Ethena Ecosystem Update: USDe's $6B Milestone, v2 Innovations, & 2025 Vision for Institutional DeFi Growth

1. Ethena Ecosystem Data Insights

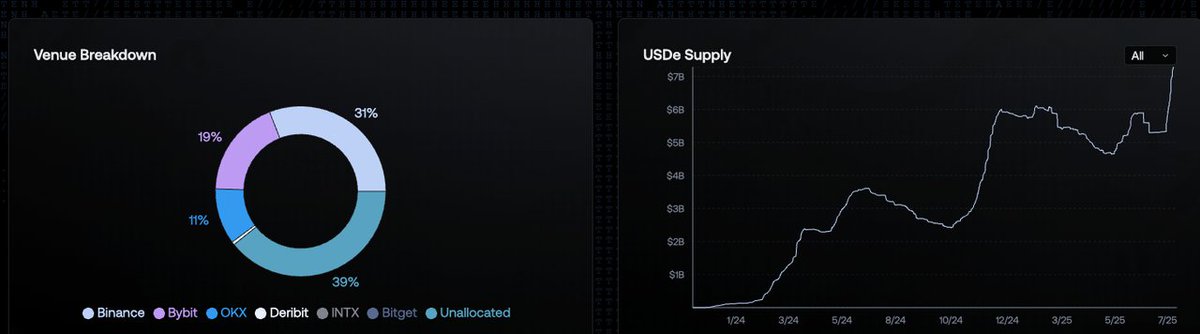

USDe Total Supply: Surpassing $6 billion, USDe is now the third-largest decentralized stablecoin. Within six weeks on TON, TVL (Total Value Locked) has reached $87 million.

sUSDe Staking: Staked amount is around $420 million with an annual yield above 10%, placing it among the top yielding products in DeFi.

Protocol TVL: Ethena’s total TVL has broken $6 billion, ranking it in the top three across all DeFi protocols.

Cumulative Protocol Revenue: Aggregate revenue has exceeded $250 million, with weekly income at $7.8 million and projected annualized earnings close to $400 million.

Funding Rate: The market-wide average funding rate is 14%; currently, Bitcoin stands at 19% and Ethereum at 12%.

Reserve Structure: 41% of USDe reserves are allocated to high-yield perpetual contract strategies.

Core Product Segment Data:

Ethereal (perpetual DEX): TVL $712 million

Terminal (liquidity hub): TVL $129 million

Strata (structured yields): TVL $13 million

Multi-chain Presence: USDe bridges 22 major chains; in some exchanges, on-platform volume has overtaken USDC.

2. Ethena v2 Proposal Innovations

Fee Switch Mechanism: For the first time, direct protocol earnings will be distributed to sENA holders, binding governance tokens to ecosystem profits and enabling true dividend capture, breaking away from the “pure governance” model.

Institutional Stablecoin (iUSDe): Features regulatory whitelist and smart contract constraints, targeting institutional players such as market makers and private funds, as well as providing traditional asset holders fixed-yield DeFi product access, helping connect real-world assets with on-chain liquidity.

Product Diversification: Acceleration of new releases—Ethereal spot trading, Derive options, and Strata structured products—expanding the full-stack on-chain finance matrix, enhancing ecosystem competition, TVL, and user retention.

UX Upgrades: The app supports direct fiat ramps, one-click USDe cross-chain transfer, and seamless access across Telegram, Apple Pay, NFC, etc., reducing the entry barriers and making Web3 accessible for mainstream users.

Multi-chain & Compliance Expansion: USDe continues to bridge across major global blockchains, notably growing presence in TON and Layer2 ecosystems. There is an increased push for compliance collaboration in Asia, Europe, and North America, and onboarding leading institutions for large-scale capital inflows.

Security & Liquidity Iteration: Reserve structure optimization continues, with over 40% deployed in high-yield perpetual contracts; introduction of advanced liquidation and security mechanisms for decentralized risk control and greater black swan resilience.

3. Future Outlook & Development Roadmap

Vision for 2025: The roadmap targets integration with traditional finance, pursuing partnerships with asset management firms, private funds, and custodians—fostering wide adoption of USDe and ENA as compliant assets among institutions.

iUSDe APY Target: Projected APY up to 20%, making it highly attractive versus prevailing global low rates.

Mobile Banking Experience: Exclusive features like Telegram and Apple Pay integration aim to deliver a true “mobile banking” feel, broadening appeal among non-crypto-native users.

Ecosystem Expansion: With multi-chain and cross-border payment expansion, USDe is positioned to enter larger liquidity markets, boosting anti-cyclical capabilities and ENA’s long-term value accrual.

From Stablecoin to Full-Stack Finance: Ethena is evolving into a comprehensive on-chain finance platform with strong on-chain data and revenue metrics. sUSDe and ENA are pivoting to offer sustainable cash flow and dividends. Leading investors such as OKX Ventures expect v2 to further drive product diversity, institutional adoption, and traditional asset integration, supporting the ecosystem’s profitability and breadth over the long run.

7.81K

14

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.