Volatility is opportunity.

Falcon is capturing it to deliver 14%+ APY on sUSDf.

Here’s a breakdown of our yield engine, how it works, and the strategies driving performance.

2/ Falcon’s diversified yield strategy includes:

• Negative & positive funding rate arbitrage ~44%

• Cross-exchange spreads ~34%

• Staking strategies ~22%

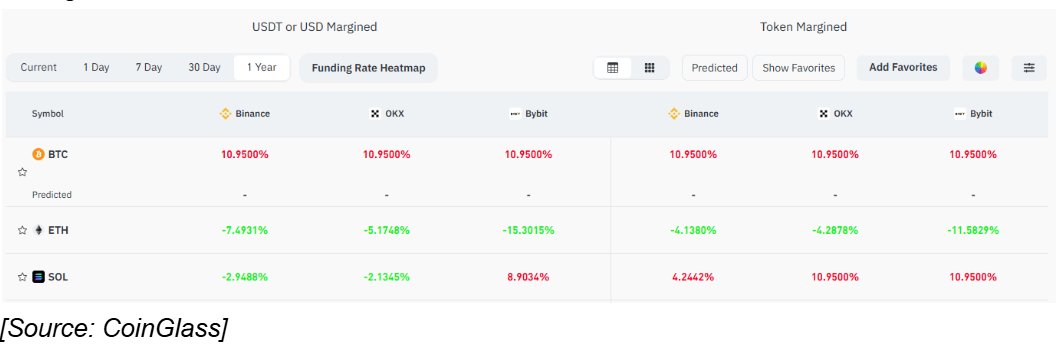

3/ Funding rate surge

Bluechip funding rates, both positive and negative, have soared past 10% annually across major exchanges.

Falcon taps into both, making it one of our core yield generation strategies.

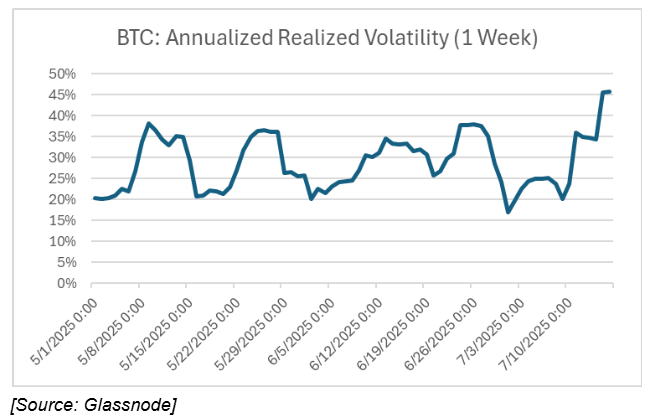

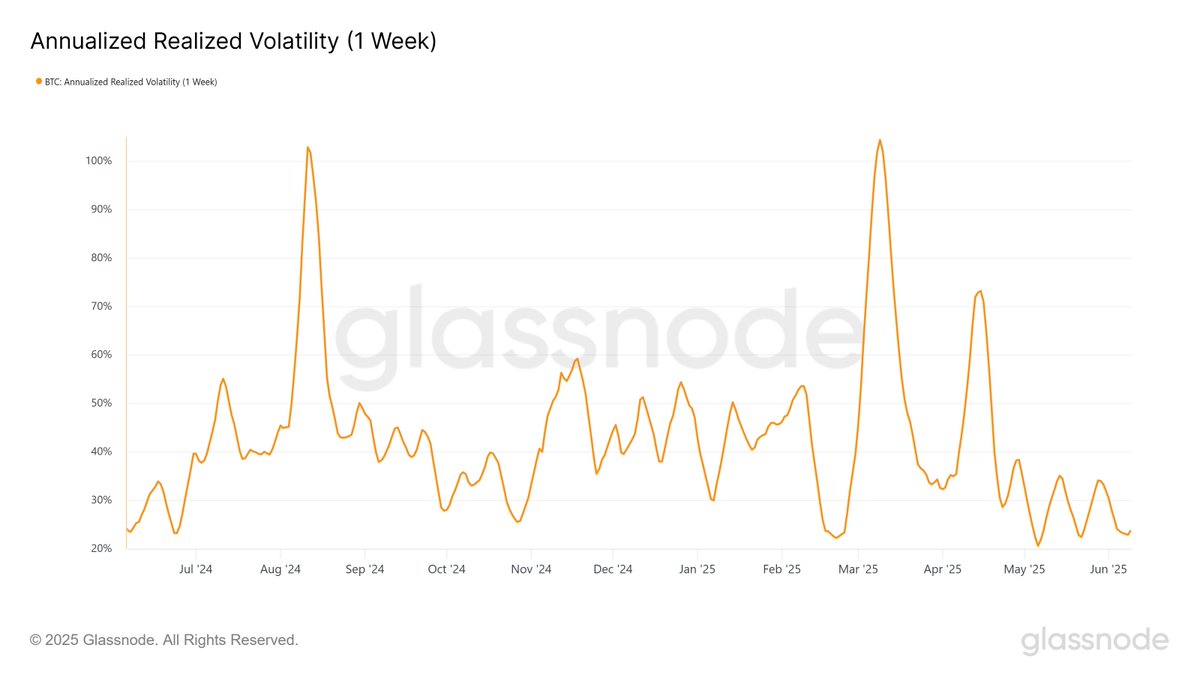

5/ Market volatility and cross-exchange arbitrage

We previously anticipated a rise in market volatility, and recently it has reached new highs.

This increased volatility implies a higher likelihood of mispricing between different trading venues.

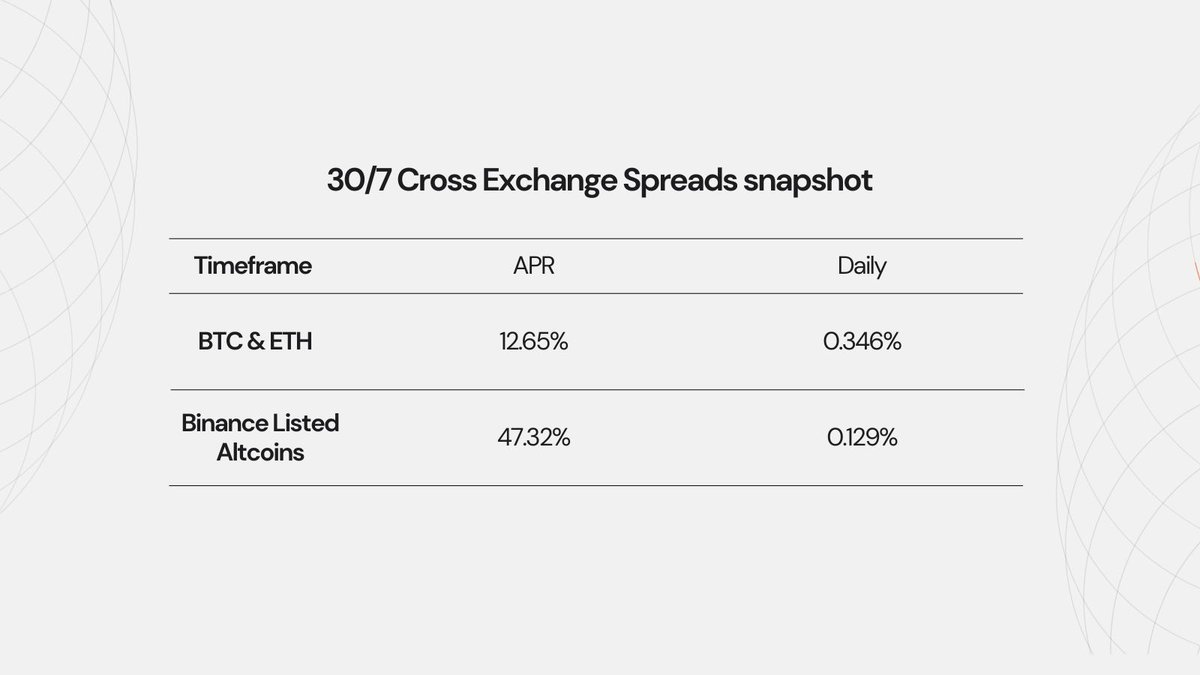

6/ Cross-exchange arbitrage remains a powerful yield engine.

Short-term market volatility tends to mean-revert around the 20% level.

Our prior research indicates a strong correlation between volatility and exchange price spreads.

As markets normalize, we anticipate a rise in cross-exchange arbitrage opportunities.

6/ Cross-exchange spreads and yield opportunities

Price spreads between leading exchanges offer notable arbitrage opportunities.

Falcon capitalizes on these while managing risk by maintaining less than 20% of the open interest market share for any asset.

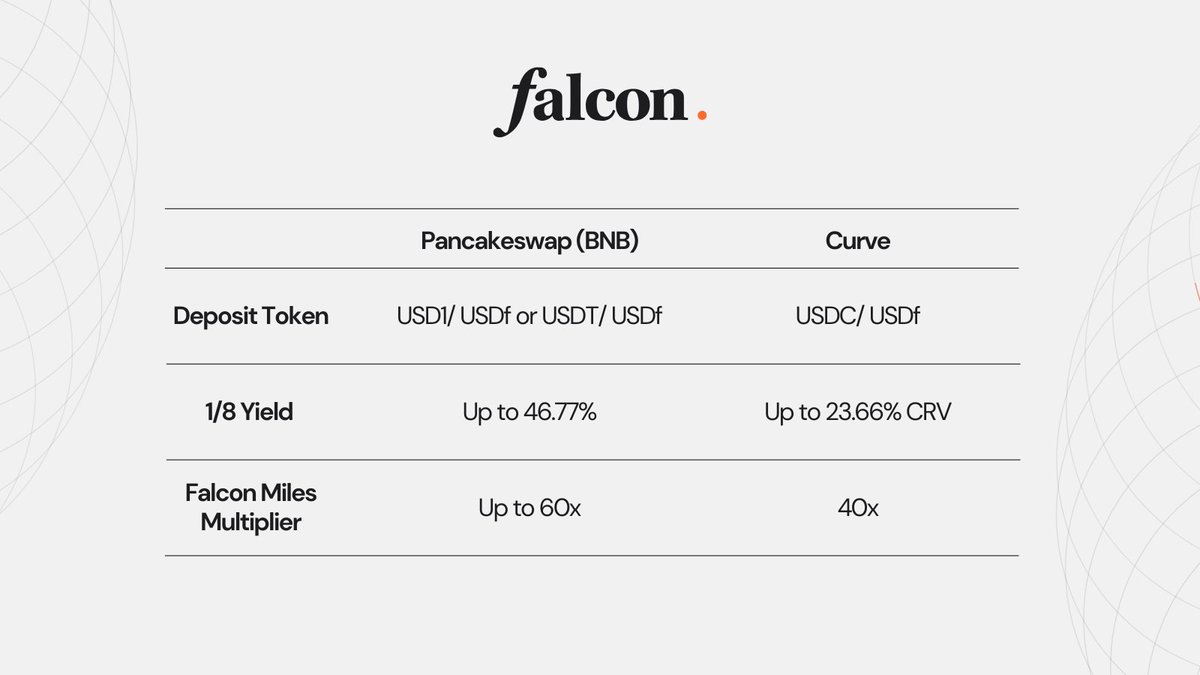

7/ Defi yield and Falcon Miles

On top of Falcon native yield, USDf and sUSDf holders can earn additional yield and up to 60x in Falcon miles by providing liquidity on DEXs.

8/ Falcon’s yield engine is built for adaptability.

Falcon’s diversified strategies and disciplined execution have enabled recent yields above 14% APY on sUSDf, with performance adapting to changing market conditions.

12.94K

90

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.