.@Superfansbobo's write up on @katana assets is awesome. Must read!

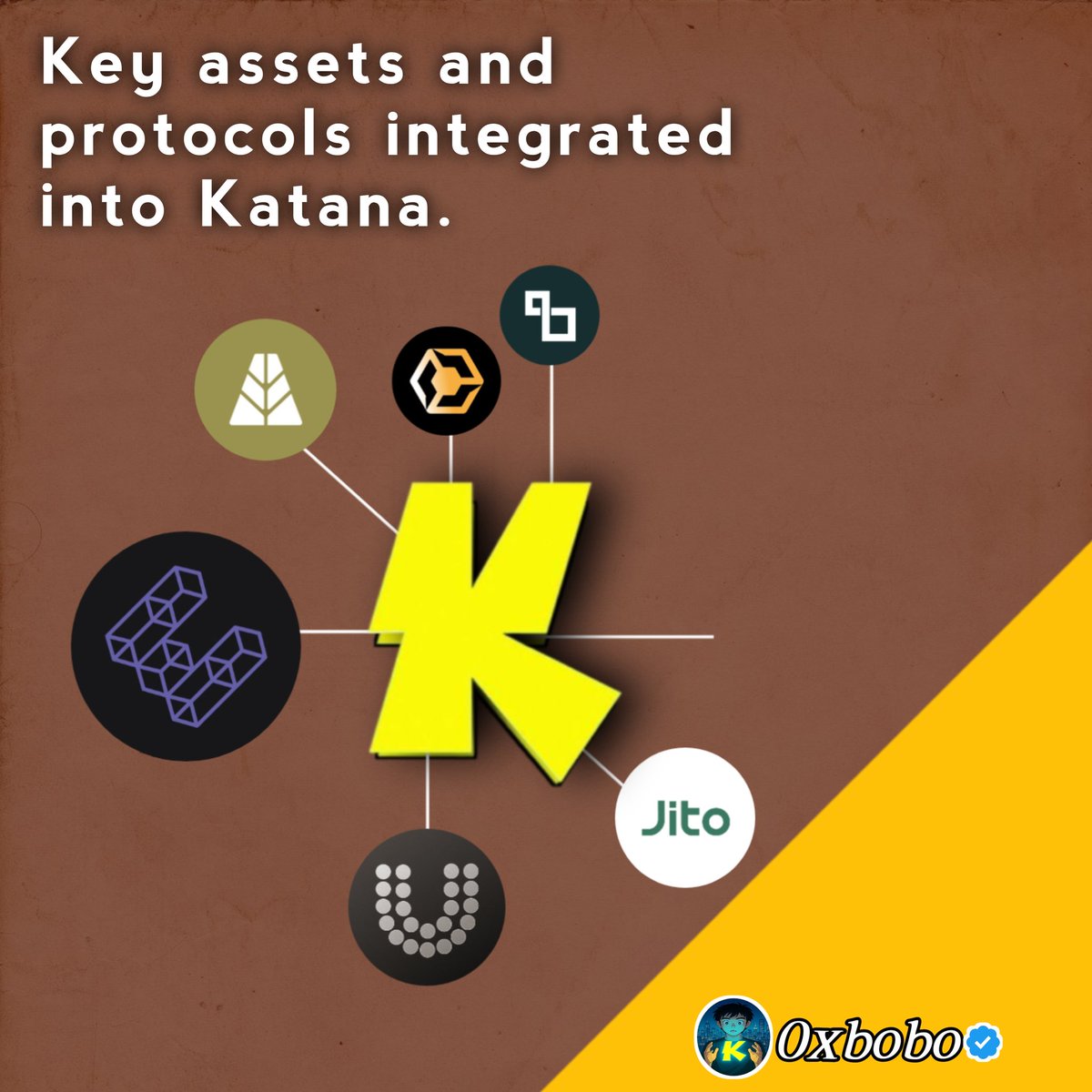

⚔️ Core Assets of Katana.

⚔️ @katana isn't just a chain; it's an ecosystem, and every powerful ecosystem needs a strong foundation. These core assets and protocols represent key infrastructure elements that drive Katana’s performance, usability, and scalability across DeFi.

⚔️ Agora – The Digital Dollar Engine (AUSD)

@withAUSD is the issuer of AUSD, a fully-backed, fiat-minted stablecoin built for real use, not just speculation.

^ Why It Matters: AUSD is designed to be freely tradable and institutional-grade, giving users access to a stable, reliable medium of exchange on-chain.

^ In Katana’s World: Agora empowers on-chain commerce, lending, trading, and staking, all denominated in a stable value. It reduces volatility and brings much-needed predictability to DeFi strategies.

⚔️ BitVault – Fortress-Level Asset Security

@BitVaultFinance focuses on secure asset management, offering a mix of custodial safety and smart on-chain integrations.

^ Why It Matters: In DeFi, security is everything. BitVault ensures user assets are stored and managed with maximum resilience against exploits or operational risks.

^ In Katana’s World: It gives institutional and individual users alike confidence to interact with the ecosystem, knowing their assets are protected by next-gen vault infrastructure.

⚔️ Ether_Fi – Ethereum Staking, Reinvented

@ether_fi provides Ethereum staking infrastructure with decentralization and user sovereignty in mind.

^ Why It Matters: Traditional staking often relies on centralized platforms. Ether_Fi flips that by enabling non-custodial, liquid staking, letting users earn yield while keeping control of their ETH.

^ In Katana’s World: Ether_Fi allows stakers to bring ETH-native yield directly into Katana’s liquidity layer, powering collateral, lending, or farming with staked ETH positions.

⚔️ Jito – The MEV & Yield Layer from Solana

@jito_sol is a protocol built on Solana, focusing on MEV (Miner Extractable Value) optimization and validator-side yield enhancements.

^ Why It Matters: MEV is a hidden force that shapes profit opportunities on-chain. Jito turns that hidden power into structured yield without harming user experience.

^ In Katana’s World: Even though it’s Solana-native, Jito’s logic and integrations can help Katana optimize validator incentives, enhance staking returns, and explore cross-chain yield strategies.

⚔️ Lombard – DeFi’s Collateral Engine

@Lombard_Finance specializes in protocol-level collateralization, unlocking value from idle assets without requiring liquidation or loss of ownership.

^ Why It Matters: It's the foundation of capital efficiency; users can borrow, trade, or stake using their held assets without needing to sell them.

^ In Katana’s World: Lombard opens the door for powerful DeFi flows where staked, bridged, or rare assets can be reused as collateral across apps in the ecosystem.

⚔️ Universal – The Missing Bridge or Identity Layer?

While still under wraps, @universaldotxyz likely refers to cross-chain routing or universal identity infrastructure—something Katana would deeply benefit from.

^ Why It Might Matter: As Katana expands its reach across chains, it needs secure, seamless bridges and ways to recognize users no matter where they come from.

^ In Katana’s World: Universal could serve as the glue that binds all apps, assets, and wallets, turning Katana into a frictionless, user-first experience across Web3.

1.69K

11

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.