The Investment Case for $FUTU, the Robinhood of HK and Singapore

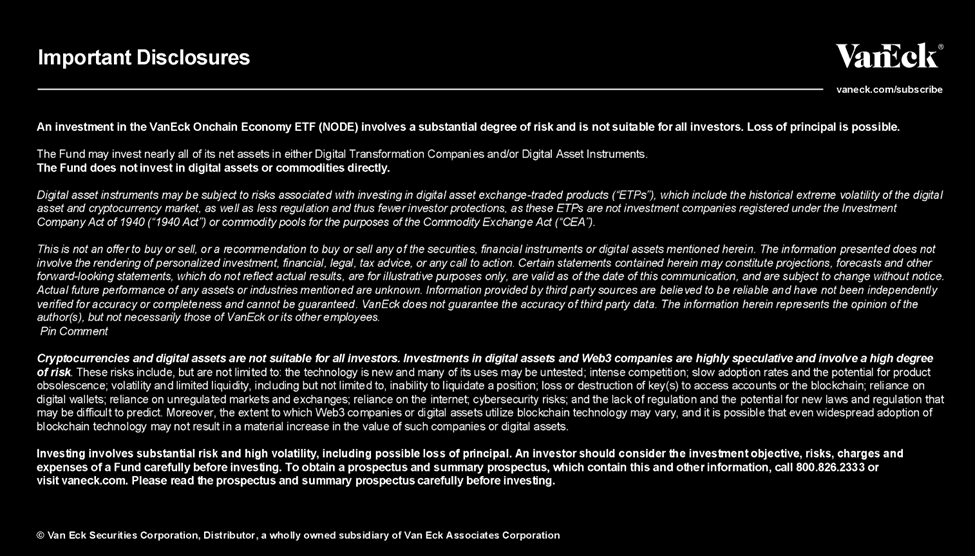

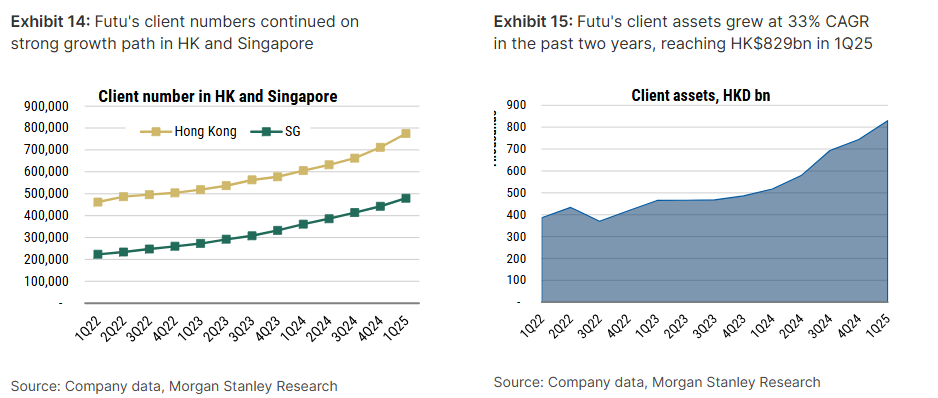

>Winning market share in core markets of HK and Singapore including high wealth individuals - 2.7M funded accounts total, 700K of 2M HK's total which is the highest share amongst HK's 500 brokers.

>High level of trading of clients - 3.6% of total volume in in HK, significant share of retail trading in HK.

>Crypto is a huge potential business for them. Possible 18% 2027 revenue uplift from crypto, additional 9% from stablecoins and derivatives, per Morgan Stanley estimates.

>Strong product with well-regarded user experience. >Tokenization is not as interesting to them, but the stablecoins and RWAs are interesting. In particular, HK intends to tokenize government issued bonds.

>Futu is very competitive in price for crypto trading at 8bps compared to 20-30 for IBKR in HK. Crypto trading is exciting because its turnover is 700% on AUM compared to equities at around 100-200% at a take rate of 3-4x compared to equities.

>Not an expensive stock at ~15x PE

$FUTU is held in VanEck Onchain Economy ETF, ticker $NODE.

4.2K

13

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.