New @a16zcrypto podcast!

The GENIUS Act just became law and it could change how money moves in the U.S. and beyond.

In this episode we go behind the scenes with members of our policy team on how it came together.

Here's what to know. 👇

1/ The Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS) gives us something we’ve never had before: clear rules of the road for stablecoins in the U.S.

Clear rules for stablecoins and the road ahead

At the White House today, the first piece of U.S. crypto legislation will be signed into law: the GENIUS Act. It provides clear rules for stablecoins.

This is a historic moment — not just for crypto, but for the world at large. That’s because stablecoins give us something we’ve never really had before: open money infrastructure.

Stablecoins are a better form of money: faster, cheaper, and more global. They cut fees and eliminate intermediaries. They are auditable and programmable. They allow developers to build new kinds of apps that weren’t possible before: low-to-no cost remittances, programmatic micropayments, AI-native transactions, transparent and disintermediated global commerce, and more.

Stablecoins give the world access to the dollar, they spread financial freedom, and they ensure that the next generation of financial infrastructure is built on U.S. standards.

For too long, innovators in crypto have operated under legal uncertainty. That uncertainty has stifled progress, driven builders offshore, and created a fragmented internet. The GENIUS Act reverses this: it creates clarity for stablecoins and sets us on a path toward broader crypto market structure reforms.

This is how the internet moves forward: through clear rule-making. With the GENIUS Act, stablecoins have clear rules, paving the way for better payments, financial products, and an overhaul of the global financial system.

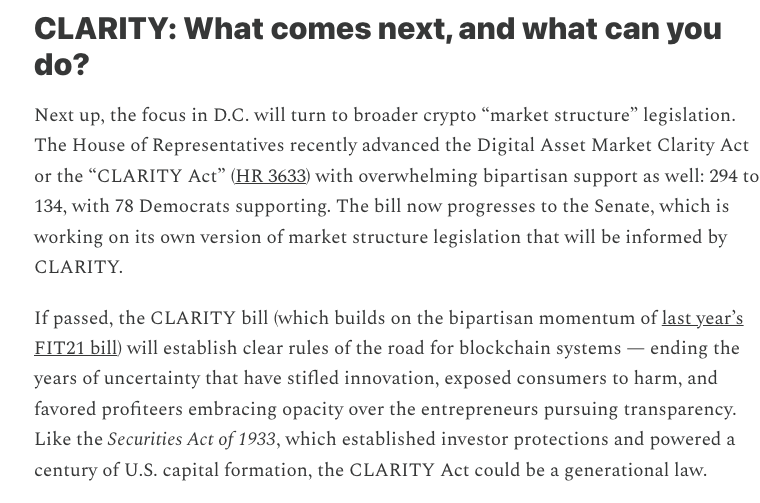

Next, we need the same for the rest of the crypto market. The Senate can do this by passing the CLARITY Act, which provides clear rules of the road for the broader crypto industry, opening a path for innovators while also protecting consumers from scams and bad actors.

We believe that the U.S. can lead the next era of the internet — the read-write-own era — by enabling open, user-owned protocols instead of the closed, corporate platforms that defined the last one. This legislation lays the foundation for that future. It's the beginning of a new chapter.

2/ Why does this matter?

Stablecoins are digital dollars. But until now, there’s been no federal framework for how to issue them safely. That’s led to blowups—like Terra/Luna.

per @milesjennings

3/ GENIUS sets strict 1:1 collateral requirements and licensing rules. It makes sure a dollar-backed coin really is… a dollar.

This law aims to prevent another Terra-type meltdown while unlocking a better, faster payments system.

4/ But the bill almost didn’t make it.

A group of House Republicans sought to attach anti-CBDC language (central bank digital currency, e.g. a “Fedcoin”) late in the process, stalling House Floor action.

Why? Privacy and surveillance concerns, fears of totalitarianism.

5/ 5/ After backroom negotiations, the bipartisan coalition held.

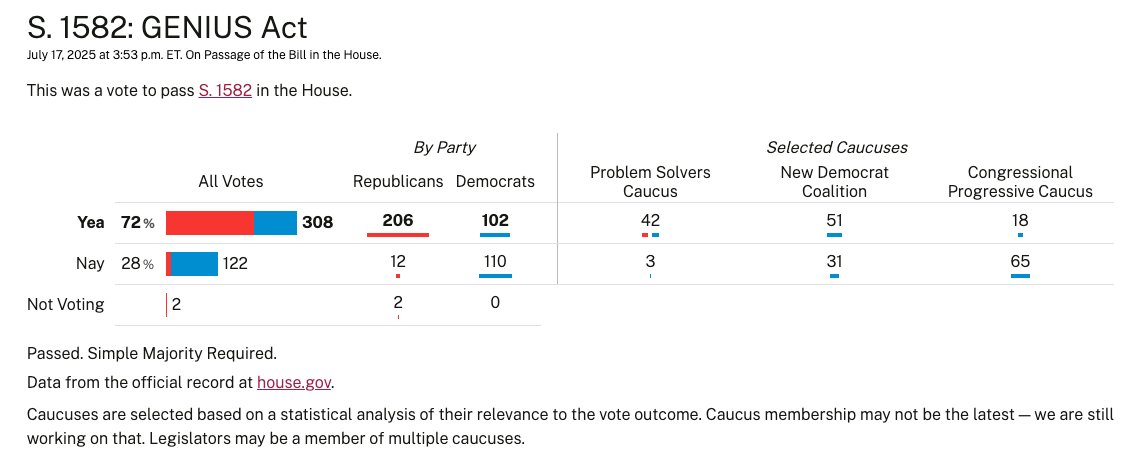

The result? 308–122 House vote, including 102 Democrats. A major shift.

For context: that’s 31 more Dems than supported FIT21, the last big crypto bill to clear the House.

6/ Leaders like @RepJeffries @WhipKClark and @RepPeteAguilar came on board. Once leadership supported GENIUS, many Democrats followed suit.

(Even the Senate had shown rare momentum: 18 Dems supported GENIUS there too.)

7/ Who wins?

- Consumers and merchants who benefit from faster, cheaper payments.

- Builders like @circle @stripe and others creating new payment rails.

- The U.S. government—thanks to increased demand for Treasuries backing stablecoins.

8/ Who loses?

- Financial intermediaries who skim fees off every transaction. Their margins will come under pressure.

9/ What about decentralized stablecoins?

GENIUS doesn’t cover them—but it opens the door for the SEC to clarify their status. (Some “decentralized” coins are decentralized in name only.)

cc @LucaProsperi

10/ This is a watershed moment for crypto in the U.S.

And it's just Act I.

Next up: The CLARITY Act, a bill that would define the regulatory structure for the underlying blockchain infrastructure.

Expected Senate action in September.

11/ Until then, listen to the episode for an insider view on how GENIUS passed—from late-night House negotiations to bipartisan breakthroughs.

With @milesjennings @bennapier Michael Reed & me.

12/ Check out the full episode here.

Youtube:

Spotify:

6.72K

36

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.