If a CFO lit $2B on fire, they’d be fired. But when bankers do it, it’s called a “successful IPO.”

@FinancialTimes calls it a win because their job isn’t reporting. It’s laundering Wall Street’s narrative.

Rent extraction wrapped in buzzwords. Delivered by the psyop machine.

@FinancialTimes @bgurley @figma @NYSE @litcapital link to the article and my thread below:

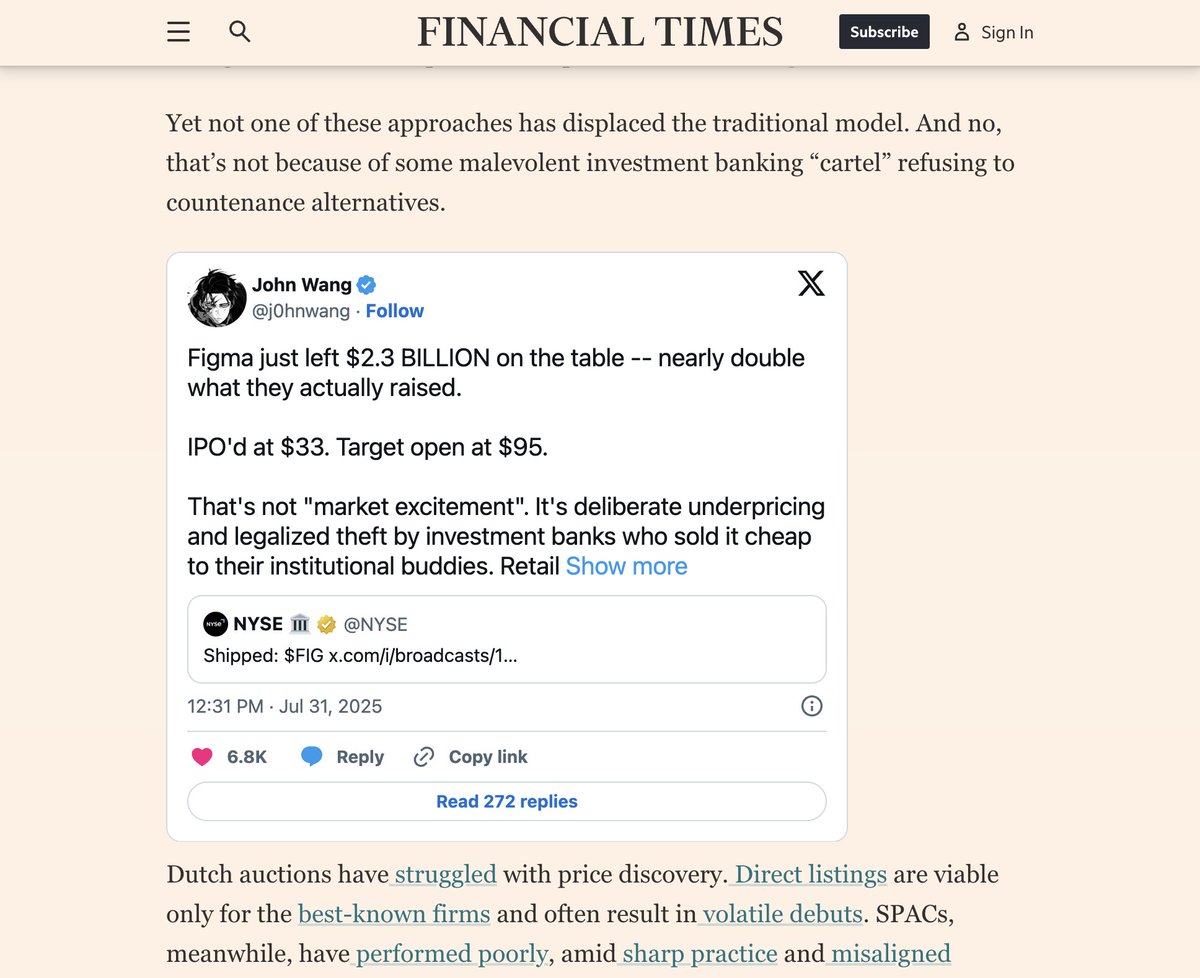

Figma just left $2.3 BILLION on the table -- nearly double what they actually raised.

IPO'd at $33. Target open at $95.

That's not "market excitement". It's deliberate underpricing and legalized theft by investment banks who sold it cheap to their institutional buddies. Retail shoves in at open and gets used as exit liquidity.

Same playbook:

- DoorDash: $3.4B stolen

- Airbnb: $3.5B stolen

- 2021 total: $50B stolen

Since 2020, this cartel has stolen over $100 billion that should have gone to real value creators: founders, employees, and retail.

5.58K

75

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.