The launch of INFINIT V2 has monetized DeFi strategies for the first time.

📌 The structure of DeFi has always been unstable.

The protocol layer is expanding horizontally, with more and more functions, but the user experience remains stuck in place.

The paths are discontinuous, parameters are hard to grasp, and execution cannot be reused, making it difficult for DeFi newcomers to understand.

What @Infinit_Labs V2 does is turn these processes into system functions, from data collection to strategy execution, from strategy design to profit sharing, forming a complete chain.

It transforms DeFi into a system where experiences can be reused. 👇

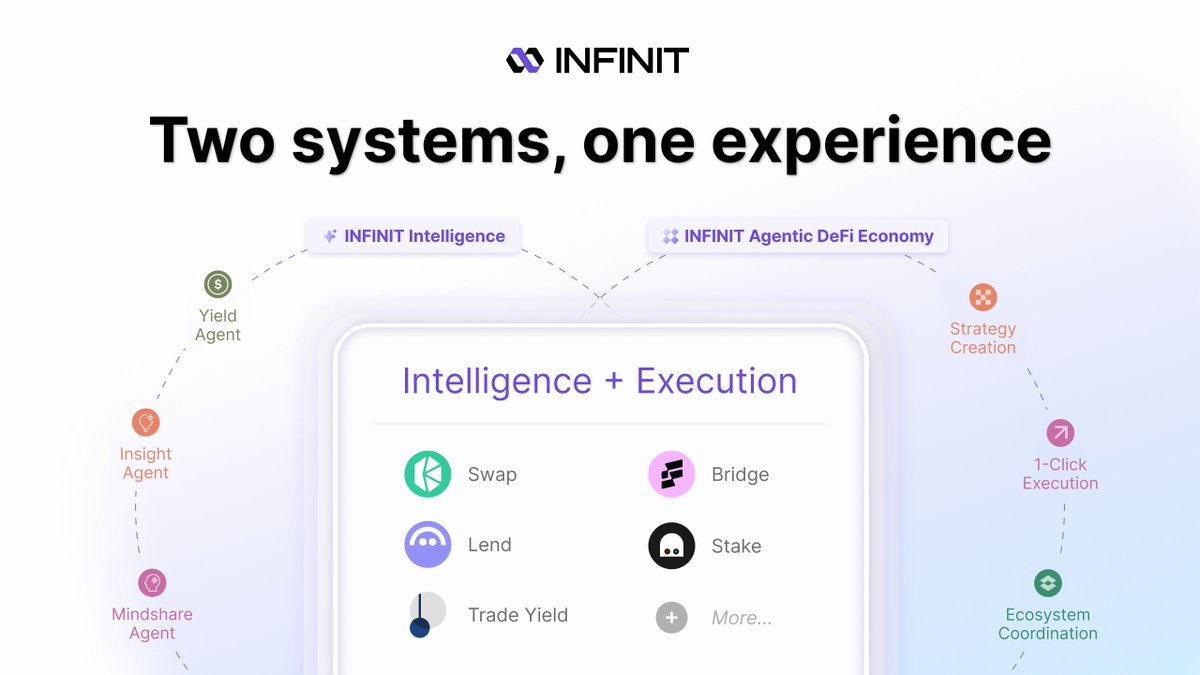

This architecture now operates as two systems working in synergy: one brain + one pair of hands.

The front end is #INFINIT Intelligence, acting as your strategy hub. It actively runs data sources, analyzes which pools have had significant recent yield changes, which protocols have rising TVL, where funds are flowing, and even captures market trends through social sentiment.

The back end is Agentic DeFi after the V2 launch, which handles execution and actually runs these strategies. It’s not just about clicking through five or six pages to swap and stake; it truly completes all on-chain interaction logic and directly returns the final structure.

After a session, users only need to express their intentions in one or two natural language sentences:

"I want to do Pendle fixed income."

"I want to add a bit of stable leverage."

The system automatically composes the execution path, assets remain in the wallet, strategies execute locally, and profits automatically flow back.

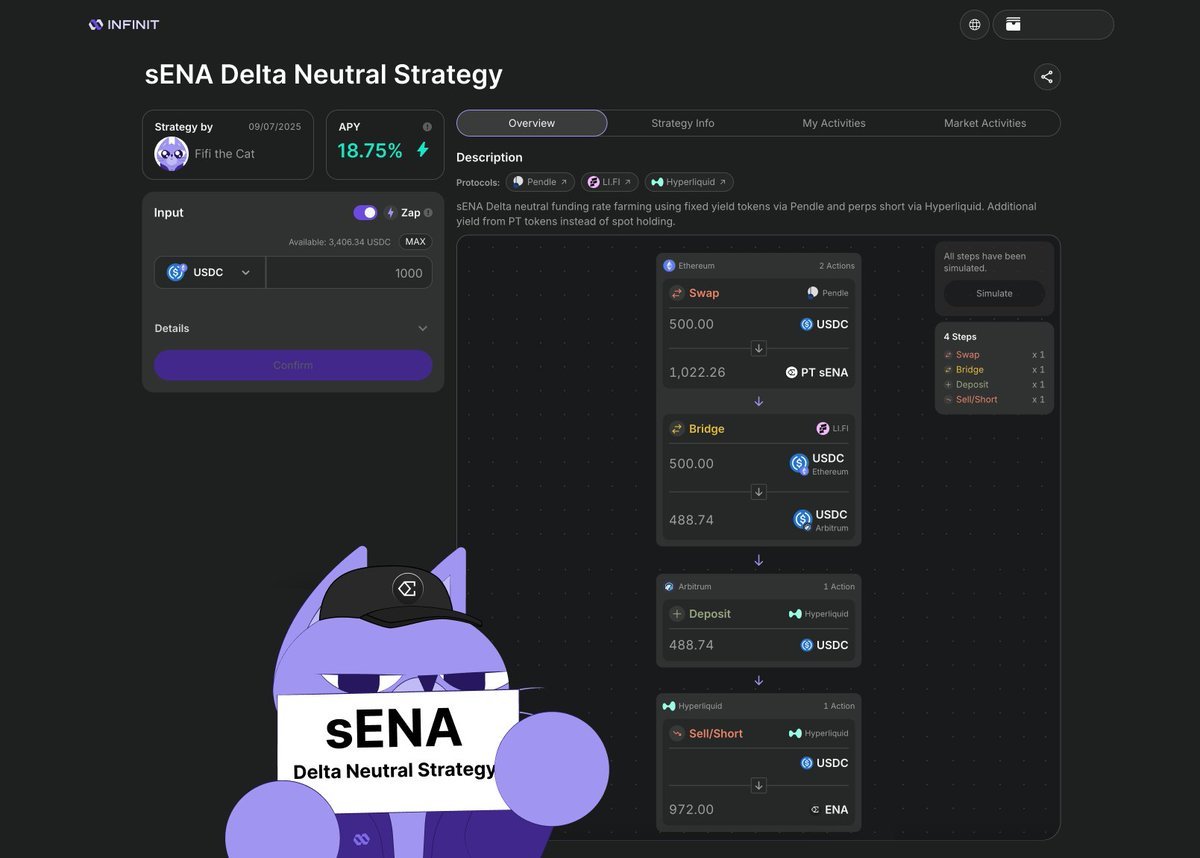

📌 But what caught my attention the most is that the strategies themselves can be commoditized.

In the past, even if you had great ideas, they were just posted on Twitter, and no one was willing to follow your long strategies or pay you for your good ideas. Now it’s different.

Your strategies can be listed, and the system automatically converts them into standard callable modules. Others can see, click, and execute them, and you earn royalties.

When others profit, you also share in the gains, all fully automated.~

This has introduced the role of strategy creators in DeFi for the first time.

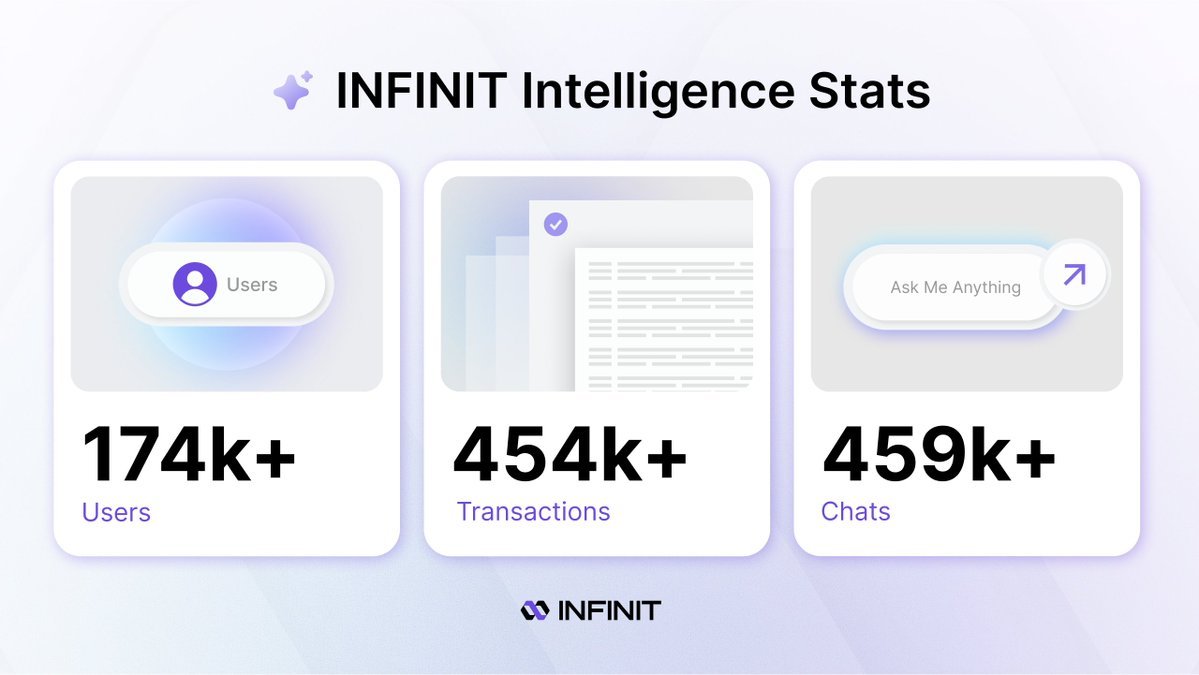

Since July, @Infinit_Labs has executed strategies over 450,000 times on the platform, with total users surpassing 160,000, and the number of participating users continues to grow.

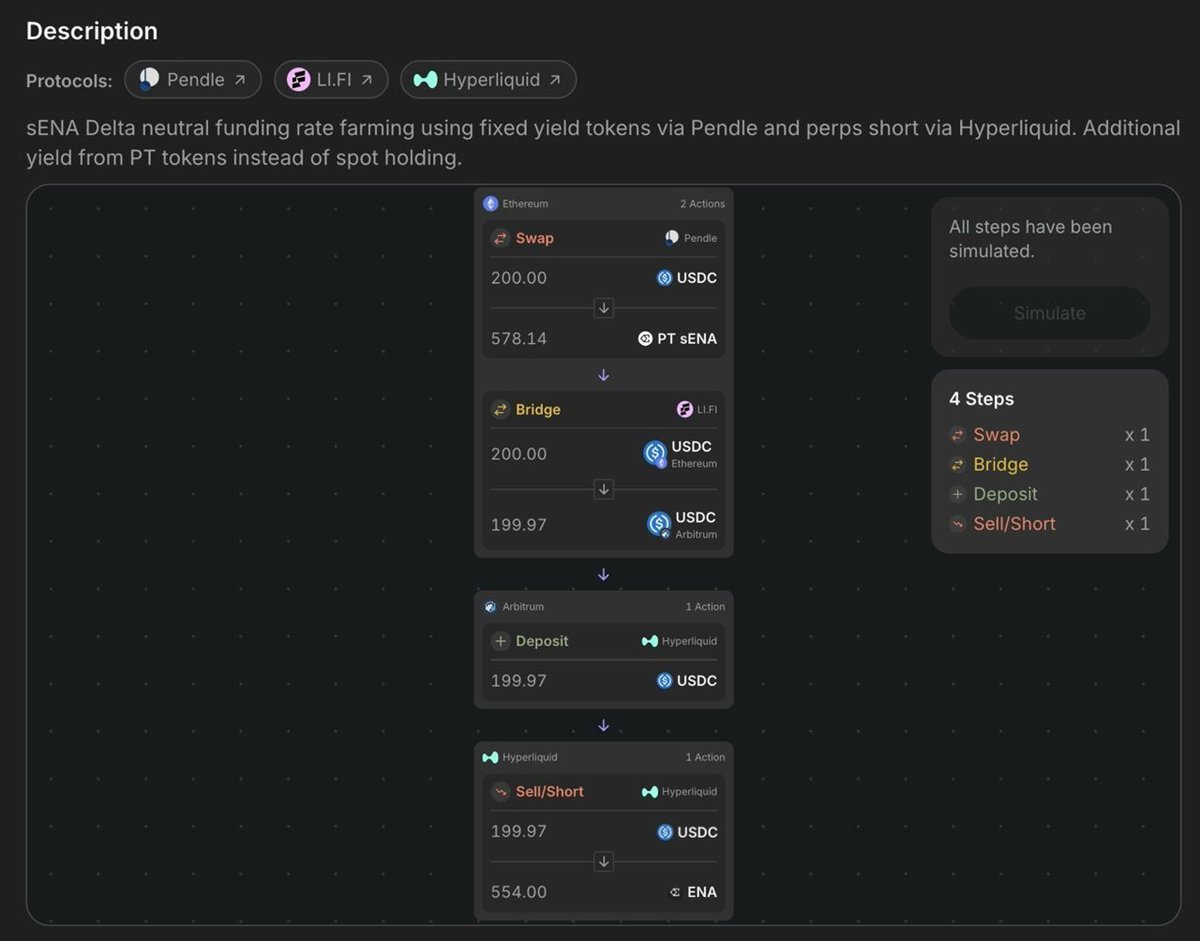

📌 Like the officially launched PT-USR Looping strategy,

which integrates the Pendle + Morpho protocols, executing 17 on-chain operations, including 6 borrowings, 5 deposits/withdrawals, with a 70% leverage structure, ultimately yielding an annualized return of 16.7%. The strategy is packaged and can be executed with a click, with assets remaining non-custodial throughout.

If done manually, you would likely make mistakes, forget allocations, or fail to bridge. But now everyone can directly reuse this strategy module.

Strategies are no longer just code or Excel templates; they are structured products that are packaged and circulated.

Meanwhile, INFINIT Intelligence itself has not been idle.

It has integrated over a hundred on-chain/off-chain data sources, covering mainstream protocols, popular chains, APY monitoring, and liquidity fluctuations. You can directly check "which pool is suitable for stablecoins recently" or "which LP structure has reasonable leverage," and the system will provide you with structural suggestions and executable versions.

Not just recommendations, it can also help you:

> One-click swap, lend, stake

> Display risk parameters, liquidation thresholds

> Run comparative pool logic and backtesting

Previously, these were tasks that strategy traders would script; now ordinary users can achieve results with just a click on a panel.

So if you haven’t opened INFINIT yet, you might be missing out on a truly foundational strategy infrastructure.

Not everyone can become an arbitrage expert, but the strategy module turns your ideas into assets, which is a first in DeFi.

Show original

12.08K

109

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.