Meteora Season 1 Snapshot and Thoughts on $MET Token

The long-awaited @MeteoraAG airdrop is finally on the way, as the team made major announcements regarding snapshot and future seasons.

Let's dive into the details and my thoughts around the imminent TGE:

Snapshot Taken

✅Season 1 snapshot of points was taken on 30 June

✅Season 2 began on 1 July (end date TBA)

✅Points are being finalised and will be viewable on Meteora soon

Recap of Season 1

✅Points based on both TVL ($1 / point / day) + Fees earned ($1 in fees = 1000 points)

✅Only applies to DLMM, DAMM v1

✅Points for DAMM v2 will be counted for Season 2

✅8% supply allocated to points earned in 2024

✅5% supply allocated to points earned in 2025

✅Additional 2% based on other criteria TBA (likely yappers and community OGs etc)

✅Separate allocation to $M3M3 pools

Season 2

✅Points based on fees only: $1 fees / 1000 points.

❌No longer counts TVL. This is to max incentivise fees earning.

✅Covers DLMM and DAMM v2 only (to phase out DAMM v1)

For more details:

My Thoughts on the criteria and the $MET Token:

🔥I like that they are rewarding early participants, though some might say this is unfair.

🔥Meteora is a great tool to earn fees regardless of the $MET airdrop. Treat this as a bonus.

🔥LP Army @met_lparmy is a community of top traders to onboard new users to earn fees together, promoting PvE as opposed to PvP in new launches through boot camps and tools.

✅LPing is a great skill to learn, as it can generate income in all market conditions. Solana is known for new launches, and shows no signs of slowing down. Newly launched coins generate insane volume and volatility, and Meteora offers great tools to capture that.

It also inspired the community to build on top of Meteora, such as automation tools @HawkFi_ and @SOL_Decoder

✅Whether $MET will do well price-wise largely depends on tokenomics, which has yet to be announced.

🔥I expect $MET to have buyback / token burn mechanism as this has become a clear meta following the massive success of $HYPE (and more recently, $BONK from Bonk Fun)

🔥Meteora has close ties to $JUP, and Jupiter has similar mechanisms in place, so I would expect similar for $MET

Project Metrics:

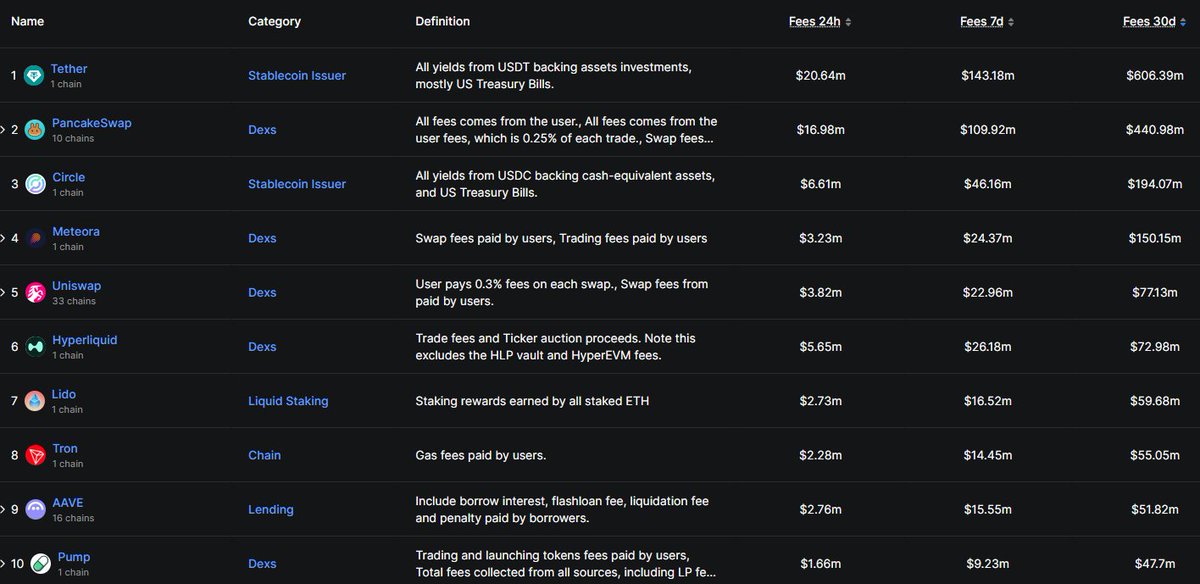

If the team plays their cards right with tokenomics, $MET could perform well, as it is a top protocol in its ability to generate revenue and TVL:

🔥TVL: $840M. Ranked 9 on Solana

the only top 10 protocol without a token

🔥Fees: Consistently top ranking in all of crypto

Ranked 7th in last 24hrs: $3.23M (vs HyperLiquid 5.65M, 5th)

Ranked 5th in last 7D: $24.37M (vs HyperLiquid 26.18M, 4th)

Ranked 4th in last 30D: $150M (vs HyperLiquid $73M, 6th)

Annualised: $1.8B vs Hyperliquid $876M

(source: DefiLlama)

In fact, if you don't count stablecoin issuers Tether and Circle:

🔥Meteora is no.2 in fees in last 30D

🔥This puts it in the same league as the big boys PancakeSwap, Uniswap and HyperLiquid.

🔥Top fee generating protocol on Solana, 1st in last 24h, 7D, and 30D, surpassing that of $PUMP, $JUP, $JTO and $RAY.

Let's await patiently for $MET Tokenomics 👊

8.66K

7

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.