When are LP APYs 'real'? Markouts is a very interpretable tool to help answer!

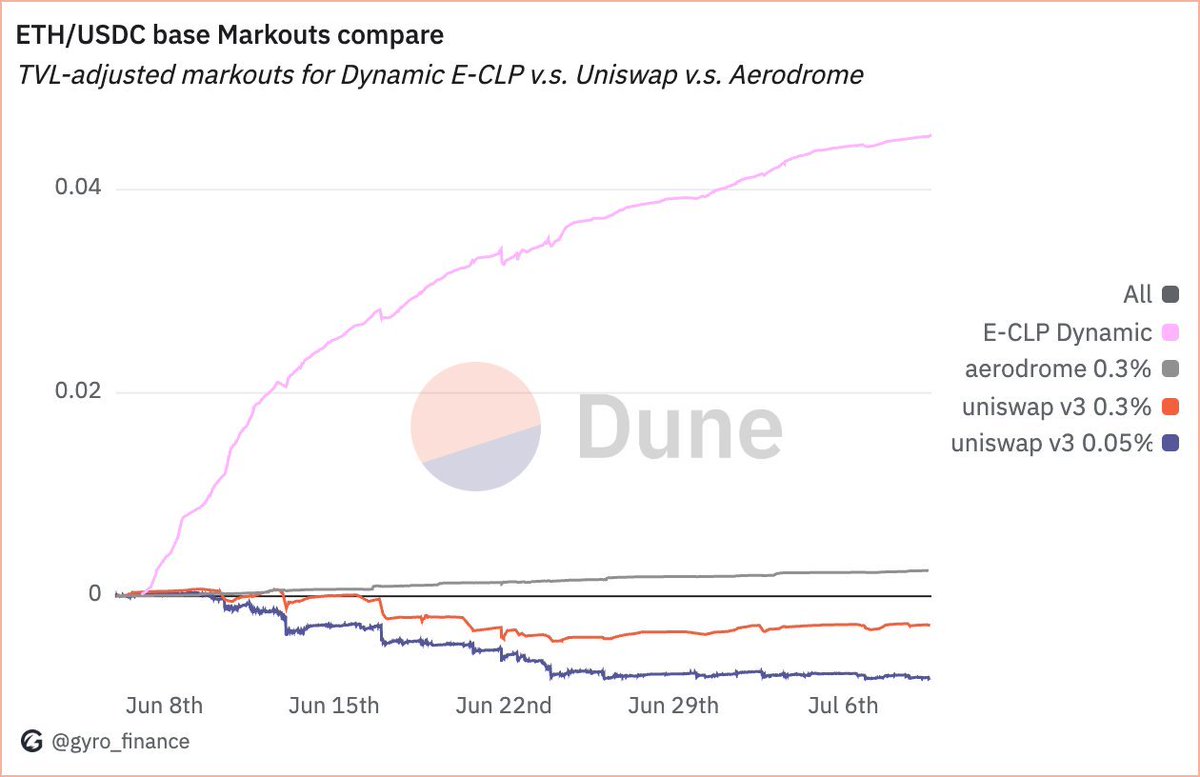

Gyroscope's Dynamic E-CLP gained 4.5% last month in markouts, which is a direct trading PnL vs the market.

That's 69% annualized (compounded), which for this pool explains most swap APYs.

In contrast, beware of pools where markouts are much less (or negative!) than swap APYs. Those are pools where LPs will likely get rekt.

You also have to know what you're doing to achieve it.

Gyroscope's pools are the only ones we're aware of that generate consistently high *positive* trading PnL for LPs. Most other pools in aggregate are negative.

Cherry on top that Gyroscope's pools are completely passive.

3.01K

16

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.