1/ @Resolvlabs, a dual-tranche, delta-neutral stablecoin engine, just activated a 10% protocol fee-share, potentially positioning itself as Beta for Ethena's rapid growth.

We break down mechanics, yields, growth, unlocks & valuation:

2/ Like Ethena, deposits (ETH, BTC, LSDs) are hedged delta-neutral via equal-notional short perpetuals.

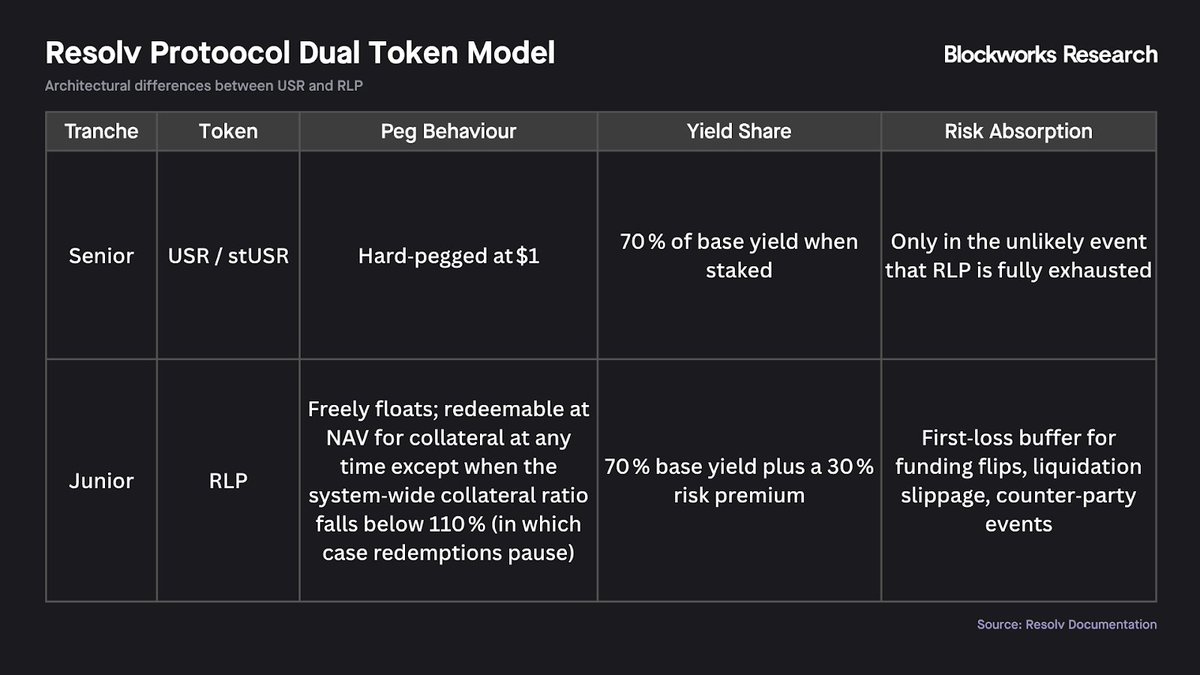

However, Resolv splits risk with its dual-token dynamic:

- USR: Senior tranche, stable $1 peg, earns 70% of base yield.

- RLP: Junior tranche, captures extra 30% yield but absorbs any first-loss.

Essentially, USR is protocol debt, and RLP is equity.

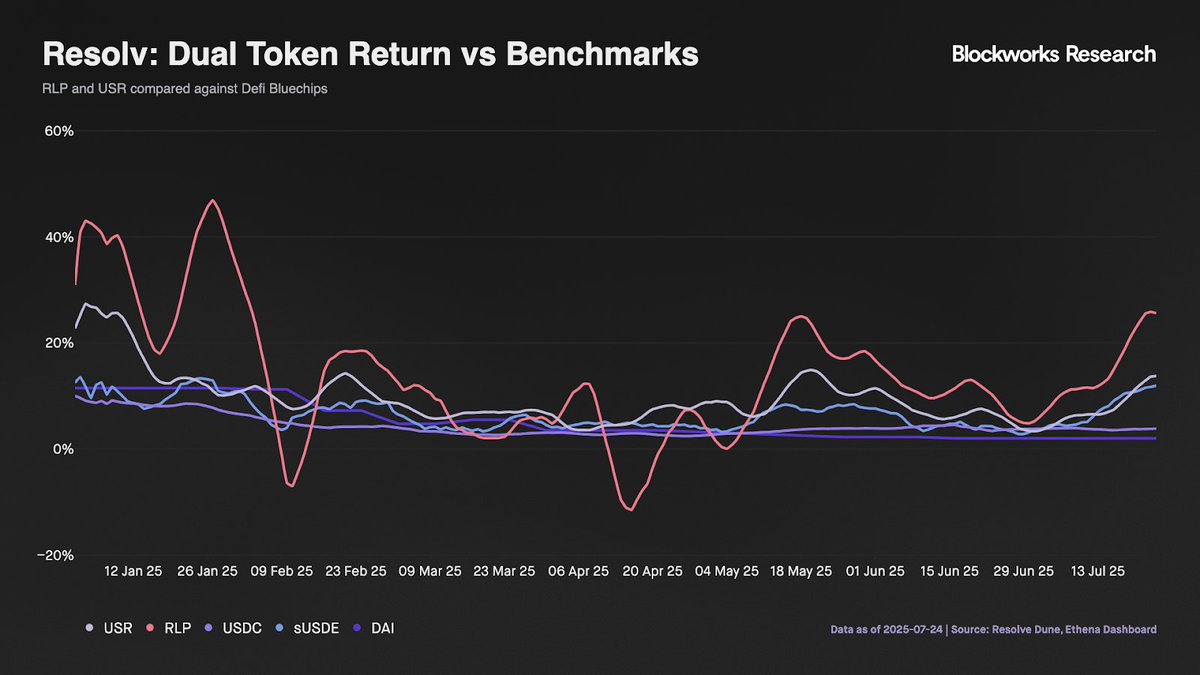

3/ This dual-tranche model leads to clearly differentiated returns:

- RLP holders averaged roughly 14% APY, experiencing volatility from -13% to +48% (daily volatility: 8.5pp).

- USR holders enjoyed a steadier yield of around 8% APY, with lower volatility (3.1pp).

In comparison, Ethena’s sUSDe sits in the middle (9.5% APY, 4.2pp vol).

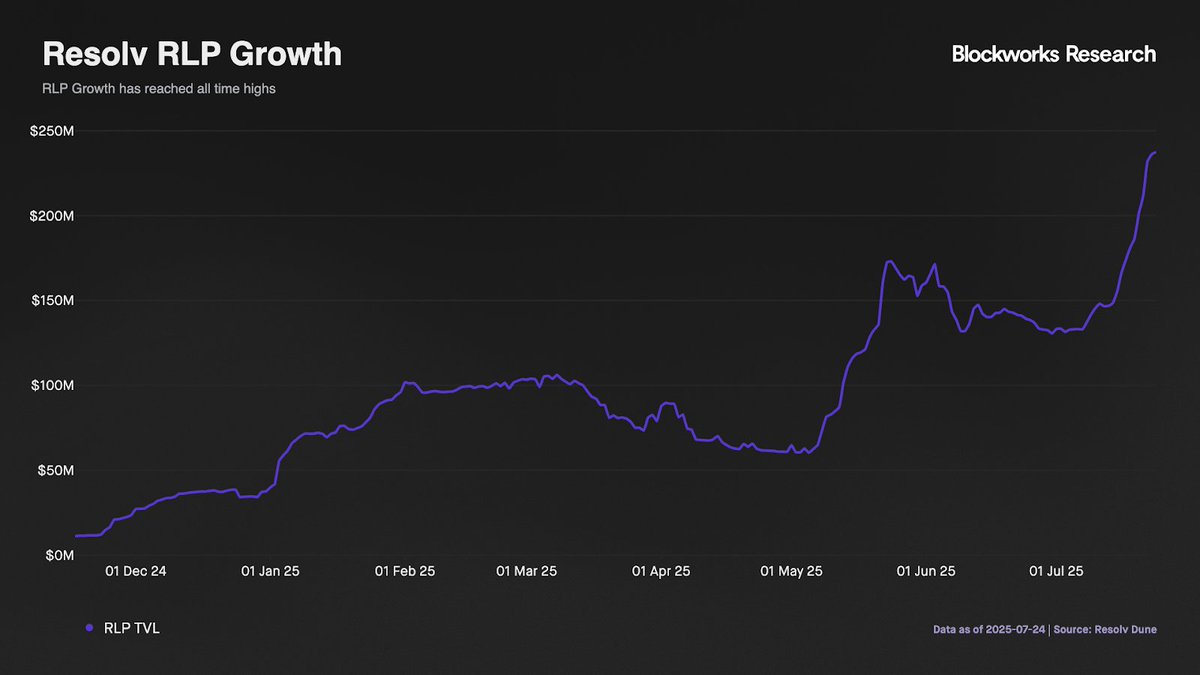

4/ Resolv’s TVL showed resilience despite market fluctuations.

It peaked at $680M during March 2025 (Season-1 incentives), declined to $338M by July post-incentive period, but rapidly rebounded to $513M following Season-2 incentives, running until September 30th.

Notably, the junior tranche (RLP) significantly grew its share of TVL from 19% to 47%.

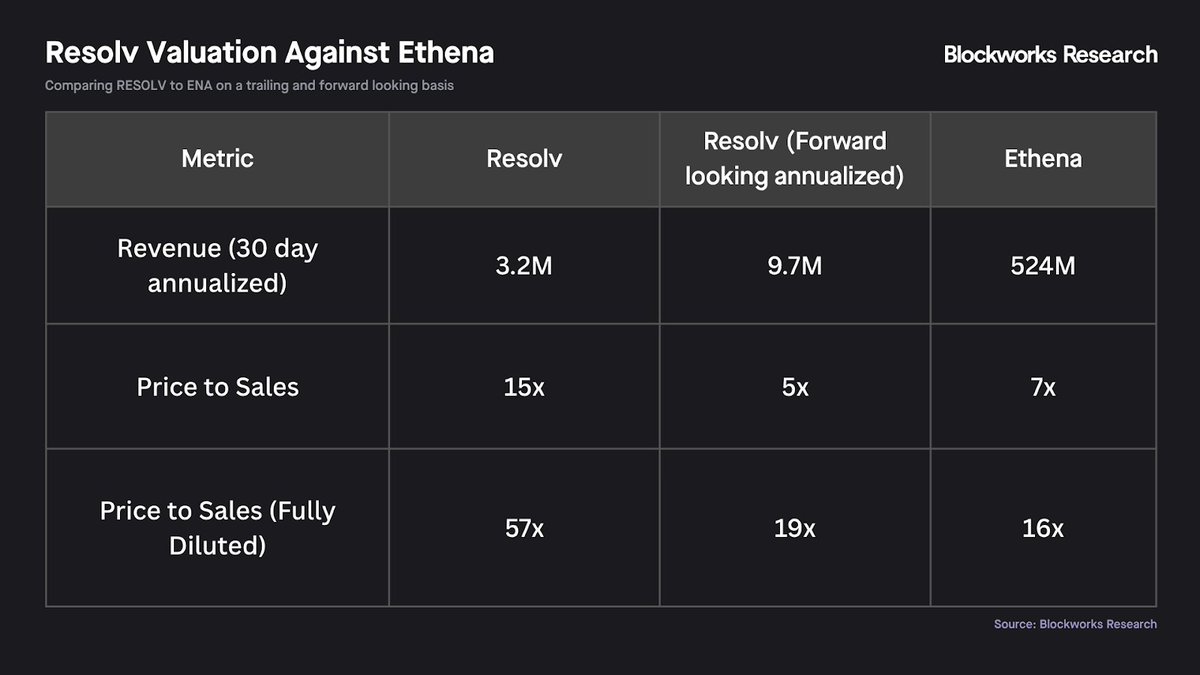

5/ The recently activated 10% fee-share mechanism directs around $9.7M annualized gross yield into the Resolv treasury.

Resolv trades at a circulating market cap of $49M and an FDV of $183M, with forward revenue multiples (5x circulating market cap, 19x FDV) similar to Ethena.

6/ On token unlock dynamics, Resolv presents an advantage: no team or investor token unlocks occur until June 2026, significantly reducing short-term selling pressure.

This contrasts sharply with Ethena’s upcoming unlocks of roughly 2.7B tokens over the next 10 months.

7/ For a deeper dive, including detailed architecture, catalysts, and valuation modeling, read the full report on @blockworksres.

13.67K

57

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.