1️⃣ Clearpool Leads Stablecoin Growth for $USDX

Clearpool has been instrumental in supporting the growth and adoption of USDX, a stablecoin issued by HT Digital Assets (@usdx_hextrust) as part of Hex Trust’s (@Hex_Trust) ecosystem.

USDX is maintained at a steadfast 1:1 ratio against the U.S. dollar or equivalently valued assets. These reserves, primarily consisting of 1-3 month T-Bills, are securely held within the confines of global, tier-1 financial institutions.

$CPOOL

🧵1/8

2️⃣ How to buy USDX?

USDX/USDC pool is now live on @CurveFinance on Ethereum:

You can also trade the USDX/USDT pair on @BitMartExchange here:

🧵 2/8

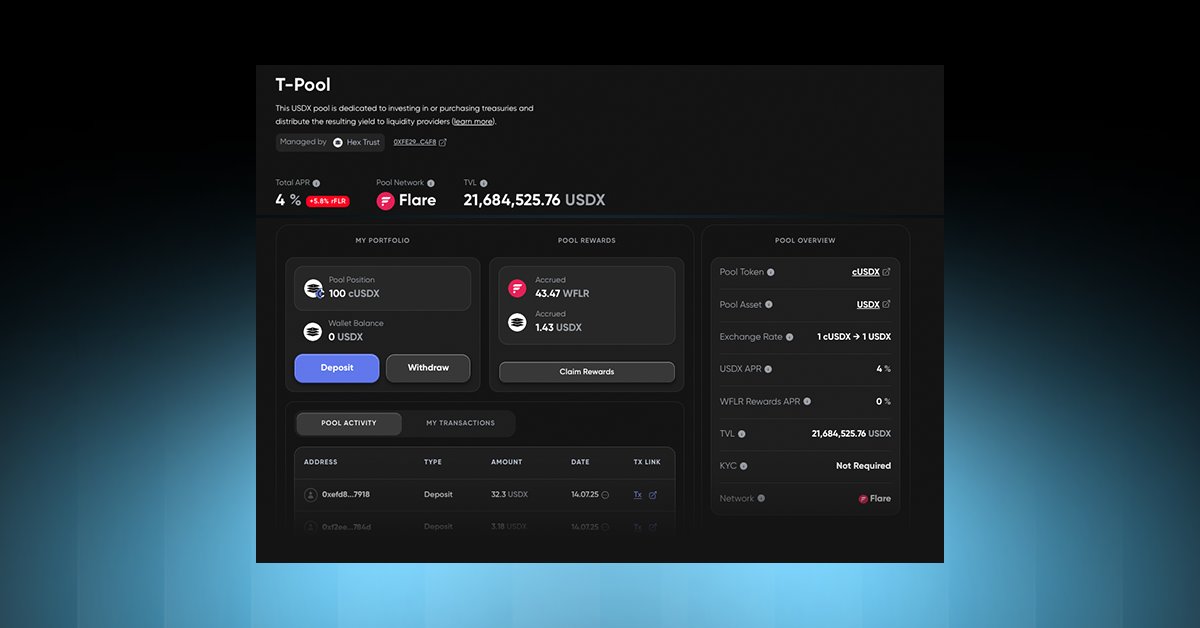

3️⃣ How Does the T-Pool Work?

Deposit USDX into T-Pool and receive cUSDX tokens in a 1:1 ratio. cUSDX acts as your proof of deposit, similar to LP tokens in other DeFi protocols.

Earn a treasury yield and additional $FLR tokens, boosting your returns.

There are no lock-up periods. Deposit or withdraw USDX at any time.

Rewards accrue every block. You can claim both USDX and $FLR rewards without needing to withdraw your deposit.

Convert cUSDX back to USDX instantly, with no restrictions.

Visit the T-POOL here:

🧵3/8

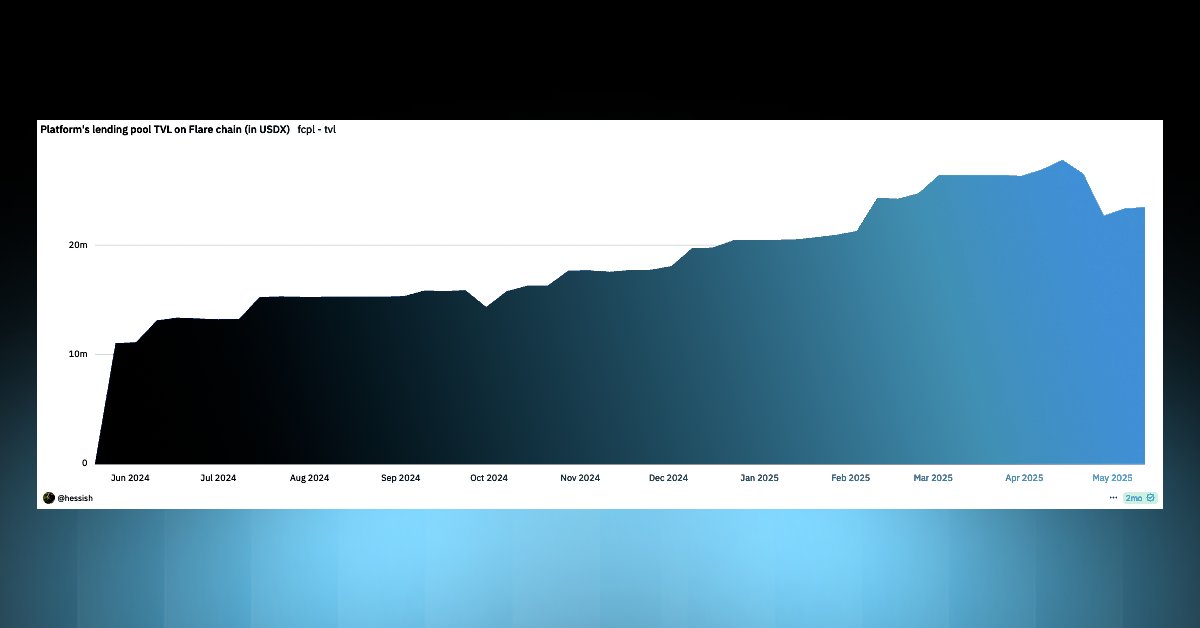

4️⃣ T-Pool Traction and Stats

The USDX T-Pool on Clearpool has seen strong adoption and growth, with over $24.5 million in TVL, representing more than 90% of all minted USDX.

🧵4/8

5️⃣ Why USDX?

USDX is primarily backed by 1 to 3-month U.S. Treasury Bills, offering security and transparency.

Institutional-grade custody and management by @Hex_Trust.

DeFi-ready, designed for composability and integration across multiple blockchains.

🧵5/8

6️⃣ Stablecoin Growth: The Big Picture

Continuous Growth:

The stablecoin market cap has grown 32% in the past six months, now exceeding $250 billion. Active wallets are up 53% year-to-date, and monthly transfer volumes have doubled to $4.1 trillion.

Regulatory Momentum:

The U.S. Senate’s passage of the GENIUS Act in June 2025 has created a federal framework for stablecoin regulation, fueling optimism and paving the way for broader adoption.

🧵6/8

7️⃣ Forecasts and Trends:

@jpmorgan projects the stablecoin market to grow to $500 billion by 2028, citing mainstream and TradFi adoption.

@StandardChartered estimates that the market could reach $2 trillion by 2028, up from $250 billion currently, as global institutions and payment giants like @PayPal and @Stripe adopt stablecoins.

Stablecoin issuers now hold $200 billion in U.S. Treasuries, positioning the sector as a significant player in global finance.

🧵7/8

8️⃣ Final Thoughts: Clearpool’s Evolution

USDX and the T-Pool on Clearpool represent the next wave of stablecoins and DeFi innovation, combining real-world asset backing, flexible yield generation, and a seamless user experience.

As regulatory clarity improves and adoption accelerates, stablecoins like USDX and protocols like Clearpool are poised to play a pivotal role in bridging traditional finance and the PayFi ecosystem, paving the way for a decentralized future.

The future of stablecoins starts now. Get ready, the next evolution of Clearpool is coming soon, set to power the stablecoin economy.

$CPOOL

🧵 8/8

8.72K

143

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.