1/

Ethereum is the backbone of the world's largest decentralized financial system.

Here are the core data and its significance for ETH. ⬇️

2/

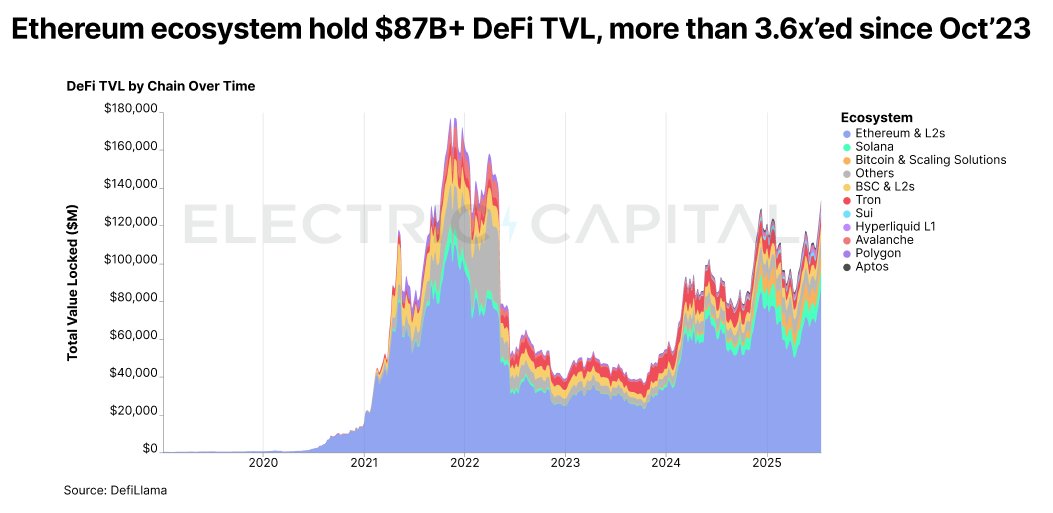

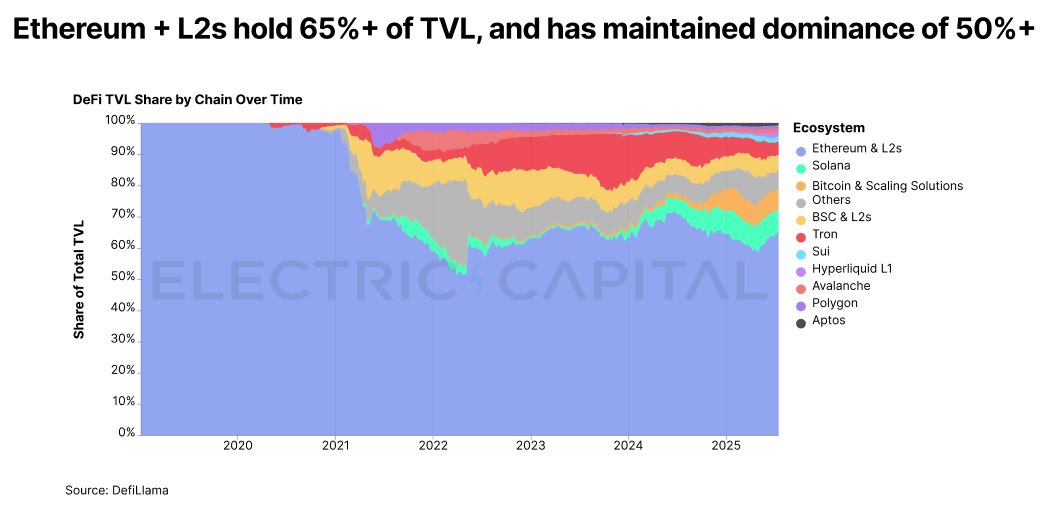

The total value locked (TVL) of the Ethereum ecosystem leads the entire network:

• The decentralized finance (DeFi) market on Ethereum and its L2 has a TVL of over $87 billion, accounting for 65%+ of all public chains

• Total TVL has increased by 3.6x since October 2023, while Ethereum still maintains its 50%+ dominance

3/

Ethereum has the highest "Total Value Secured" (TVS) on the entire network:

The Ethereum ecosystem provides security for 56 tokens in the top 100 by market capitalization, with a total value of more than $1.08 trillion→ which is 2.6 times that of the second largest ecosystem (Solana's $404 billion, 20 tokens).

5/

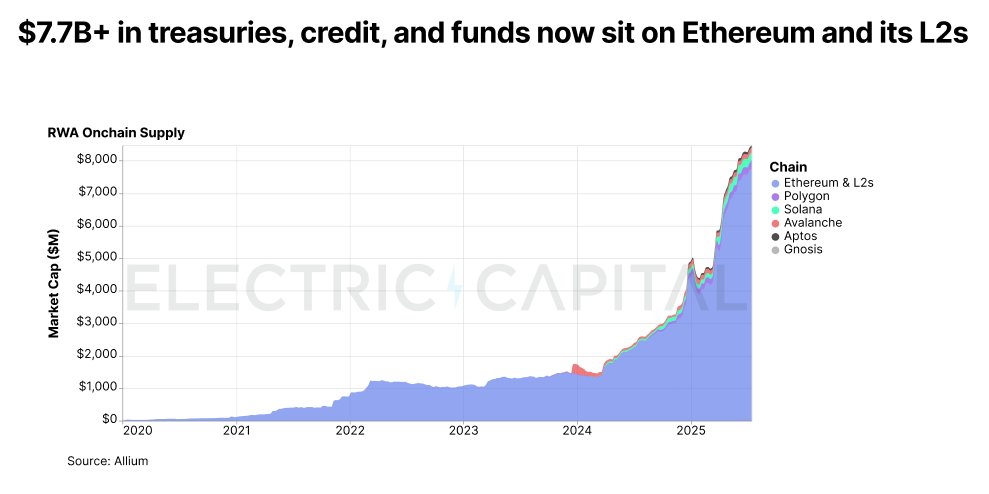

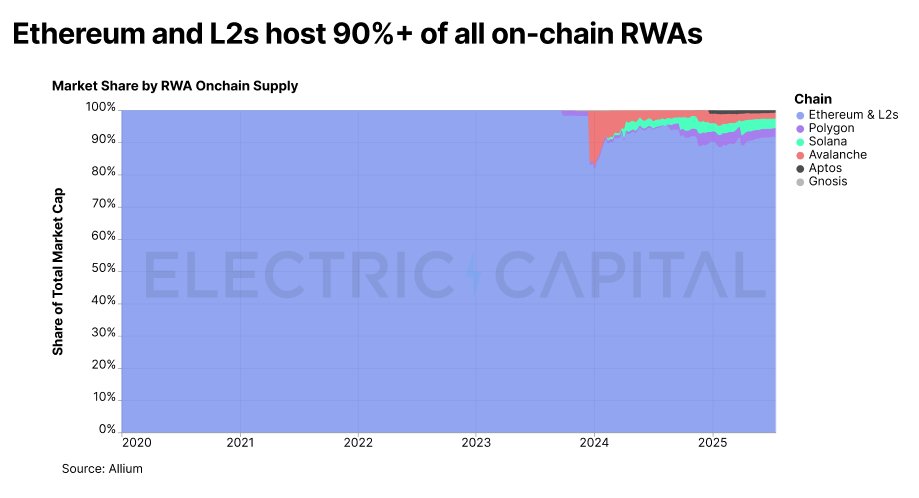

Ethereum hosts the most real-world assets (RWA):

• Government bonds, credit, funds, etc., totaling over $7.7 billion, distributed across Ethereum and its L2 → accounting for 90% of on-chain RWA

• Since January 2022, the supply of RWA on Ethereum has increased tenfold.

6/

Ethereum can carry the most TVL, stablecoins, and RWAs because it is the most trustworthy.

Trust Comes from Security:

✅ Over 1 million validators

✅ Multi-client architecture with no single point of failure

✅ Ten years of stable operation

7/

Trust → Liquidity → Users → More Apps → More Trust.

Ethereum's financial system continues to grow because it is the most secure and liquid.

It's a compound interest cycle.

8/

As Ethereum's economy continues to expand, so does the demand for ETH.

ETH is:

• Potential reserves of value

• DeFi collateral

• Safeguard the core assets of the network

→ Check out @ElectricCapital's comprehensive discussion of ETH:

14.54K

35

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.