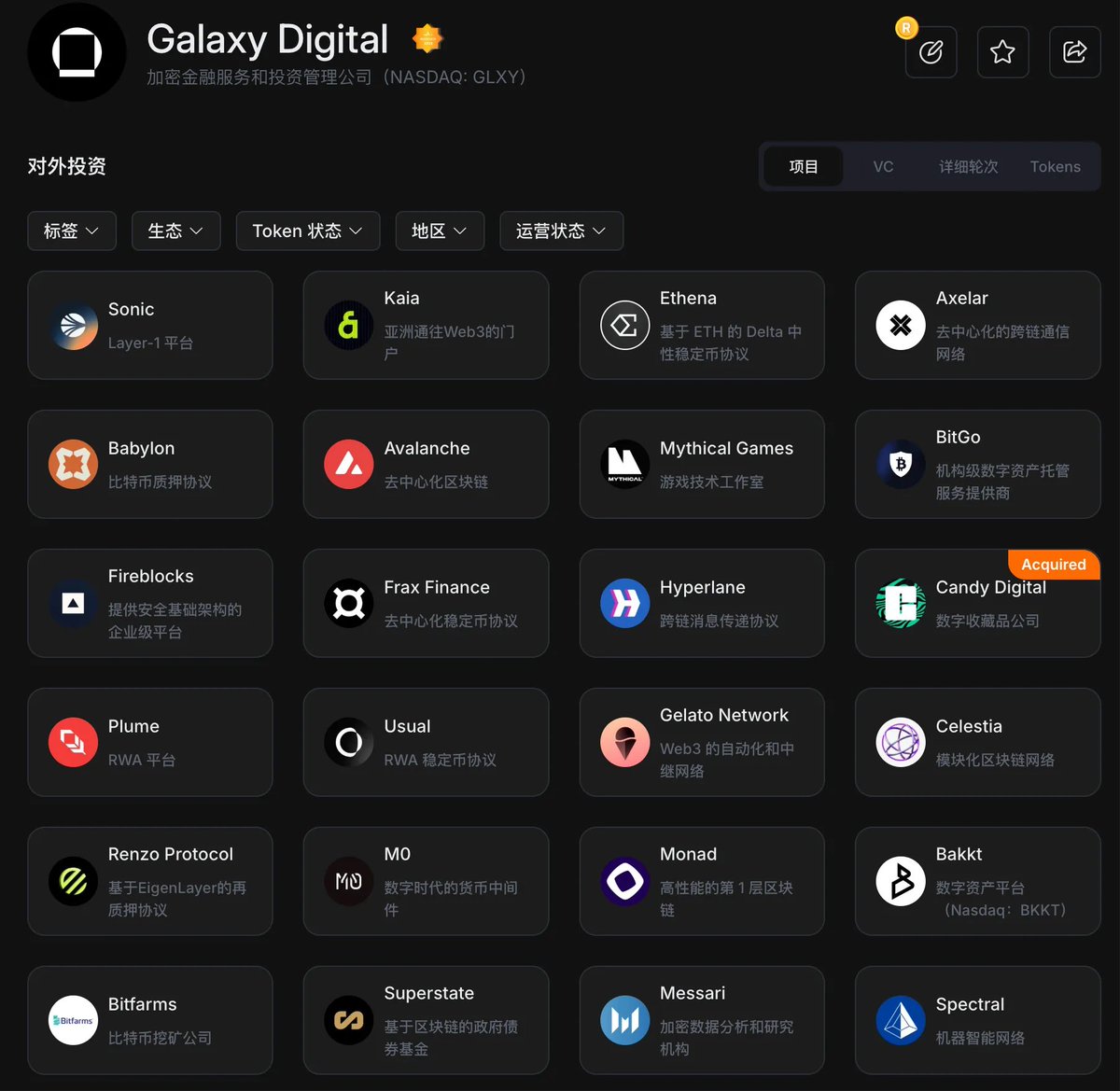

5/ Foreign Investments

According to information from Rootdata, Galaxy Digital has invested in 124 projects, including Sonic, Monad, Ethena, Babylon, and Plume. Among these, the investment in EOS during the period of 2018-2019 yielded a profit of $71.2 million, with a return on investment of 123%.

Portal 👉

6/ On-chain Holdings

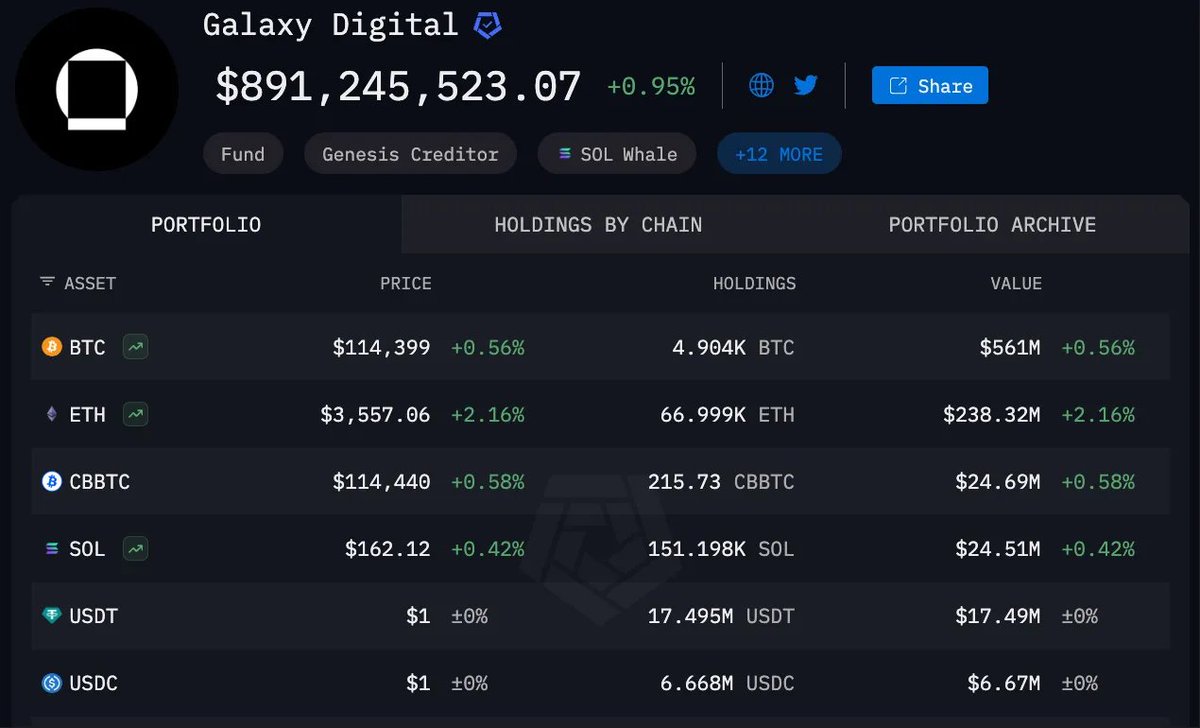

Currently, Galaxy Digital holds $921 million in assets on-chain, with the TOP 5 assets being mainstream coins and stablecoins.

♦︎ BTC: 5,119.73 coins, approximately $585 million

♦︎ ETH: 75,425 coins, approximately $268 million

♦︎ SOL: 151,196 coins, approximately $24.51 million

♦︎ USDT: 17.49 million coins

♦︎ USDC: 6.67 million coins

7/ Final Thoughts

The introduction to Galaxy Digital has been updated on my personal homepage:

If you find the content helpful, feel free to share / like / comment! 💕

If there are any other interesting topics about Galaxy, see you in the comments section~

84.07K

118

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.