Crypto native treasuries are the new onchain institutions.

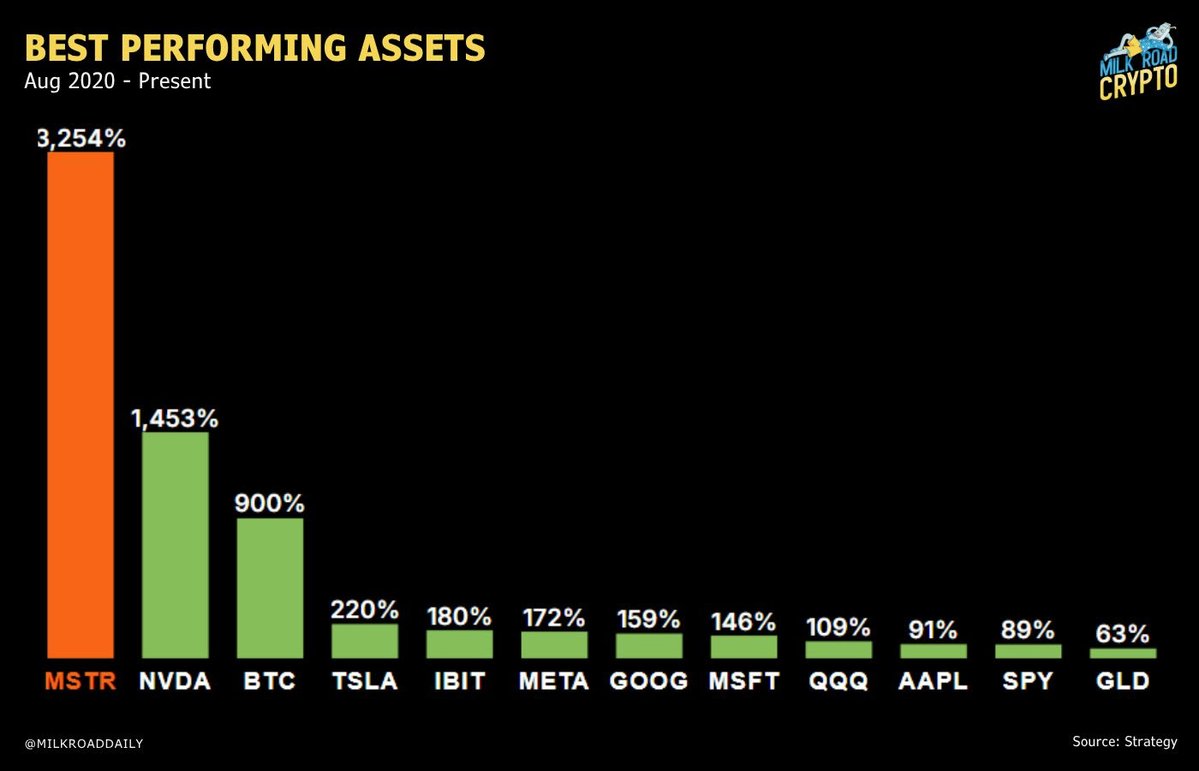

The @strategy playbook proved what’s possible with 3,254% returns in 5 years.

Now the next generation are building on Ethereum and plugging into DeFi.

This is how the flywheel starts.

( a thread )

At first, people thought he was crazy.

$MSTR tanked, $BTC crashed multiple times.

But @Saylor kept buying and he has had:

60+ purchase events since 2020 with almost 600,000 BTC accumulated.

And about $42 B total investment, average cost near $71k/BTC.

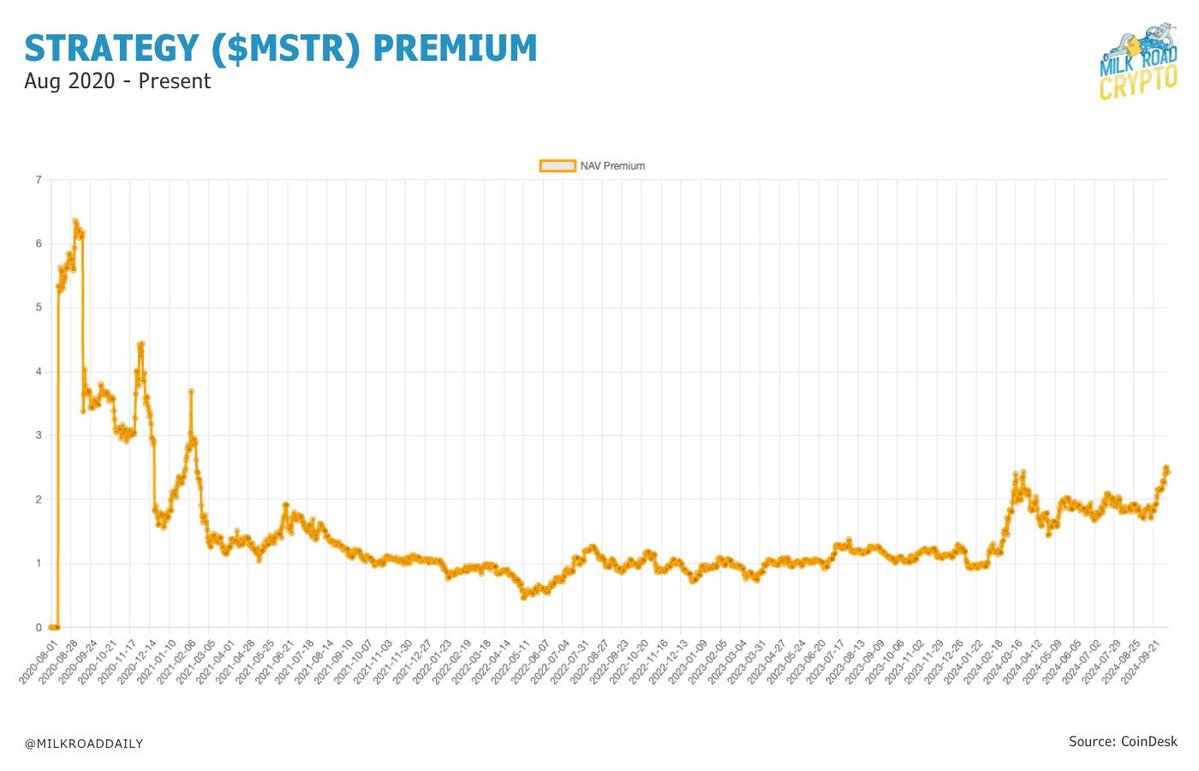

MicroStrategy isn’t just holding BTC it’s monetizing that position via public markets.

Investors are willing to pay a premium for Saylor’s execution, access, and scale.

That same idea, structuring smart crypto exposure is what new $ETH treasury companies are now aiming for.

And so far, it's working.

These $ETH treasury companies aren’t just promising exposure.

They’ve already pulled in real capital and real demand from investors.

Okay, so how does it actually work?

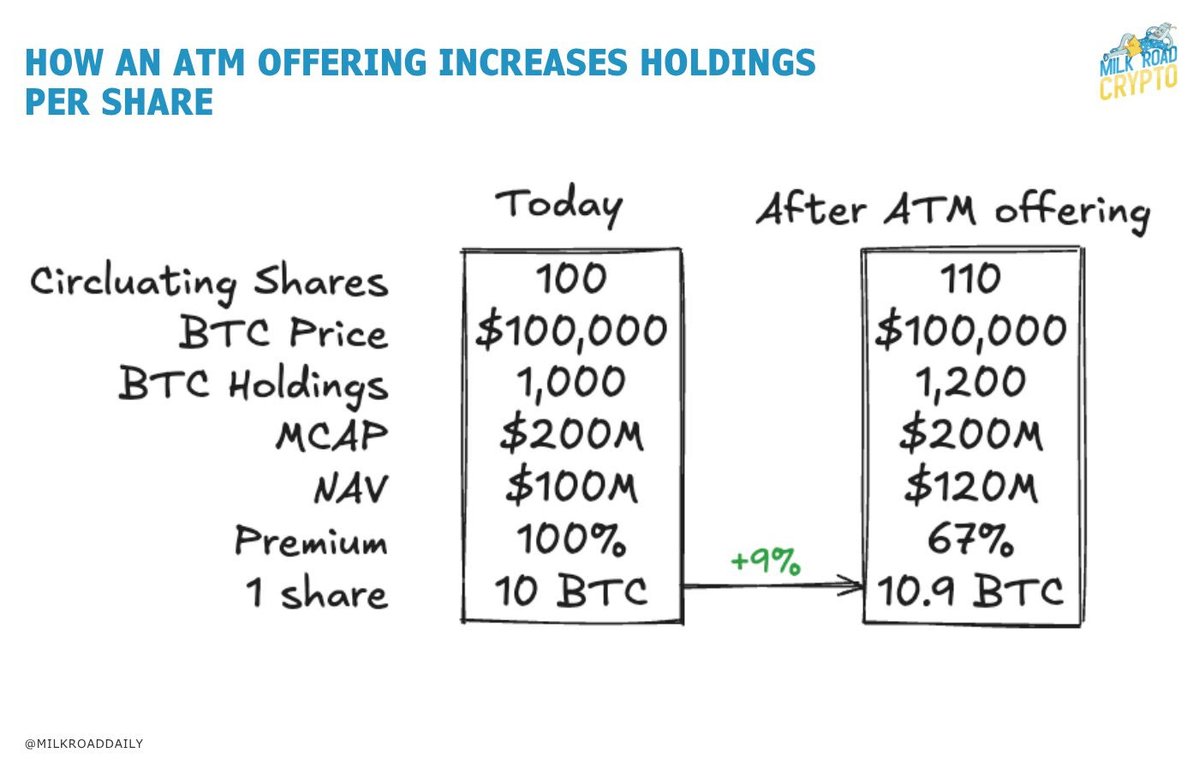

When these companies trade at a premium just like $MSTR they can raise capital by selling new shares through ATM offerings. (At-The-Market)

This creates a flywheel.

And that flywheel has done exactly what it was designed to do.

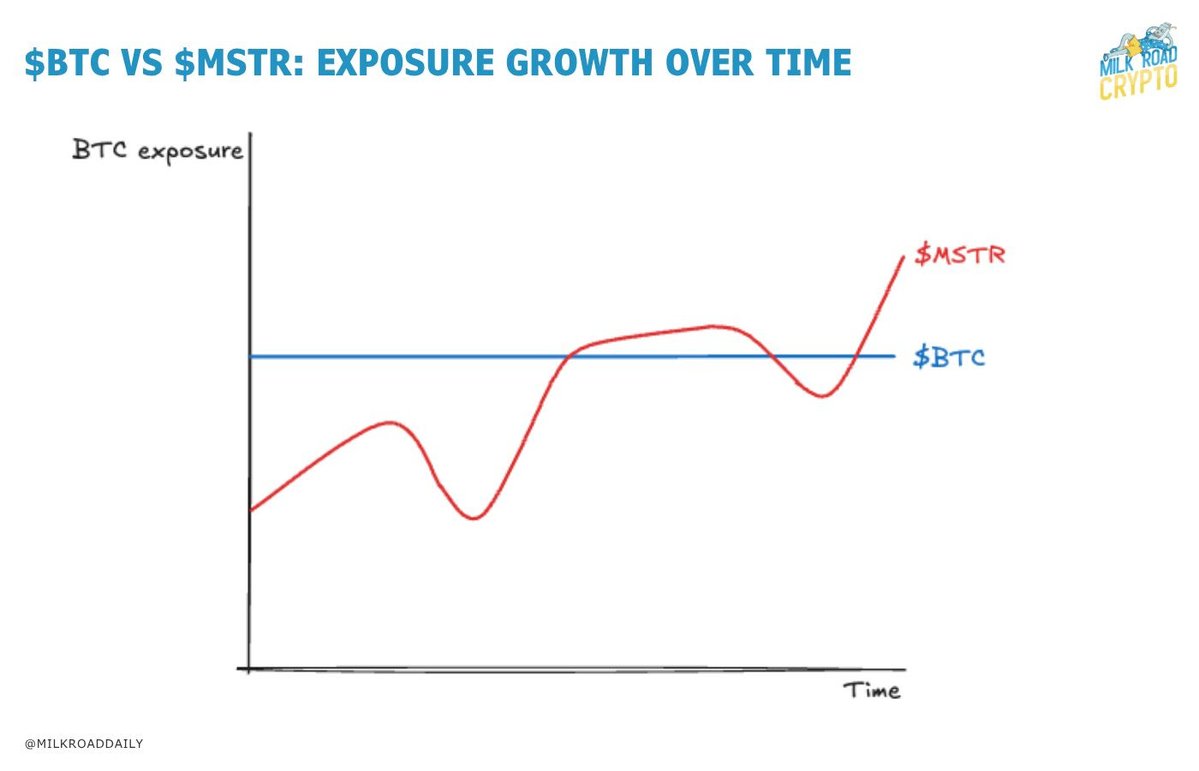

MicroStrategy shares haven’t just tracked Bitcoin they have outperformed it.

Because over time, the company keeps increasing $BTC per share.

But here’s the thing.

$BTC is static. It just sits there.

Whereas $ETH is productive capital.

ETH treasuries can stake, restake, and earn yield on top of their holdings.

That turns the flywheel into something even more powerful.

And the market is catching on.

New digital asset treasury companies are popping up almost every week.

Not just holding crypto, but turning it into a structured, investable strategy.

Some are focused on $BTC, others on $ETH, and even $SOL.

$ETH isn’t just an asset; it’s a financial engine.

If you want to understand how it’s powering a new wave of public market plays,

sign up here:

6.77K

22

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.