$IREN - Complete A-Z investment case

In this post I’ll cover why I expect this hyper-growth stock to crack $150 over the next 18 months—representing a gain of 1150% from its current price of $12 📈

I went ‘All-In’ this stock, and for good reason….

🧵

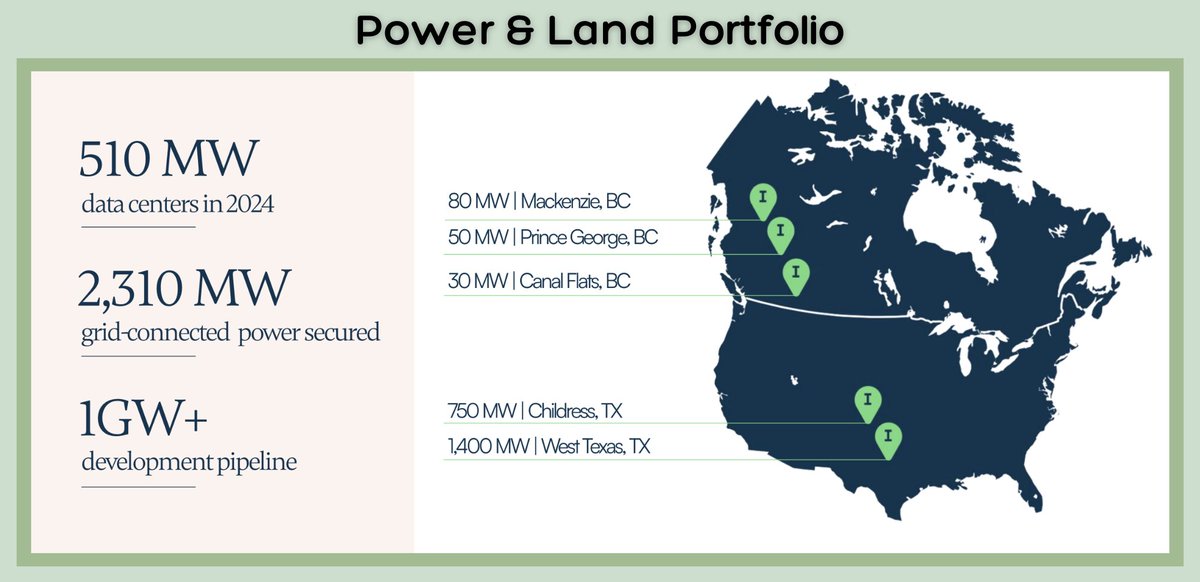

3) $IREN's Infrastructure Portfolio

After gaining extensive experience in the energy infrastructure sector, the Roberts brothers launched $IREN with a clear focus: finding land with access to the cheapest available energy.

Contrary to popular belief, many renewable energy sources are often the most cost-effective forms of energy. This is in part because renewable energy typically generates electricity that must be consumed immediately, as storage technologies are still insufficient (although $TSLA is slowly changing this).

Without sufficient demand, much of this energy goes to waste. In some regions, government subsidies have led to an oversupply of renewable energy, creating a mismatch between supply & demand. Recognizing this market inefficiency, the Roberts brothers strategically sought out data center locations near these renewable energy projects, where providers were keen to supply their power to the local grid at low rates.

Canada

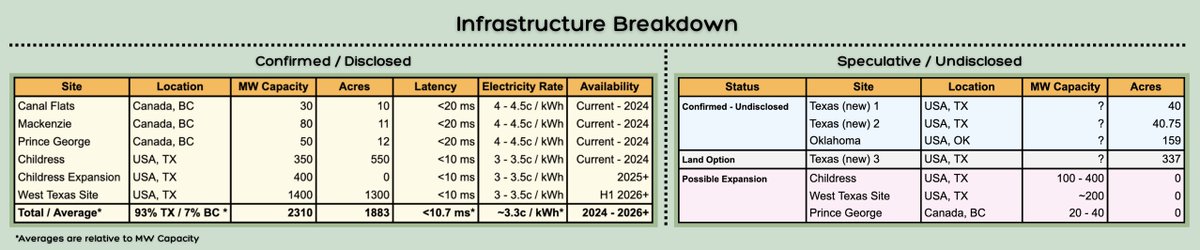

The first site they acquired is located in Canal Flats (30MW / 10 Acres), British Columbia (BC), Canada. This facility was built next to a shutdown pulp mill, taking advantage of the local oversupply of hydroelectric power. The Roberts brothers ‘purchased’ the data center (more on that later) and used the existing infrastructure to support their Bitcoin mining operations.

Shortly after the ‘acquisition’ of the first site in Canal Flats, $IREN expanded further by securing 2 additional sites in British Columbia: Mackenzie (80MW / 11 Acres) and Prince George (50MW / 12 Acres). Both locations, like Canal Flats, primarily rely on cheap & renewable hydroelectric power. Prince George is currently being used as Iren's hub for AI computing. The company is also currently conducting power studies with the intention of potentially expanding this site by an additional 20-40 MW.

These Canadian sites have electricity rates in the mid $0.04 range per kWh, which is decent for commercial purposes but not exceptionally low. All BC sites are grid-connected and receive power from the BC Hydro network (in front of the meter), which is almost entirely hydroelectric. The BC Hydro grid is highly stable, with a reliability rate of 99.931%. Additionally, Iren has installed battery and generator backups for key components such as network, storage, security, and key management systems to ensure redundancy and minimize downtime.

The infrastructure sites also have sub-20ms latency, which is more than sufficient for maintaining smooth operations in most AI workloads, specifically in the context of inference.

Inference refers to the process of using a trained machine learning model to make predictions or decisions based on new data. For example, when you interact with an AI system like ChatGPT, the model performs inference by processing your inputs in real-time to generate responses. Low latency is crucial in this context because it directly impacts the response time, which ensures a smooth & efficient user experience. High latency would result in noticeable delays, hindering the performance of real-time applications.

Texas

Following their success in Canada, $IREN expanded into Texas with the massive Childress site (750 MW / ~550 Acres). This site was initially announced to have a capacity of 600 MW but was upgraded to 750 MW in late July this year.

The majority of Iren’s growth over the coming year will come from this site, especially regarding their Bitcoin mining operations. Out of the 750 MW capacity, 350 MW will be operational by the end of 2024, with the remaining 400MW scheduled to be operational by late 2025 / early 2026. By the end of this year, Childress will make up about 70% of the company’s built-out MW capacity.

Interestingly, Iren states on their website that this site has a size of 420 Acres. However, investment analyst & $IREN investor @FransBakker9812 found proof that Childress is actually 553 Acres large and consists of 3 pieces of land. Given the scale of this site, it’s possible that the company has intentions of increasing its capacity yet again, beyond 750 MW.

As of now, Childress has one 640 MVA transformer and is set to receive a second one by Q2 2025. This addition will enable Childress to achieve its 750MW capacity, but theoretically speaking, these two transformers could support up to ~1.2 GW. Given the recent upgrade from 600MW to 750MW, one could speculate that the site could potentially reach 1-1.2GW in the future.

However, it’s worthwhile noting that any additional expansion beyond 750MW at Childress would likely be contingent on securing new connection agreements & getting approved by ERCOT (Texas grid operator).

Similar to Iren's Canadian site, the Childress facility is grid-connected, drawing power from the AEP network which has a reliability rate of 99.957%. To ensure redundancy, like all of Iren’s sites, Childress is equipped with backup generators and battery systems, which provide additional resilience and minimize the risk of downtime.

Lastly, the Childress facility is connected to dual physical fiber paths, achieving sub-10ms latency, which is considered excellent for AI inference tasks. Iren states that ALL its sites have this level of ‘best practice’ network redundancy, using *at least* two physically diverse fiber paths with multiple tier 1 Internet Service Providers (ISPs). This means that if one ISP or fiber path encounters an issue, such as a physical cable cut or technical failure, the other path with a different ISP can take over, maintaining connectivity.

This setup addresses a common concern with rural or remote sites, where connectivity issues are more likely due to fewer infrastructure options compared to metropolitan or city-adjacent sites, which often have more robust network infrastructure. Iren’s approach ensures that its sites are well-equipped to handle these risks, effectively negating this concern and providing reliable, low-latency network performance.

1.4GW West Texas site:

Iren’s second site in Texas is the largest asset in their portfolio, featuring a massive 1.4 GW capacity. Currently this site is mostly undeveloped, however, the company has already secured all necessary connection agreements, with the procurement process underway for substantial parts of its infrastructure.

This site is very attractive for potential AI colocation / joint venture deals with hyperscalers like Amazon’ AWS, Microsoft’s Azure, Google Cloud, or even Meta. There are not many sites with >1 GW of freed-up energy capacity and there are even less sites of that scale that would be ready to use as early as H1 2026.

A colocation deal between a data center host like Iren and a hyperscaler typically involves the hyperscaler renting the host’s infrastructure, while bringing their own compute hardware like GPUs. These arrangements can vary significantly; the host might offer a standard, off-the-shelf setup or build a customized facility tailored specifically for the client’s needs. This flexibility allows hyperscalers to quickly scale their operations using the host’s established infrastructure without having to invest time & money in building their own data centers.

As of Iren’s most recent updates, the current target for the energization date of the site’s 1.4 GW substation is in April 2026. It’s likely that Iren would be able to start building data centers already before that date, possibly as early as late 2025 and energize them by April 2026. This H1 2026 energization date is a crucial factor in the context of this site’s value proposition.

The world’s largest tech firms are locked in an AI compute arms race, prioritizing rapid scaling and time to market (TTM) as they compete to expand capacity as quickly as possible. For example, @elonmusk's @xai recently built its 'Colossus' mega cluster of 100,000 H100 GPUs in just 19 days, with plans to add 50,000 H200 GPUs soon. One could criticize Elon for heavily investing in an older generation of GPUs, like the H100s, when the newer H200 GPUs are gradually becoming more available, and the much more powerful Blackwell generation is being launched next year. However, this decision underscores the critical importance of time to market (TTM). Elon is focused on securing as much AI capacity as soon as possible, and currently, H100s are the most readily available option, even if they are not the latest & best. The top firms know that achieving the most AI capacity earliest is key to dominating this new market and securing a potentially unassailable lead.

One of the constraining factors that is becoming increasingly more prominent, as the scale of AI clusters increases, is access to power. The new generation of AI purposed GPUs require much more energy than traditional data center hardware. Access to power is rapidly becoming a scarce commodity. Keep in mind that, as mentioned earlier, the global data center capacity in 2023 was ca. 33 GW, with most of it dedicated to well-established needs such as hosting, file storage, and other enterprise cloud services. While some of this capacity will inevitably be adapted for AI compute, it's unlikely to be a substantial amount, as these traditional services remain critical and continue to drive significant demand. Thus, most of the new AI capacity coming online will require new access to energy.

The challenge with this is that developing greenfield sites for data centers is a complex, multi-year process that often takes upwards of 5 years to become operational. This process consists of:

👉 Site Selection and Due Diligence (1-2 years)

👉 Power Studies and Connection Agreements (1-2 years)

👉 Permitting and Construction (2-3 years)

$IREN had the foresight to not only acquire the massive 1.4 GW site in west TX years ago, but also start the process of conducting power studies and getting connection agreements / permits well in advance. Having such a large quantity of new, unpurposed, power available as early as 2026 makes this a true ‘unicorn’ site in this new era of compute.

$IREN recently clarified that it has the procurement process underway for 4 x 560 MVA 345 kV/138 kV transformers. This provides the company with plenty of optionality in terms of redundancy and potential for energy expansion beyond 1.4 GW. Four x 560 MVA transformers would provide enough energy for 2240 MW. However, it's unlikely that the site will increase capacity to beyond 2 GW without adding additional transformers. One must understand the importance of redundancy in the context of HPC cloud hosting.

This site’s current set-up of transformers would be sufficient for a T3 facility of 1120 MW (1.12 GW) - whereby two 560 MVAs would be in use and two are on standby for redundancy purposes.

In the data center industry, uptime & redundancy are classified into four tiers, with Tier 1 being the most basic level and Tier 4 representing the highest level of redundancy and fault tolerance. Tier 3 (T3) is generally considered the standard that most hyperscalers strive for. T3 facilities must provide N+1 redundancy, meaning they have at least one backup component for every critical infrastructure element. This ensures that the data center can remain operational during maintenance or equipment failure.

In the case of Iren’s new west Texas site, the current setup of 4 x 560 MVA transformers allows for two transformers to be actively used while the other two serve as backups. This configuration supports the N+1 redundancy required for a T3 facility, ensuring that if any of the active transformers fail, the backups can immediately take over without disrupting operations.

Alternatively, $IREN could push for higher MW usage at the expense of redundancy, similar to what they did at their Childress site. For instance, they could operate with 3 out of the 4 transformers, providing upwards of 1.5 GW capacity. This setup would sacrifice the N+1 redundancy standard required for T3 status but would likely still qualify for a T2 facility, as it maintains basic redundancy with one transformer on standby.

I would also like to point out that while redundancy is a critical factor in cloud computing, it’s less of a factor in the realm of Bitcoin mining. Sure, having high uptime is detrimental to mining revenues, but having occasional outages isn’t going to break the camel’s back. You are not going to upset any customers when maintenance work is being done for a couple of hours in your facility, because you have no customers. This is why a facility like Childress, which is primarily being built for the purpose of mining $BTC, can get away with less redundancy.

In any case, their current setup offers plenty of optionality, allowing them to balance between maximizing capacity and maintaining redundancy based on operational needs.

Besides the site's massive scale and short-dated availability, making it an attractive option for colocation deals, the site also has exceptional latency of under 10ms (just as Childress) with multiple fiber paths & tier-1 ISPs . Located in Texas, the site also benefits from some of the lowest energy rates in the country, making it especially appealing for energy-intensive AI workloads.

In later sections of this post, I’ll delve into the financial implications of colocation arrangements, focusing specifically on how they impact cash flow dynamics for $IREN.

Texas & Declining Energy Costs

As it relates to declining energy costs, Texas is arguably one of the most promising locations on earth, certainly within the U.S.

It already ranks among the 5 cheapest energy states in the US, however, this position is further strengthened by rapid growth in wind and solar power, coupled with significant investments in battery storage. These developments will play a crucial role in driving prices even lower over the coming years.

Solar energy is currently the cheapest source of energy, even outperforming traditionally cheap sources like nuclear, coal, and natural gas from fracking. If you doubt this claim, I strongly encourage you to check out the research published by @tonyseba (especially his presentations on YouTube).

As Elon Musk once said: “Once you understand the Kardashev Scale, it becomes utterly obvious that essentially all energy generation will be solar. Just do the math on solar on Earth and you soon figure out that a relatively small corner of Texas or New Mexico can easily serve all US electricity.”

Texas also benefits from the free-market dynamics of its unique electricity market, where competition among providers drives innovation and efficiency. ERCOT, the grid operator for most of Texas, manages real-time electricity supply & demand, allowing prices to be set based on market conditions. This system makes it relatively easy for companies to develop projects like solar farms and sell their generated electricity to the grid, thanks to clear market regulations and streamlined processes.

Moreover, Texas is now moving towards a system that allows private companies to compete for building the transmission network, which could further accelerate energy cost declines in the state. Traditionally, transmission development in Texas has been more restricted. The right-of-first-refusal (ROFR) law gave established utility companies the exclusive right to build new transmission lines, which meant that other companies couldn't compete for these projects.

However, a recent court ruling deemed this law unconstitutional, opening up transmission projects to competition. This change allows private companies to bid on building transmission lines. By introducing competition in this part of the market, the ruling could lead to more efficient and cost-effective infrastructure development. Just as the free-market model for electricity generation has driven innovation and kept prices competitive, this new approach to transmission development could further lower costs and speed up the expansion of the grid to meet growing demand.

The benefits of Texas’ energy landscape are evident in Iren’’s Childress site, which has a historical average spot cost of just 3.5 cents per kWh, which is significantly lower than the energy costs of most competitors.

For instance, Bitcoin mining competitor $CLSK, primarily operating in Georgia, faces average costs of ~ 4.5 cents per kWh. Similarly, $WULF, with operations in New York and Pennsylvania, incurs rates ranging from high 3s to high 4 cents per kWh. As a reference point, the miner with the industry’s lowest electricity rates is $CIFR, with a cost of just 2.72 cents per kWh. However, this low cost comes from a long-term Power Purchase Agreement (PPA), (set to expire on July 31, 2027), that requires them to curtail up to 5% of their energy use annually. This drawback effectively reduces their operational days and thereby its revenue potential & usability for AI workloads that require constant uptime.

Although Iren’s average spot rate at Childress was just 3.5 cents per kWh from April 2023 to July 2024, the company ended up paying a realized price of 4.3 cents per kWh during this period, due to its use of hedging strategies to mitigate price volatility. However, this changed in August 2024, when the company shifted its approach to primarily using spot pricing, by leveraging the favorable rates in Texas and the flexibility to curtail operations during brief periods of volatile price spikes.

This new strategy allowed the company to secure remarkably low energy costs for its Bitcoin mining operation in Childress, with rates of just 3.1 cents per kWh in August, 3.2 cents per kWh in September, and just 3.06 cents per kWh in October. The fact that Iren’s electricity rates for the past 3 months were significantly lower than the average of 3.5 cents suggests that energy prices in Texas are trending downwards. This trend is likely due to the increasing deployment of solar and battery storage. As a result, over the next nine months leading up to summer, $IREN could potentially achieve average electricity rates in the high 2 cent range to low 3 cent range per kWh at their Childress site. In the realm of Bitcoin mining and AI compute, where margins are primarily influenced by energy costs and mining efficiency, this would act as a significant cost advantage and tailwind for rising margins.

However, I do want to point out that, generally speaking, average electricity rates will likely always be cheaper if you have the optionality to curtail when prices spike. Curtailing involves temporarily shutting down operations for a few hours or even several days when electricity prices surge unexpectedly, often due to grid instability. Usually, you only have this sort of optionality in the realm of Bitcoin mining and not in the (AI/HPC) cloud computing market where constant uptime is required.

This means that while I do expect Iren to achieve electricity rates as low as $2.5-3 cents per kWh at their TX sites, I think this will mostly be in regards to their mining operations. In the AI cloud segment, I expect energy rates to be closer to 3-3.5 cents per kWh (at TX), factoring in the occasional pricing spikes that tend to happen from time to time. That being said, the Texas grid is becoming more stable with the deployment of large-scale battery storage, which will enhance network reliability and price stability, leading to fewer sudden pricing spikes over time.

Speculative / Undisclosed Sites

In addition to the confirmed 2,310 MW of secured power across existing sites, $IREN has stated that they have over 1GW of additional land & power capacity in the pipeline.

While the company hasn’t provided much info on this additional ~1 GW pipeline, my good friends @FransBakker9812 & @Brenno2332 discovered that Iren acquired several pieces of land in recent times. They did that by discovering the actual property deeds recorded with the municipality, showing that these sites are indeed owned by the company.

According to their research, Iren recently acquired two additional sites in Texas, each approximately 40 acres in size. They also confirmed the purchase of a 159-acre site in the neighboring state of Oklahoma. Moreover, just a few days ago, Frans discovered that Iren recently signed a Memorandum of Contract (MOC), giving them the option to acquire a new 337-acre land site in West Texas, with a 6-month window to exercise the option.

Big S/O to Frans & Brenno for doing so thorough due diligence & finding these nuggets of information.

In conclusion, Iren is on track to achieve a total capacity of 510 MW by the end of 2024, and with the continued development of the Childress site, this capacity is expected to expand to 910 MW potentially as early as 2025. Not only is their ambitious 1.4 GW project set to break ground shortly before April 2024, with a potential start as early as late 2025, but they also have over 1 GW of additional capacity in development.

CEO Dan Roberts confirmed that Iren is currently growing its built-out data center capacity by ~50MW / month, far exceeding the industry standard of ~5-20 MW per month. Given this rapid growth rate and the company’s extensive infrastructure portfolio, $IREN is poised for an unprecedented surge in computing power over the coming years.

Iren’s extensive land & power portfolio provides significant flexibility for both Bitcoin mining and its expansion into the AI sector - topics I will explore further in the following sections of this post.

For anyone interested in staying up to date with the company’s infrastructure progress, I highly recommend following @FransBakker9812. He provides frequent updates & insights by publicizing satellite images and sharing his in-depth investigative research.

558.48K

1.68K

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.