This morning's news from Bloomberg was a big deal that the White House will allow 401(k) investments in cryptocurrencies. In other words, the US pension is about to enter the market, and it must be a blockbuster in the long run.

But in the short term, pensions cannot fluctuate greatly or even lose money, so the odds are not enough for the #BTC around $120,000, so the pension needs a good price to intervene. This logic is similar to China's pension allocation of A-shares, generally before buying, the price must be lowered! 🧐

If there is a sexy enough price that allows you to buy #BTC at the same time as the US pension, after the decline, do you dare to buy the dip? For example, again at $74,500 on April 7, do you dare to fill your position? 🧐

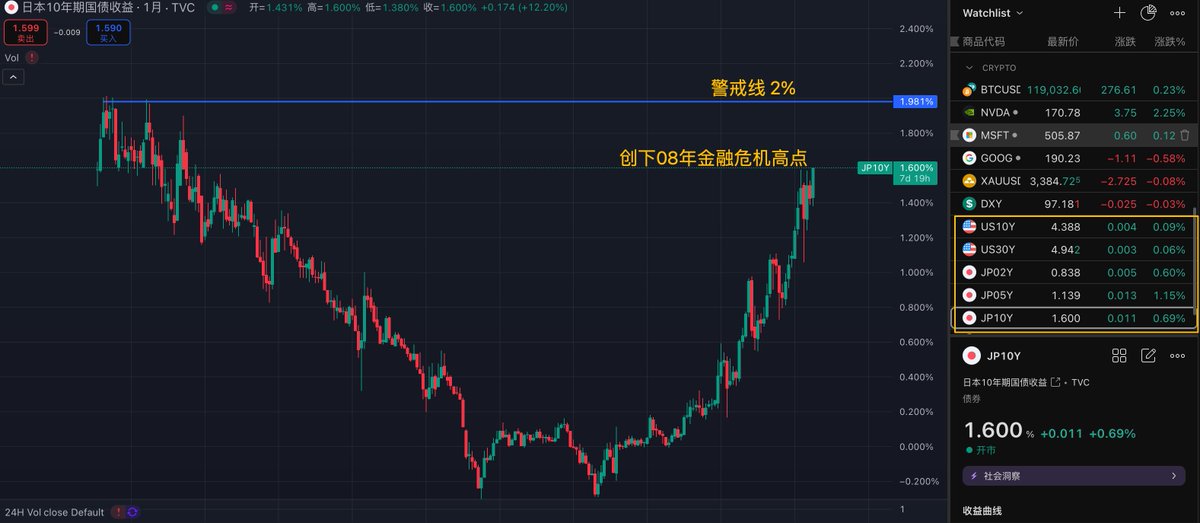

Japan's 10-year government bond yield has reached a new high since the 2008 financial crisis!

The warning line is at 2%, and once it breaks, it signals the end of the low-interest-rate era, ushering in a chaotic time of high interest rates + high asset pricing + high inflation!

For decades, Japan has been the "extreme representative" of negative and low-interest-rate policies globally. The 10-year government bond yield has long hovered around 0%, with the underlying logic being:

✅ Deflation + Aging Population

✅ Central Bank's unlimited bond purchases (YCC: Yield Curve Control)

✅ Yen assets treated as a "free funding pool," widely used for global arbitrage (carry trade).

Now that the yield has soared to 1.6%, it indicates a significant drop in bond prices and a rise in yields, prompting some to start selling Japanese government bonds. In the short term, the market may be testing whether the Bank of Japan dares to control the bond market without limits. If it breaks 2%, it would mean a formal battle between the market and the Bank of Japan.

For many years, Japanese institutions (like life insurance and pension funds) have lent money globally (to U.S. bonds, European bonds, and even U.S. stocks) due to low domestic yields.

Now, if JP10Y can offer a yield of 1.6%-2%, it creates an opportunity to "make money while lying down":

1️⃣ Japanese funds may sell U.S. bonds, European bonds, and foreign stocks → Reinvest in Japanese government bonds

2️⃣ U.S. bonds, European bonds, and risk assets may come under pressure due to reduced liquidity

3️⃣ If the Federal Reserve does not lower interest rates quickly, the pressure will increase.

The awakening of the Japanese bond market is like a "debt Godzilla" that is stirring; this is not just a matter for Japan but also a signal for the global repricing of interest rates and capital structure. Caution is advised ⚠️

49.76K

129

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.