For 16 years, Bitcoin has been the most important asset in crypto - and the most underutilized.

Lombard’s roadmap aims to bring Bitcoin to life: a multi-phased approach to build the infrastructure and liquidity to enable a Bitcoin-based economy.

Here’s how.👇

Bitcoin sits idle in every sense. The vast majority of BTC remains in cold wallets, the blockchain is isolated from all others, and the ecosystem sees limited innovation.

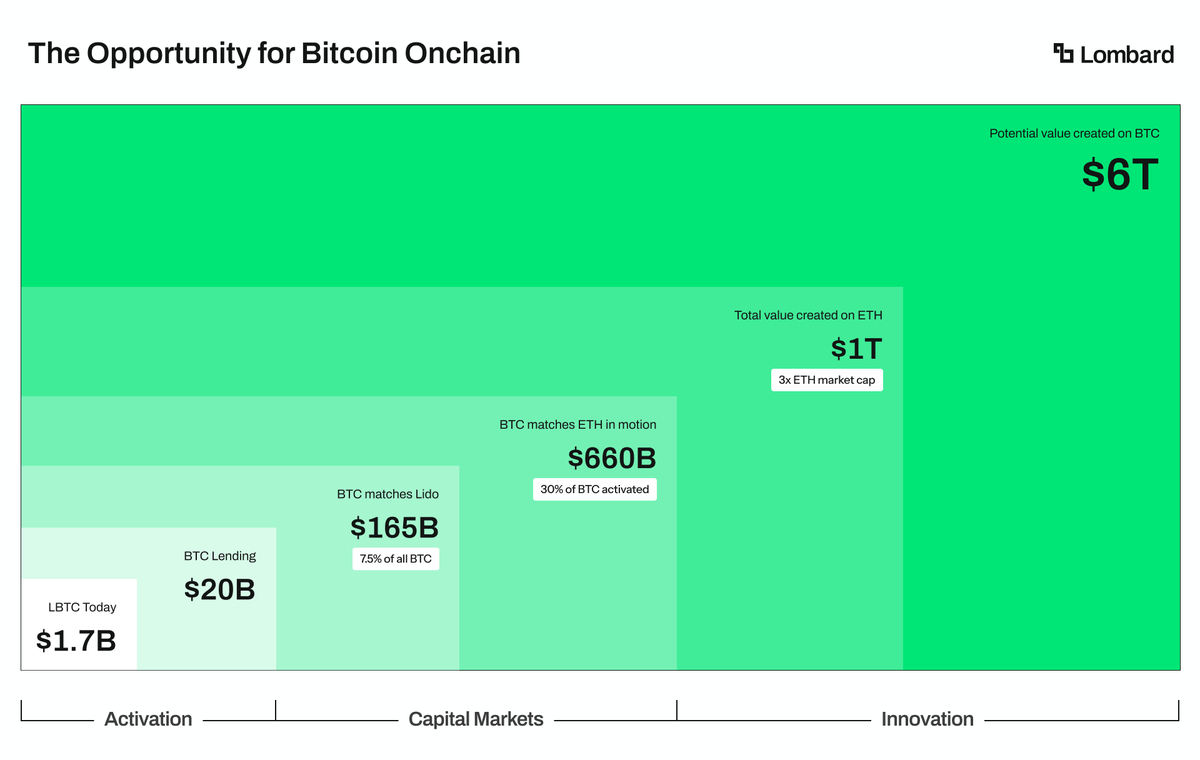

This represents trillions in unrealized opportunity. As BTC sits dormant, the digital economy built around it remains untapped.

Lombard started with LBTC - a liquid, yield-bearing version of Bitcoin secured by leading digital asset institutions. The results revealed massive demand for Bitcoin on-chain:

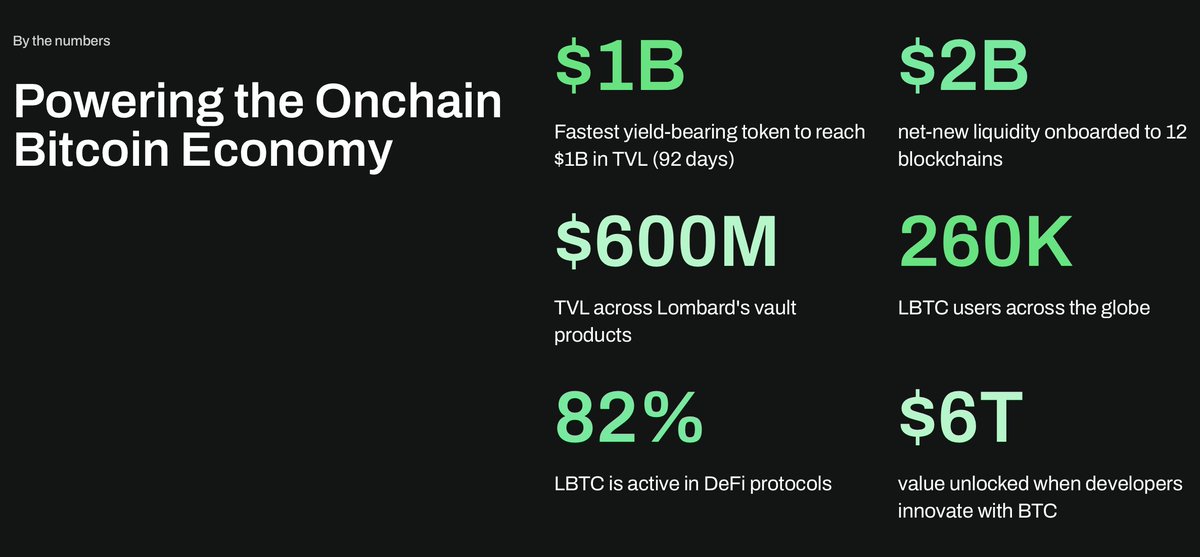

$1 billion TVL in 92 days, now over $2 billion. Fastest-growing yield-bearing token in crypto history.

LBTC started a Bitcoin DeFi renaissance. Leading protocols - Aave, Morpho, Maple, Pendle, EigenLayer - integrated Bitcoin as a strategic priority for the first time.

Over 80% of LBTC is active in DeFi. We activated $600M+ across new ecosystems like Sui, Berachain, TAC and more.

Phase 1: Put every Bitcoin in motion, no matter where or how holders want to use it.

Liquidity is the lifeblood of capital markets. LBTC was our catalyst - revealing demand and creating the playbook for Bitcoin DeFi. We unified institutions through our Security Consortium.

Phase 2: Build liquid markets for BTC onchain to enable the next generation of innovation.

Phase 1 revealed demand. Phase 2 will hyperscale liquidity, exponentially growing utility for Bitcoin onchain through a suite of middleware products.

Lombard's Middleware for Bitcoin

- Cross-chain BTC: a neutral, permissionless asset with native liquidity across chains

- Lombard SDK: developer infrastructure to embed BTC deposits and yield anywhere

- BTC DeFi Marketplace: a curated hub to deploy BTC in DeFi, CeFi, and TradFi

- Institutional products bridging Bitcoin to traditional finance

- The Lombard Ledger: the leading Bitcoin bridge operated by trusted institutions

Phase 3: Enable permissionless innovation on Bitcoin.

Today, Bitcoin is still an asset without an onchain economy. Builders face custody complexity, compliance friction, and integration barriers that limit progress.

Phase 3 will remove these constraints and make Bitcoin programmable and composable across ecosystems.

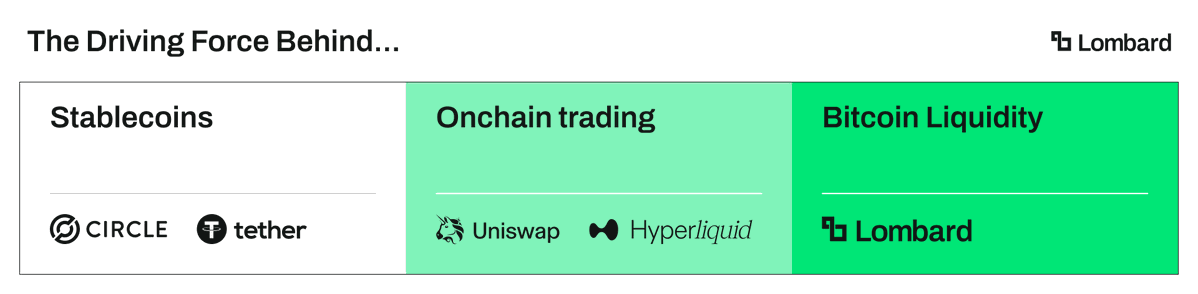

Lombard will do for Bitcoin what Tether and Circle have done for stablecoins.

We're creating the liquidity flywheels, distribution engines, and onboarding mechanisms that drive industry-wide growth.

With the full stack in place, barriers that have restricted Bitcoin innovation for 16 years will disappear.

We will see the next major crypto breakthroughs emerge from the Bitcoin ecosystem.

End.

10.65K

268

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.