The GENIUS Act: Will DeFi Surge as Stablecoin Yield Gets Banned? 🔎

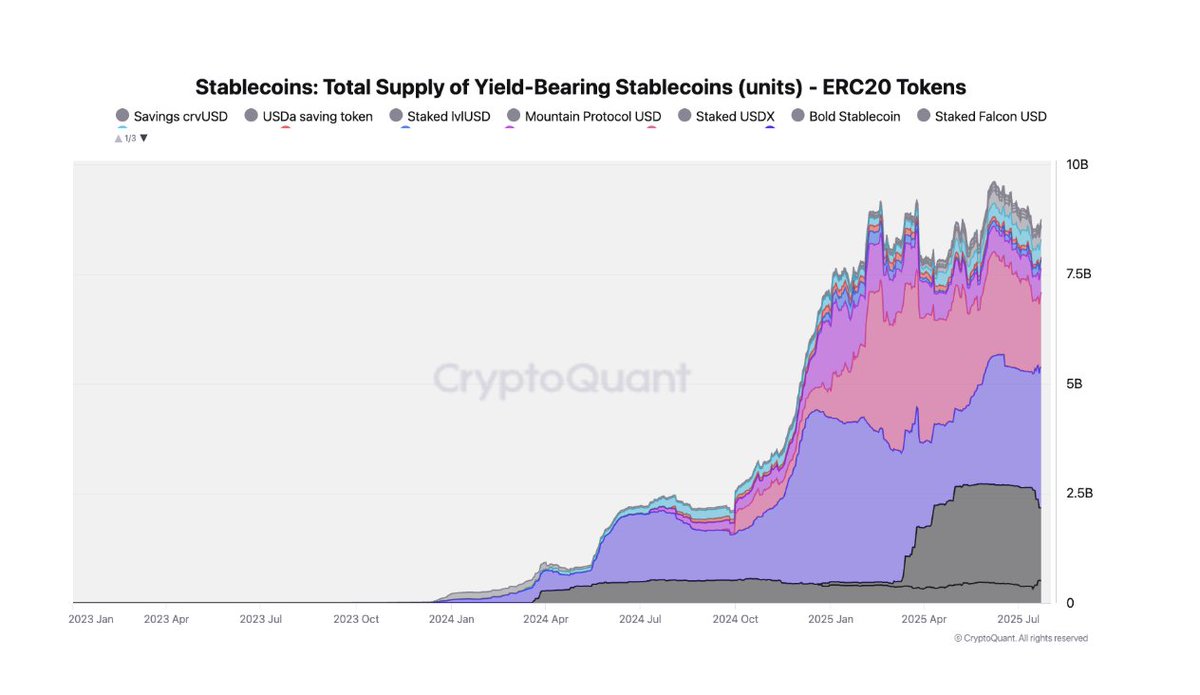

As stablecoin issuers lose the right to offer interest, yield-hungry capital needs a new home.

Could DeFi step in? Experts from @CryptoQuant_com, @sentoraHQ & @centrifuge weigh in 👇

1/ The GENIUS Act officially bans stablecoin issuers from offering interest to holders.

But this yield vacuum could redirect capital to DeFi protocols, where yield flows freely through lending, staking & real-world asset tokenization.

2/ The GENIUS Act isn’t shaking the giants.

@CryptoQuant_com’s Head of Research @jjcmoreno says:

"The largest stablecoins like USDT and USDC have never offered direct yield to their holders, so there is no material change in this from the GENIUS Act."

3/ DeFi could become the new yield magnet.

@sentoraHQ’s Head of Research @juan_p2p breaks it down:

"This could redirect investor capital toward decentralized platforms offering more transparent and potentially higher-return opportunities, such as lending protocols, liquidity pools, and tokenized real-world assets."

4/ TradFi isn't out of the game, it's re-entering with a new playbook.

@centrifuge General Counsel Eli Cohen sees opportunity:

"Only the stablecoin issuer is blocked from offering yield, but others can do so, including now banks and broker-dealers. The GENIUS Act will expand the opportunities for stablecoins and not restrict them."

The GENIUS Act changes everything for stablecoins, especially their ability to offer returns. 🧊

But could this ban boost DeFi’s appeal to institutions?

From yield bans to DeFi booms @c_grigera connects the dots with insider insight 👇

4.87K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.