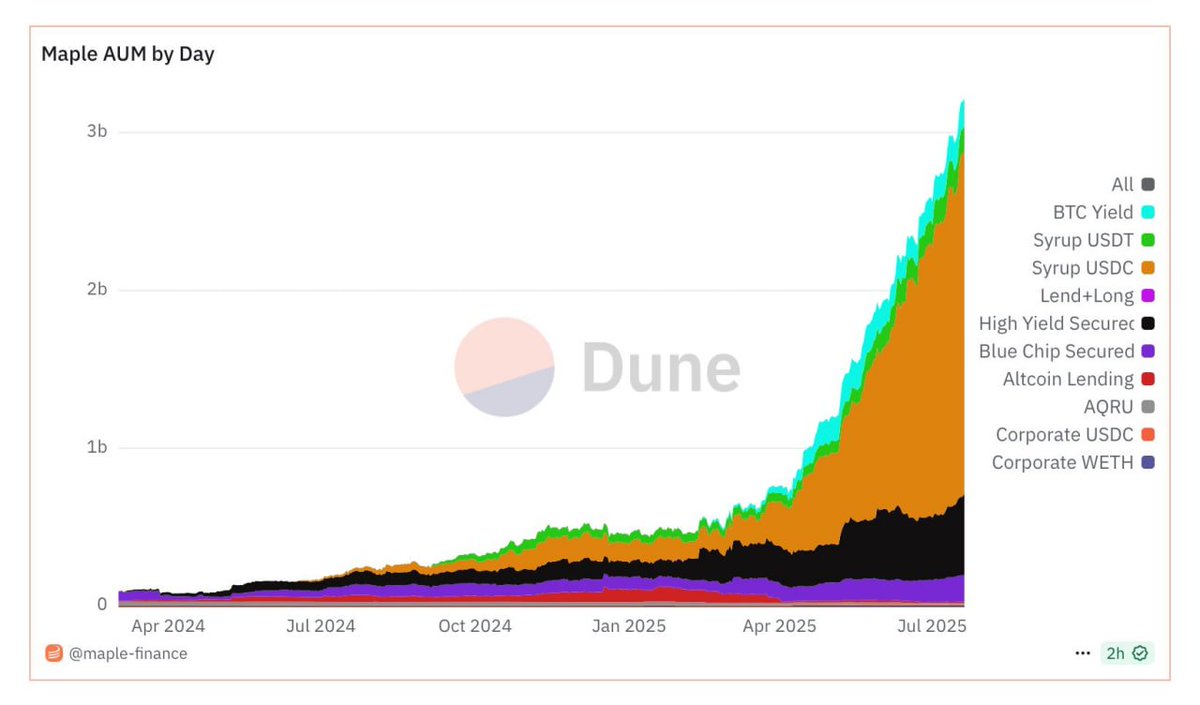

This tells me everything I need to know.

Institutions want exposure to real-world yield on-chain, even if the structure is narrow.

They don’t need dozens of assets or advanced tools. They want simplicity, predictability, and yield they can explain to a compliance team.

There’s clearly unmet demand because Maple Syrup isn’t even that flexible. It’s basically “plug your USDC in and trust Maple to allocate.”

Maple shows that institutions are ready. They’re hungry for structured yield products that look familiar, behave predictably, and scale with real-world exposure.

This is why I’m bullish on @TharwaUAE

It’s not trying to out-yield the market with gimmicks. It’s building the rails that serious capital actually wants: structured products, real diversification, automated risk management, and yield that doesn’t collapse under pressure.

The demand is already here and Tharwa is building the system to meet it.

Show original

4.1K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.