Simple rule: Every 1 billion SyrupUSDC = ~$15M revenue

Alpha for @maplefinance:

There's more dominos beginning to fall for $SYRUP that makes me think "you ain't seen nothing yet".

Big Domino

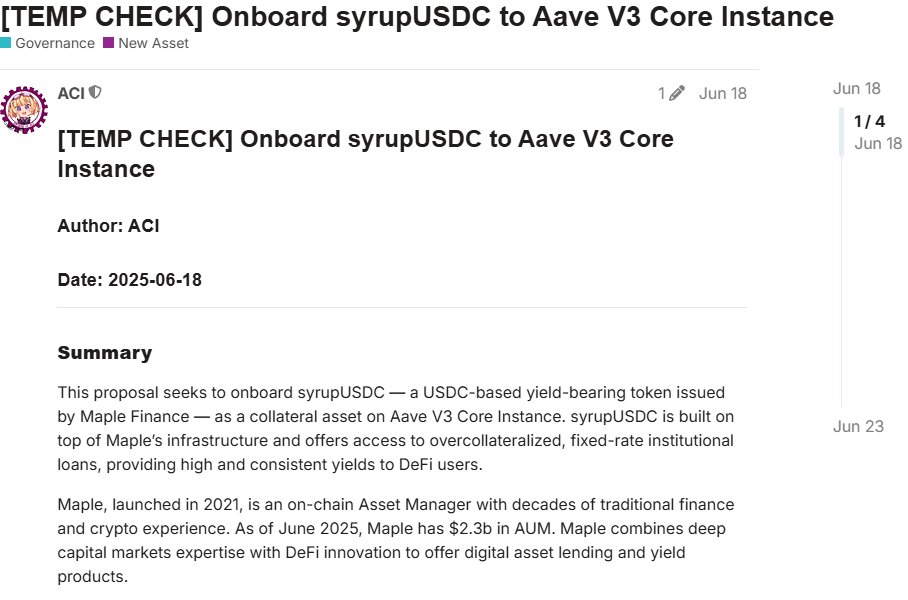

Last month a "Temp Check" appeared on @aave to onboard syrupUSDC.

Why is the proposal so positive sum for both parties?

Aave gets:

- New collateral type with real-world yield.

- Potential for $500M+ institutional inflow into syrupUSDC if loopable on Aave (but I think way more, keep reading).

- Boosts TVL, USDC utilization, and interest rates.

- Maple will provide $250k in incentives to kickstart adoption.

Benefits to Aave:

- Supports Aave’s broader strategic goals, like GHO adoption via institutional lending.

- Ultimately, this brings in more institutional capital via Maple’s distribution network.

- Sets the stage for future listings (a yield-bearing BTC asset 👀).

---

Why is this Beneficial to Maple?

For starters, I can't say for certain if this will pass or where it's currently at, but I've heard rumors that it's going through a risk assessment.

If you ask me my opinion, I think this is a slam dunk to pass (seeing Llamarisk signaling early support in the governance forum):

So what does that mean?

You simply just need to look at what happened with Aavethena.

Ethena's sUSDe has achieved $3.19B in circulation on Aave.

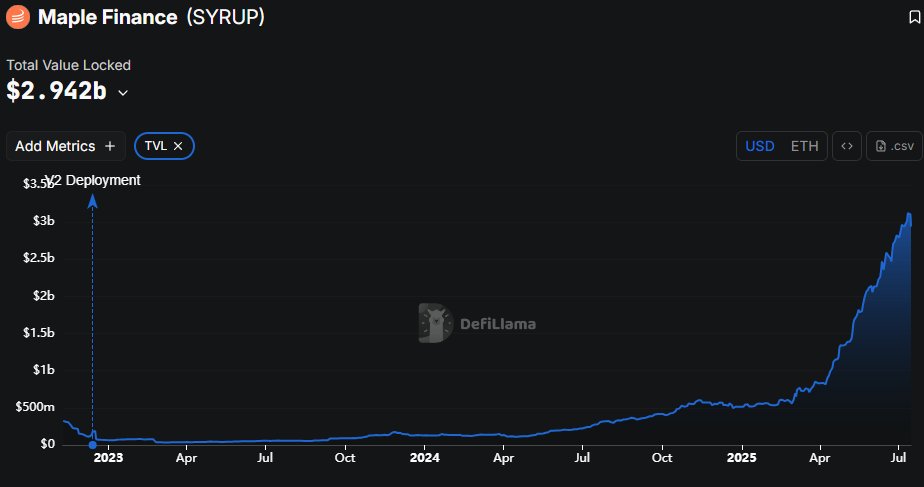

If passed, I think syrupUSDC could add $1B and very possibly $2B to the syrupUSDC circulation (that might even be conservative).

And I think it could happen very quickly - as in, within this quarter. I think the caps will be the only holdup and that their will be insatiable demand.

Then you can imagine how much attention this drives to looping an asset that can attain 7% - 15% APY 👀

---

OK bringing this back to $SYRUP and why this matters?

I've heard from reliable sources that $1B of syrupUSDC in circulation adds $15M ARR back to Maple.

If they can get $2B in circulation on Aave, that's an extra $30M of ARR to add to their $15M - 20M they are already achieving. This would put them at $45M - $50M ARR.

From talking to the team, they are lean and adding people no longer helps scale the business so overhead costs should stay low. Which means, they could be in a position sometime in Q3 to really accelerate token buybacks.

One other piece of info.

I have it on good authority that whenever you see parabolic hockey stick TVL growth like we're seeing, there's a 30 day to 40 day lag in revenue.

Meaning, the TVL growth you see in July, won't be fully reflected in revenue numbers until August or even early September 👀

We're actually only seeing revenues right now from TVL growth in early June...

2.26K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.