1/ @bonk_fun and @pumpdotfun are battling for launchpad dominance.

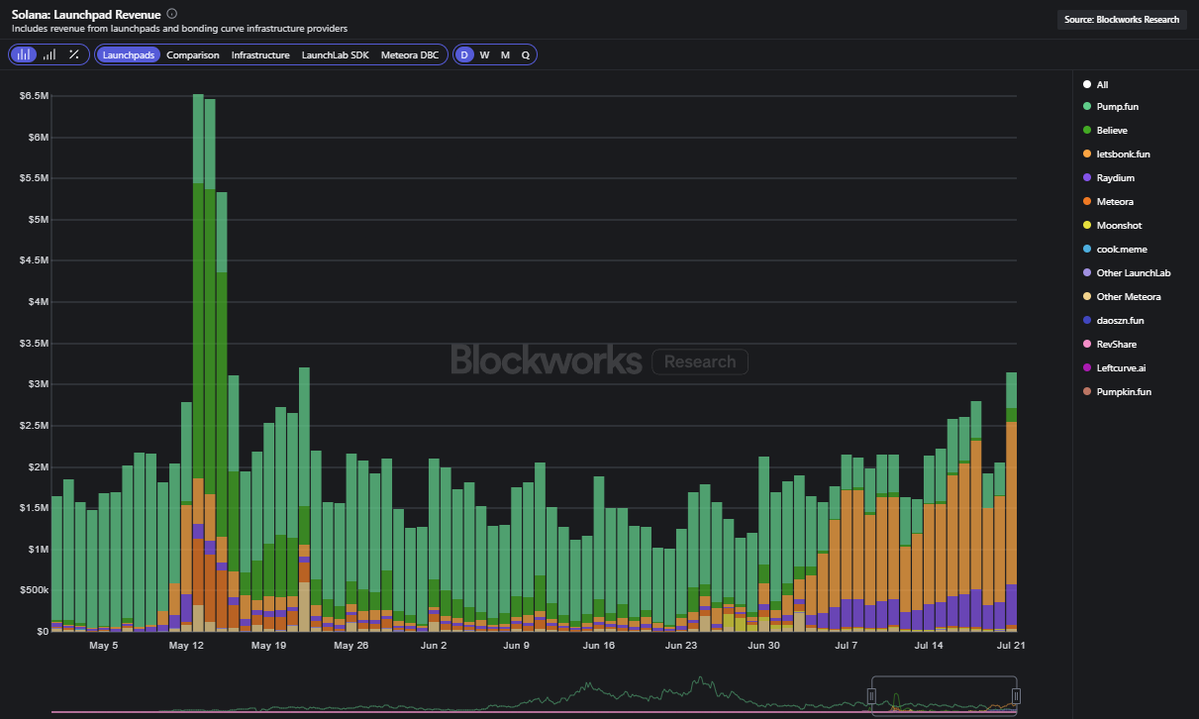

Bonk's rise over the past month has placed it firmly in the top spot as the leading Solana launchpad by revenues.

What else can we glean from analyzing Bonk's growth? Let's dig in.

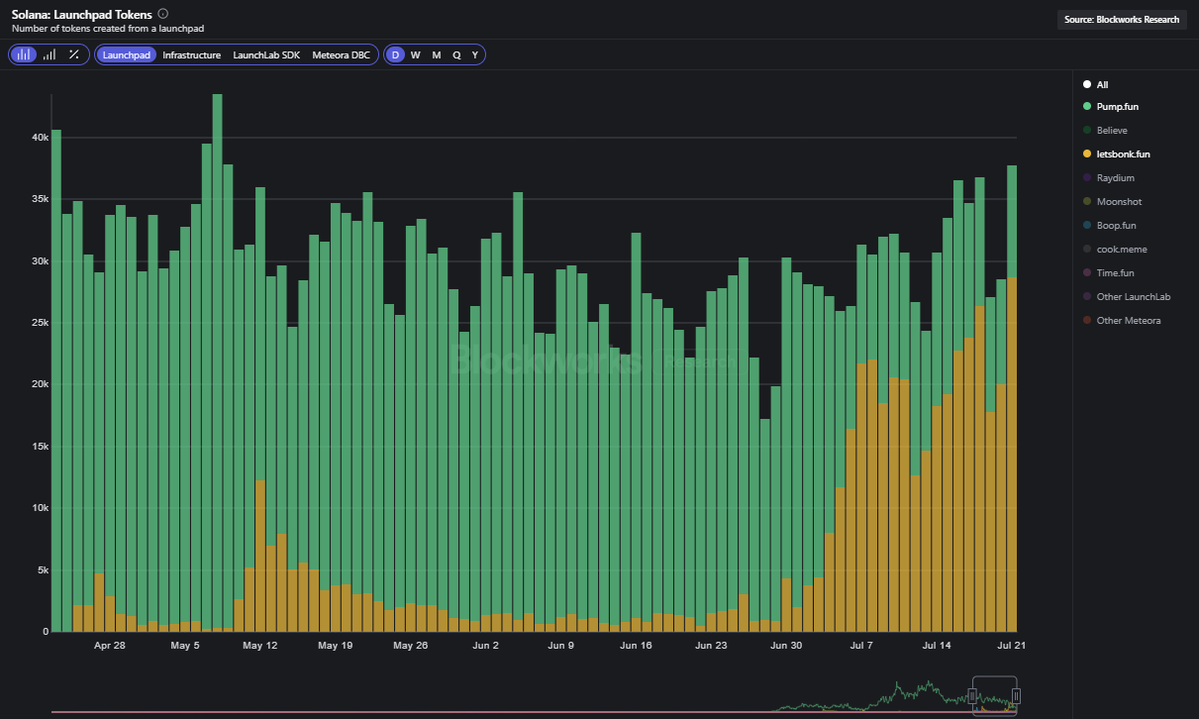

2/ Prior to Bonkfun, Pumpfun consistently saw 30-40k token launches daily.

Since Bonk's takeover, the total amount of tokens created across platforms has stayed relatively consistent.

However, Bonk is now capturing upwards of 25k launches while Pump sees south of 10k per day.

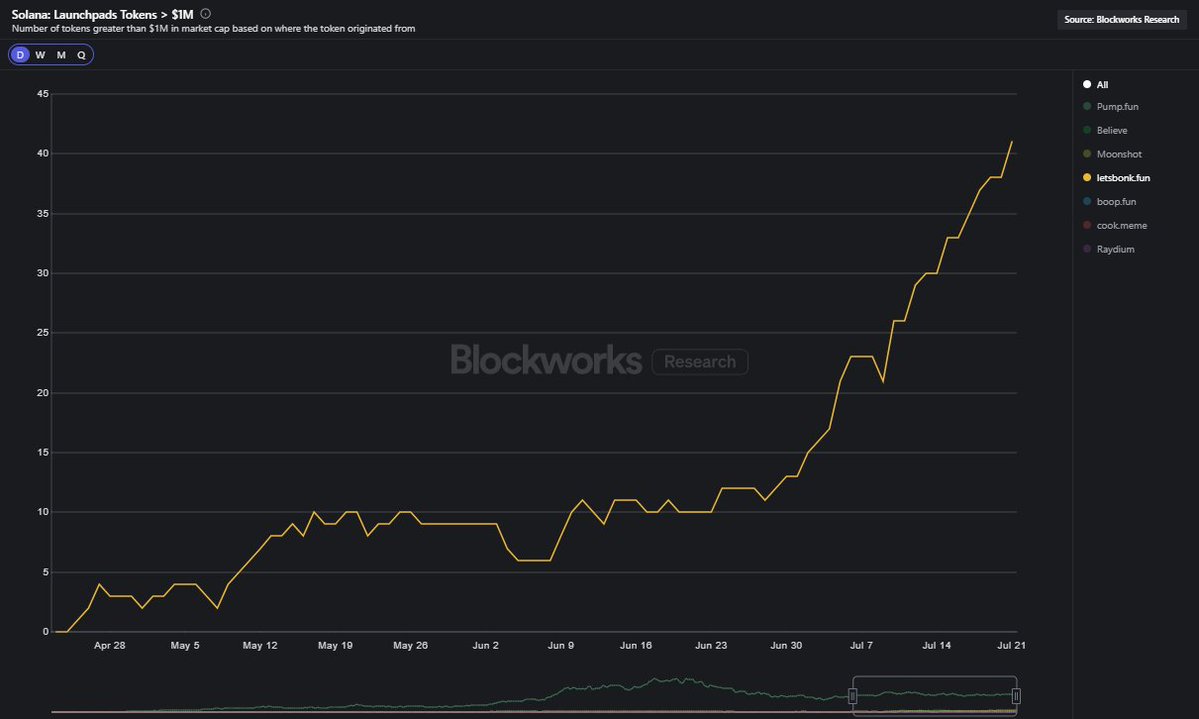

3/ In line with token growth, Bonk has also experienced growth of token market caps.

As the platform has taken market share, the number of tokens with a market cap greater than $1M has trended up and to the right.

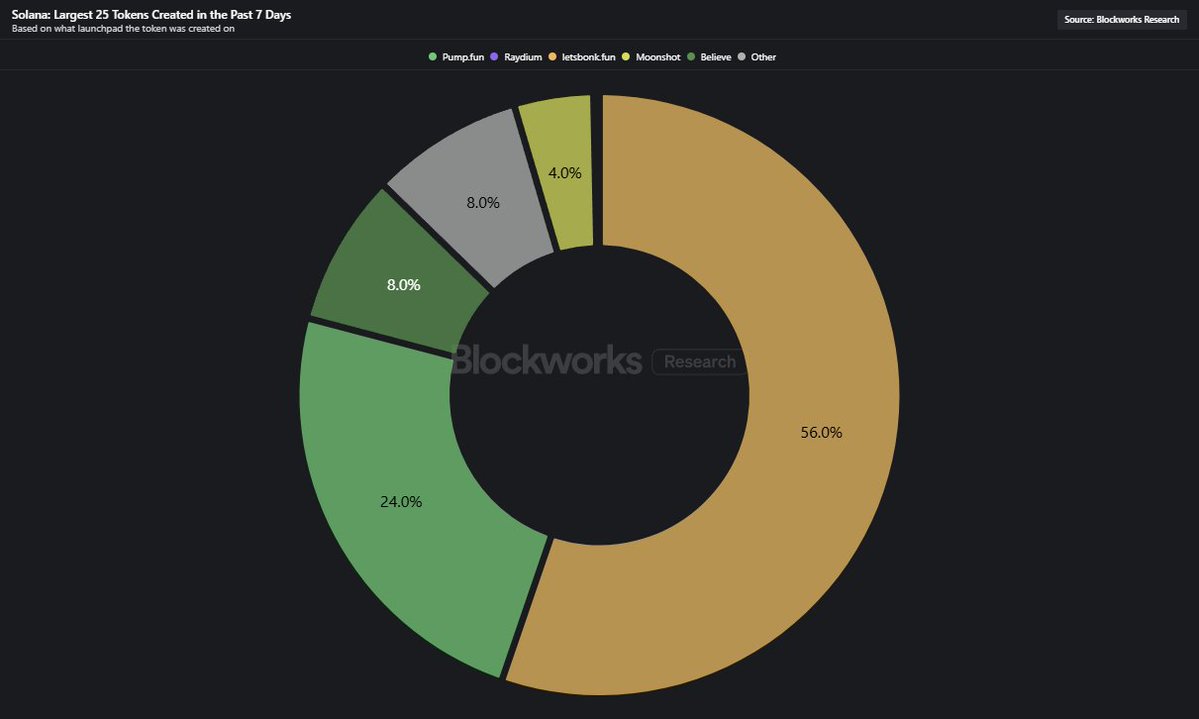

4/ We also see that the majority of the highest market cap tokens launched in the past 7 days are originating on Bonkfun.

The growth of launches, volume, and market caps may be accelerating a flywheel where traders prefer Bonk-based tokens due to their performance.

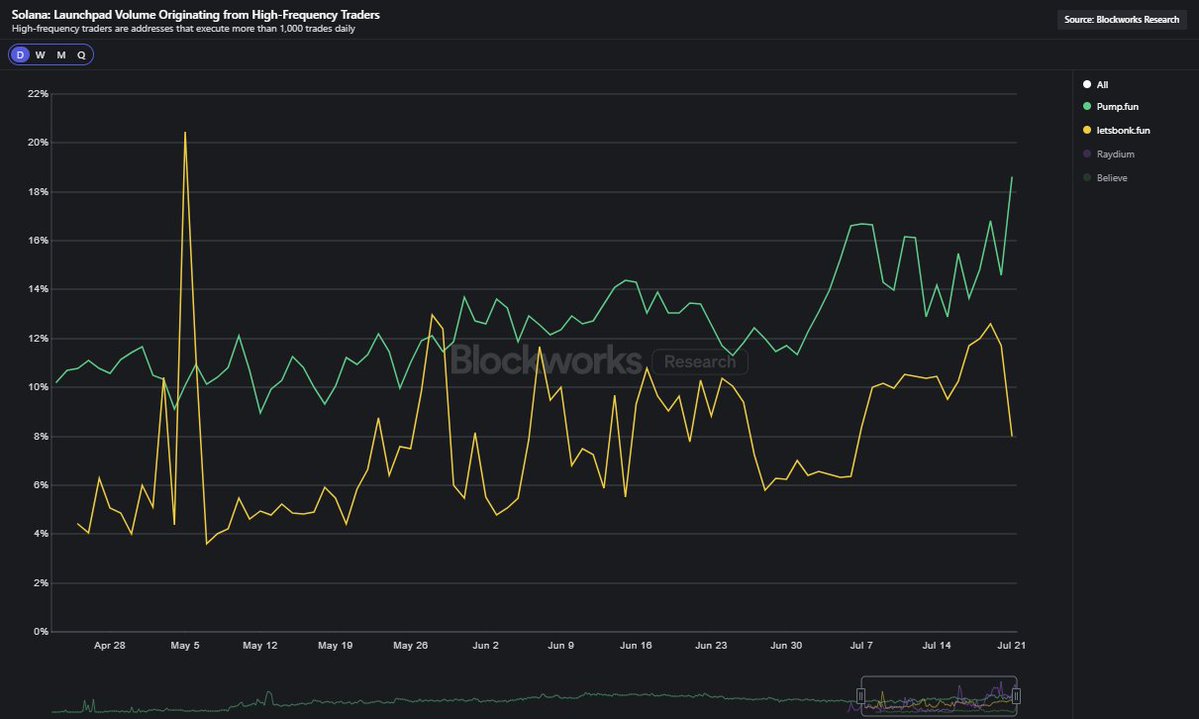

5/ Interestingly, Pumpfun maintains a greater ratio of high-frequency traders on its platform relative to Bonk.

This could suggest a growing presence of prosumer traders or bots which is interesting given Bonk's growth across the board in tokens and trading volume.

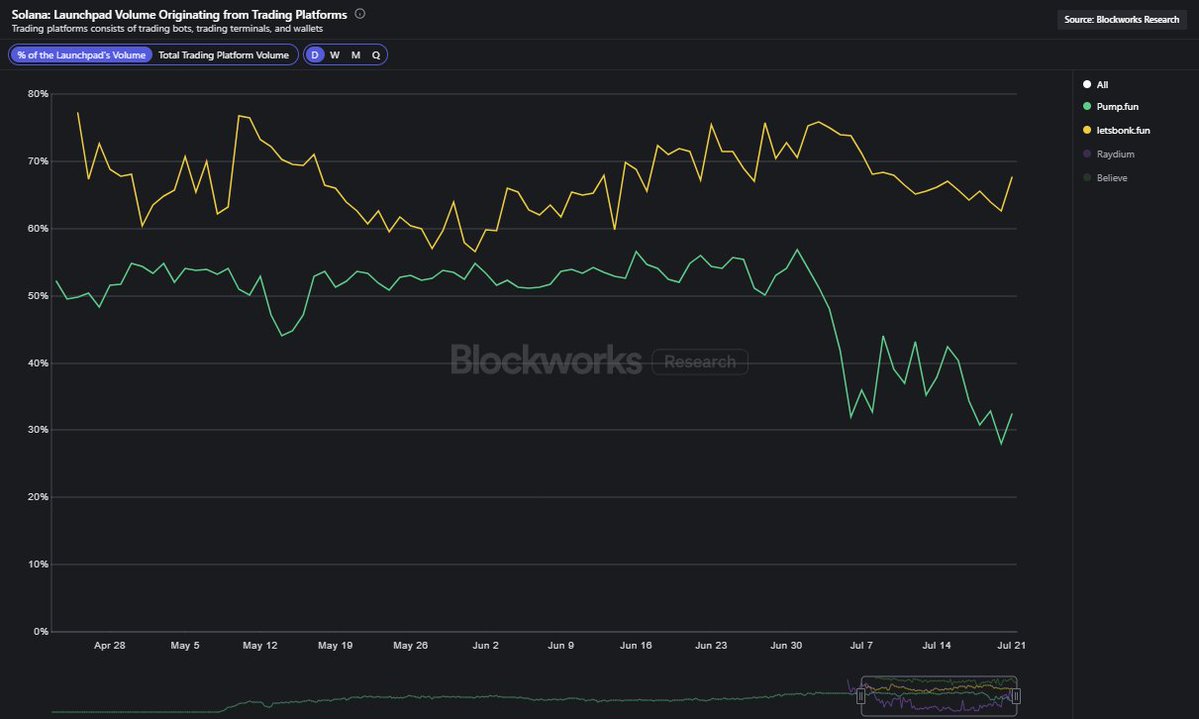

6/ We also find that north of 2/3rds of Bonkfun's volume is originating from 3rd party trading apps.

Meanwhile, the ratio for Pump has declined from more than half to now around 30%.

7/ Several months ago, Pump had unwavering control of the trenches.

But recent weeks have shown that Pump can be challenged, with Raydium and Bonk taking the launchpad market by storm.

With Pump's recent raise and token launch, we are left wondering how the team will respond.

18.77K

54

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.