I discovered an amazing project, a new track, a big opportunity!

I have always believed that RWA will be the engine of the bull market. The foreign exchange market has always been the largest and most active financial market in the world, and stablecoins, as the next generation of digital currency infrastructure, are experiencing explosive growth. Have you ever thought about what kind of narrative would emerge when the two combine: foreign exchange + stablecoin RWA? Mento @MentoLabs is precisely the unique presence in this track, a digital technological innovation in the traditional foreign exchange market!

1. Project Introduction: Breaking the Traditional Limitations of the Forex Market

Mento @MentoLabs is an infrastructure protocol focused on decentralized foreign exchange, dedicated to the digital issuance, trading, and settlement of national fiat currencies through on-chain stablecoins. By utilizing an over-collateralization mechanism, on-chain transparent asset pools, and multi-currency combinations, Mento is building a new financial system with the potential to bring substantial trading capital on-chain.

From a positioning perspective, Mento can be understood as an on-chain innovation of the traditional forex market, operating without permission, 24/7, with zero slippage transactions, and allowing free exchange between fiat stablecoins, addressing the core pain points of traditional forex in terms of transaction fees and settlement efficiency. It can be seen as an independent application of the RWA concept.

2. Project Background: Addressing Real-World Issues to Effectively Solve the Gaps in Financial Infrastructure

The foreign exchange market is the largest financial market in the world, with a daily trading volume exceeding $7.5 trillion. However, this massive market remains highly centralized, with high barriers to entry and long cycles, making it quite difficult to truly participate. Mento aims to bring all of this on-chain, promoting foreign exchange equity.

Mento's core audience consists of users who have been marginalized in the traditional financial system, particularly in emerging markets such as Africa, Latin America, and Southeast Asia. In these regions, currencies are unstable and financial infrastructure is weak. Mento provides a new participation channel that does not require a bank account, making it akin to an on-chain Alipay for these countries.

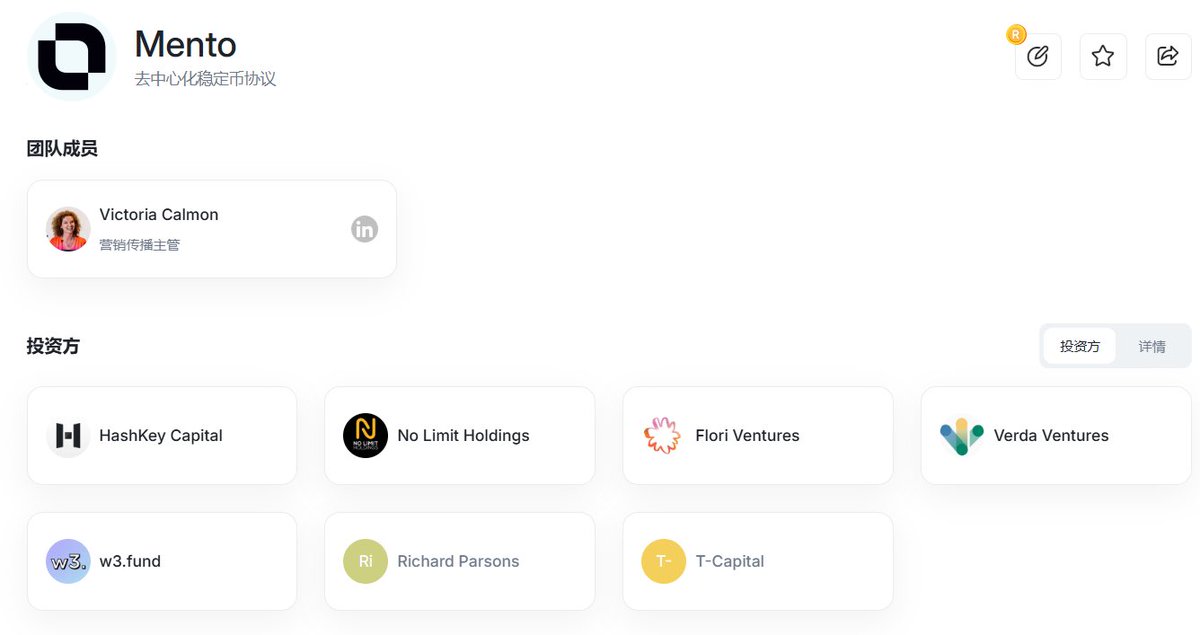

In October 2024, Mento Labs completed a $10 million funding round led by Hashkey Capital and NLH, which has previously invested in several well-known projects such as Ethena, Sage, Sei, Resolv, and Berachain. This indicates that the sector Mento operates in has garnered significant attention from capital.

3. Project Advantages: Real Users and Real Markets, the Most Solid Moat

1) Real Demand: What Mento addresses is a real, high-frequency market demand—foreign exchange trading. On-chain liquidity is abundant, allowing for instant transactions of tens of millions of dollars with zero slippage. Through collaboration with MiniPay, Mento has entered real user scenarios, covering over 140 countries, serving more than 8 million users, and completing a total of 700 million on-chain transactions, with a total settlement amount exceeding 15 billion dollars. You can observe relevant data at any time through the link:

2) Protocol Security: Mento employs an over-collateralization mechanism, with all stablecoins supported by a transparent on-chain Mento reserve pool, currently with a collateralization ratio exceeding 3:1, far above the industry safety line. Coupled with complete on-chain verifiability, Mento's design in stablecoin security is among the industry's leaders.

3) Multi-Currency Strategy: Currently, mainstream stablecoins are still pegged to the US dollar, while Mento offers over 15 types of local fiat stablecoins, including cEUR, cREAL, cKES, cNGN, etc. Breaking the dominance of the US dollar is a global expectation. Saving and paying in the on-chain form of familiar local fiat currency is the biggest differentiation between Mento and other stablecoin protocols.

5. Project Analysis and Summary

Stablecoins remain the most dominant asset in the Web3 world. In recent months, major exchanges have been focusing on related projects, and Mento is not competing with any rivals in this space. It has carved out a brand new, independent path centered on non-USD stable assets + on-chain foreign exchange. Just this point alone, I believe, is enough to create a narrative. Oh no, not just a narrative; from the perspective of product maturity, Mento has been live for over three years, with solid real user scenarios and numerous partners, and PMF is clearly visible.

A series of updates are also waiting to be released:

- The cross-chain collaboration with Wormhole will be officially announced.

- Upgrading to a multi-chain platform to expand cross-chain foreign exchange services.

- Releasing the V3 white paper, launching a CDP-based stablecoin issuance system.

- Announcing the follow-up progress with ecosystem partners like Chainlink and RedStone, etc.

RWA refers to real assets on-chain, and projects like Mento @MentoLabs, which are so genuinely powerful in bringing assets on-chain, are very unique. Instead of fixating on USD stablecoins, they aim to connect the global stablecoin market, providing a narrative for stablecoins that differs from the past. Large firms and institutions will definitely appreciate such unique projects with data and ideas, so brothers, stay highly attentive and don’t miss out.

24.63K

43

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.