Full BonkFun/Raydium vs. PumpFun/PumpSwap Fee and Tokenomics Deep Dive (Very long, wrote for nerds who care & for people to search and reference. For everyone else, skip down to "Conclusions" section for a tldr)

Intro:

I wanted to understand the full picture of differences between PumpFun and BonkFun fees, platform revenue, creator revenue and buybacks so I did some research and onchain experimentation.

It's important to note that PumpFun + PumpSwap is not competing with just BonkFun, but with BonkFun + Raydium Dex + Raydium LaunchLabs (onchain backend for BonkFun). Both projects and tokens ( $BONK & $RAY) need to be included in the comparison with PumpFun/PumpSwap and $PUMP.

Also important to note I could not find any official announcement from PumpFun about token buybacks. While they have obviously begun token buybacks already, the exact percent being determined by fees is currently an assumption based on a BlockWorks article and "sources". All sources for my research included in tweets below (#* = source). Lots of math in the simulation here. I possibly got things wrong. Please correct me if I did.

------------------------

Fees/Tokenomics Breakdown

Bonkfun:

Bonding curve: 1.25% fees on swaps (1% bonkfun, .25% Raydium LaunchLabs)*1.

.58%*2 (58% of the 1% bonk fee) buys back $BONK

Post Migration: Defaults to .25% fee AMM*3 (.03% of this .25% fee is used to buy back $RAY)*4

Token Creator Fees: Creators receive 10% of bonding curve fees (.1% of swaps). 10% of LP fees (10% of the .22% Raydium LP fees or .022% of swaps)*5

PumpFun:

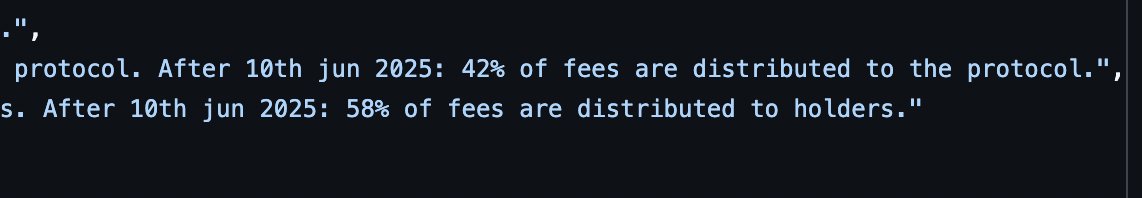

Bonding curve: 1% (.25% buyback $pump)*6

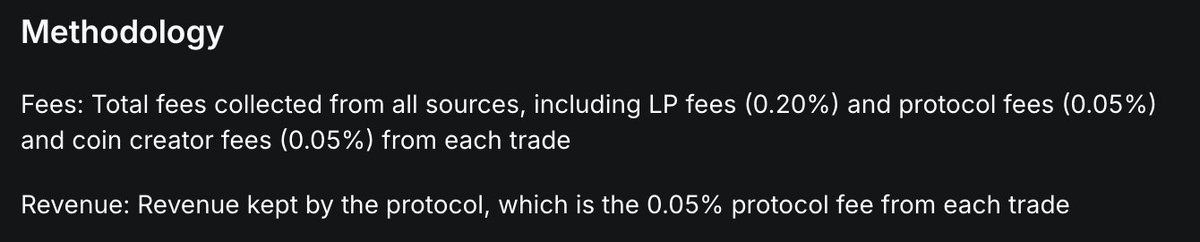

Post Migration: .3% (.2% LP, .05% pumpfun, .05% creator)*7

Token Creator Fees: .05% of swaps

------------------------

Token Simulation Exercise (Based on example of $1M bonding curve volume, $10M post-migration volume)

BonkFun

Bonk Bonding Curve: $12,500 in fees: $5220 $BONK buyback, $3780 BonkFun revenue, $2,500 LaunchLabs revenue*8 ($6280 total platform revenue between BonkFun + LaunchLabs), $1000 creator rewards

Raydium Post-Migration: $25,000 in fees: $19,800 to LP (not including creator), $3,000 $RAY buyback, $2,200 to creator

PumpFun

PumpFun Bonding Curve: $10,000 in fees -> $2,500 $PUMP buyback, $7500 PumpFun revenue

PumpSwap Post-Migration: $30,000 in fees -> $20,000 LP, $1,250 $PUMP buyback, $3,750 PumpFun revenue, $5,000 to creator

------------------------

Fee Summary (Note: % next to fee line item is % of total fees that line item represents)

BonkFun + Raydium:

Total Fees: $37,500 or .34% of total volume

Total LP Fees (excl. creator): $19,800 (52.8%)

Total Platform Revenue: (all sources): $6,280 (16.7%)

Total Buybacks: $8,220 (22%) [$5,220 $BONK (14%), $3,000 $RAY (8%)]

Total Creator Revenue: $3,200 (8.5%)

Total Revenue Distribution (buyback + creator): $11,420 (30.5%)

PumpFun + PumpSwap:

Total Fees: $40,000 or .36% of total volume

Total LP Fees (excl. creator): $20,000 (50%)

Total Platform Revenue: (all sources/platforms): $11,250 (28.1%)

Total Buyback (PumpFun + PumpSwap): $3,750 (9.4%)

Total Creator Revenue: $5,000 (12.5%)

Total Revenue Distribution (buyback + creator): $8,750 (21.9%)

------------------------

Conclusions

There's tradeoffs between the two platforms for "devs"/token creators, traders and the market/industry as a whole. Here below are some conclusions:

>BonkFun has bonding curve creator revenue (bonding curve creators/short term creators win)

>BonkFun higher bonding curve fees (bonding curve traders lose)

>Raydium lower post-migration fees (long term markets win)

>BonkFun + Raydium lower post-migration creator rewards (long term creators lose)

>BonkFun + Raydium more revenue distribution ( $BONK holders win on bonding curve fee buybacks vs PF, $RAY holders win on LP fee buybacks vs PF)

>PumpFun lower bonding curve fees (bonding curve traders win)

>PumpFun no bonding curve creator rewards (bonding curve creators lose)

>PumpSwap higher fees post-migration (long term markets lose)

>PumpSwap higher post-migration creator share (long term creators win)

>PumpFun + PumpSwap shares the same token, accruing fees from both into $PUMP

>PumpFun/PumpSwap more extractive via platform/team revenue by almost +50% (21.9% total revenue vs 30.5% from BonkFun + Raydium in the simulated example)

Final notes:

1) For (*8) I could not confirm what happens with the .25% fee for LaunchLabs from the BonkFun bonding curve. BlockWorks reporting seems to indicate all frontends using LaunchLabs have a static .25% fee to LaunchLabs presumably as SOL revenue, so this is my best guess.

2) In spite of BonkFun claiming in their annoucement tweet (*5) that bonded tokens receive 10% of bonding curve SOL rebates and 10% of LP fees, I personally launched and bonded a token on BonkFun 10 days ago, and there is no creator rewards on BonkFun or LaunchLabs for that wallet from either the bonding curve or post-migration LP. I assume the token needs some level of volume or fees to become eligible (their creator rewards front end has an "Eligibility" checkmark, so I believe their creator rewards only apply to tokens which reach certain thresholds, which I cannot find publicly).

3) BonkFun apparently previously would burn 90% of LP upon migration and keep 10% of the Raydium LP for BonkFun platform revenue, where 10% of post-migration LP fees = platform revenue (including buyback breakdown)*9. It appears they changed this to 90% burn, 10% LP given to the token creator for creator rewards. However, I was not able confirm whether BonkFun still reserves some LP for BonkFun revenue (SolScan transactions are hard to follow🥲)

*1 BonkFun

*2 Defi Llama

*6 Blockworks

*7 Defi Llama

*8 Blockworks

*9 Blockworks

16.19K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.