Lighter Point Value Estimation

A well-known user in the @HyperliquidX community has shared his estimation of @Lighter_xyz's point value.

(He previously predicted Hyperliquid points would hit $50 pre-TGE — it is now worth around $250 each.)

1️⃣ Estimated value per point : $15–$20

2️⃣ Valuation based on OI, not FDV

3️⃣ Referenced Hyperliquid as a benchmark, while also factoring in Lighter team quality

I personally agree with the overall approach — especially valuing based on OI rather than FDV.

He mentioned that if the bull market continues, the value could potentially reach $100 per point.

While I’m not sure about $100, I do believe it will be worth more than the current OTC price of $5.

Lighter

I think we're close enough to @Lighter_xyz TGE to calculate the possible value of one point.

The market is hot, the end of the beta season is very soon, and the public mainnet season will probably be very short.

Everyone calculates airdrop value based on the FDV, but in a real bull market, FDV is just a meme. What we will focus on here is only the initial mcap.

As in my previous points value calculation, we won't take into account volume, as Lighter is a 0% fees platform, and I think there may be a lot of wash trading bots (they are being flagged anyway).

The best metric to consider while thinking about it is OI. I was also considering calculating the value based on the TVL, but with such great LLP performance, I don't think it's good to include it (people just deposit into the vault and don't trade with this money).

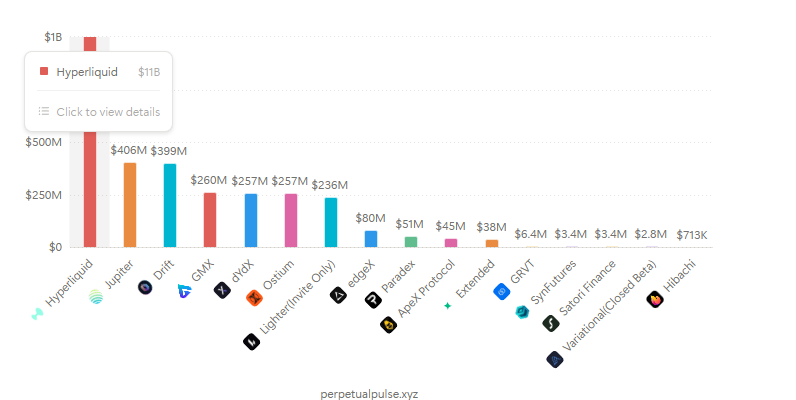

Hyperliquid just had another ATH of OI, and it's around $11b. Lighter's OI is at $236M. There are obviously people farming it, who may leave after the first points season, but Lighter is still in its closed BETA, and I still see many people asking for an invite code on Twitter (you will probably see them in the comment section of this tweet as well), so I think it's safe to assume this amount as the organic OI Lighter generates.

The CEO of Lighter mentioned on one space (if I remember correctly) that they want to give 50% to the community through an airdrop, though I don't expect it to be only for the season 1 activity. I would expect them to airdrop between 25-30% of the supply.

What's more important is that I don't think any other form of supply will be released on day 1 of TGE. It means that the rest of the tokens aside from the airdropped ones will be locked/vested and won't be counted at the beginning in the mcap.

The Hyperliquid airdrop was special, and I don't think Lighter will be even close to that, but let's stay realistic: the perps space is big enough for more than one protocol.

HL airdropped $16.2b to its users at the current price. If we try to calculate the value of the Lighter airdrop based only on the OI, it would give us a $350m airdrop from Lighter. Though Hyperliquid is quite different from anything else. The first protocol in the space to do it in the correct way for its users. Hyperliquid is also a chain on its own, but I don't think this plays a crucial part in the price of $HYPE, as it mostly comes from the perps exchange.

People are trading Lighter points for $5, and we will have around 10m points in total. If I'm right and 100% of circulating supply at TGE goes for an airdrop, it means that people price Lighter's mcap at $50m, which means that it would sit at place 741 on Coingecko and be worth less than many useless protocols.

The Lighter team isn't random. Those guys are from top universities and are locked in. That's what built my conviction to farm HL at the beginning of my journey with perps.

That being said - I think Lighter points will be worth around $15-$20 at the beginning, going as high as $100 if the market doesn't stop its bull run, giving Lighter a mcap similar to Sonic or Virtuals.

Do you think fund managers will fade exposure for one of the top perps platforms in the emerging markets after seeing Hyperliquid's success?

Higher.

11.56K

19

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.