“When pullback?”

The real answer is: I don't know. But some spots have a higher probability of dips.

Let’s check if this is one of them.

/ A few notes before we start:

Just to be clear: I’m not selling to buy back lower.

I’m not trying to outsmart the market. I'd rather sit on my good entries and add if the opportunity shows up.

/ Price behaves irrationally in this stage

It’s hard to predict dips when price is going vertical. even harder to guess where they dip into.

That’s part of why I don’t sell to buy back lower. It makes me way too vulnerable to missing the move.

/ Higher probability of having 1 bet right than 10

My style is simple: buy the lows in the bear or early in the cycle, then ride it as long as possible, scaling out very slowly in the late stage.

Every bet carries the chance of being wrong. Make 10 short-term bets to buy back lower while riding the big cycle, and at some point, you’ll miss the move. I’d rather keep it simple.

If we dip, we dip. If there’s real fear and red, and it makes sense, I’m happy to add.

So let’s dive in and see if this is one of those spots.

1. Total Crypto Marketcap

> Weekly close above local range high, after breaking macro range high

> So Macro outlook = very bullish

> But on lower timeframes, range extremes are where the fuckery happens, and where pullbacks can show up

> We did close above, yes, but still a higher chance of a mini deviation, some chop, or a quick crash

> Still would say the highest probability is minimal chop and continuation higher, but compared to a couple of weeks ago, after deviation at the local range low and macro range high, this is the first place with higher odds of a pullback.

2. Total Altcoin market cap (total 3)

> Just like the last chart, price is near the range high, this time a bit below.

> Compared to the steady uptrend of the past weeks, this is a spot where we could see some chop or dips.

> Don’t get me wrong: macro bullish, not selling, bla bla, but be prepared as there is a higher probability of a dip here.

> Last cycle’s real breakout also came with a 30% flash dip.

> Not saying it will happen, just noting the shift in probability vs the last 2 months.

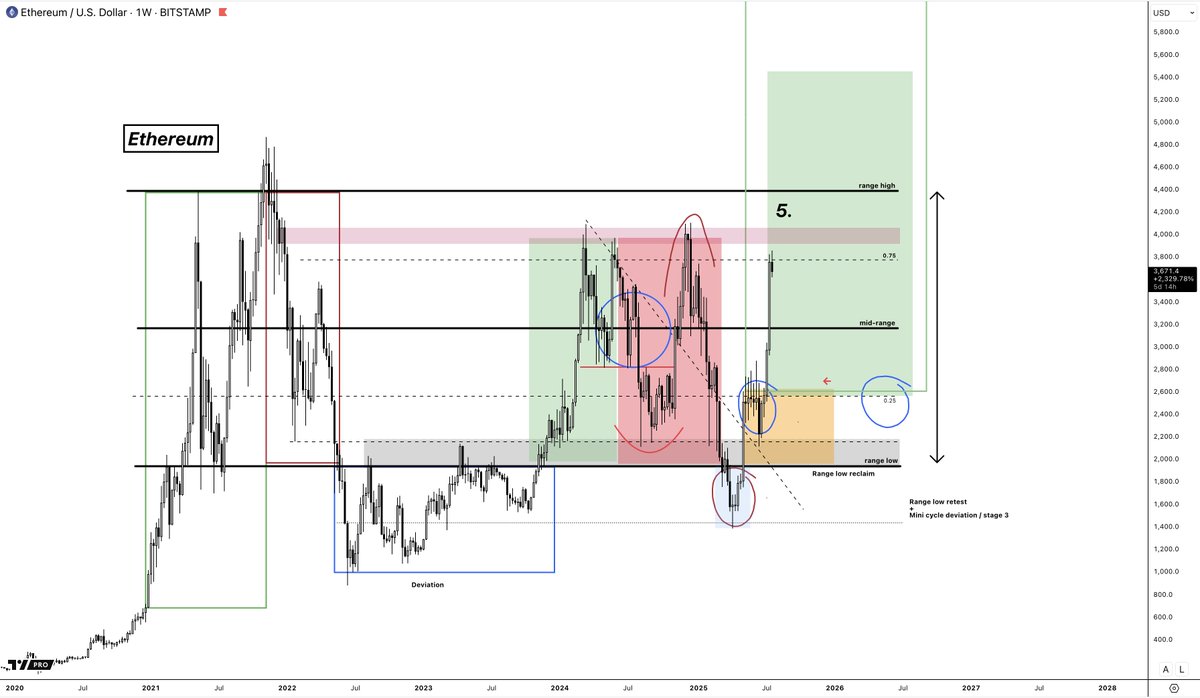

3. Ethereum

ETHUSDET

> Mega rally with 9 green daily candles into the 0.75 range resistance (range quarter level) and close to the supply.

> Same story, macro very bullish on Ethereum continuation, but this is a spot with a higher probability (again, don't need to happen) of a dip.

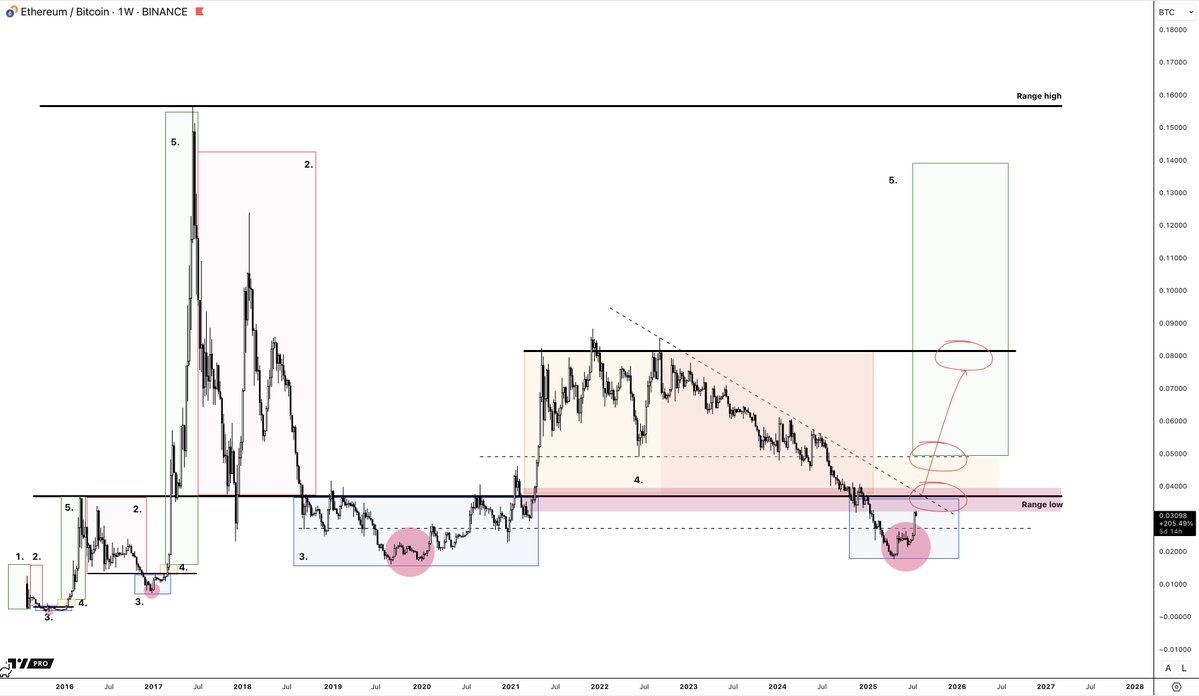

ETHBTC

> ETHBTC is in stage 3, the accumulation range.

> Usually, assets can spend quite some time in stage 3, and stage 3 can be seen as a separate range.

> We're now nearing the upper part of the range after rallying from the range low

> Until we break out of this range high, and get a clear reclaim of the macro range low same story; increased probability of pullbacks.

Again, one more clarification on this thread:

Not to:

> Predict lower time frame dips and play these

> Scare you out of positions (I'm not selling, trying to buy back lower)

> Say to not buy anything if you have zero exposure (if I personally had zero, I would still buy a small starter's allocation)

It is for:

> Giving you guys some clarity in the short-term probability, which can help you control fear and panic

> Can help you not capitulate into support if you are macro bullish or prepare you to buy dips if you want more exposure and not get struck by fear in red weeks, to then fomo later again in green weeks.

I hope ya'll get another opportunity to load up because I truly think we're gonna send everything higher in the last part of the cycle.

gm bulls

you can smell the fear of a pullback

I’m not selling good entries trying to get better ones

I’m gonna sit and wait

and throw in some lowball bids on my favorite tokens

I’ve seen this before

53.8K

313

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.