🚨 #Bitcoin Hits New All-Time High! 🚨

We're at $118,000 per $BTC. Is this the start of the real crypto bull run?

And more importantly, is alt season next?

Let’s break down the key signals, Fed policy shifts, and trade setups I’m watching🧵👇

1/x Bitcoin breaking ATH is huge but it’s not the whole story.

We’ve seen this setup before: $BTC leads, alts lag until liquidity shifts.

So today we’re diving into:

🔹 $BTC & altcoin technicals.

🔹Liquidity trends.

🔹My bot setups.

🔹Why Q4 could change everything.

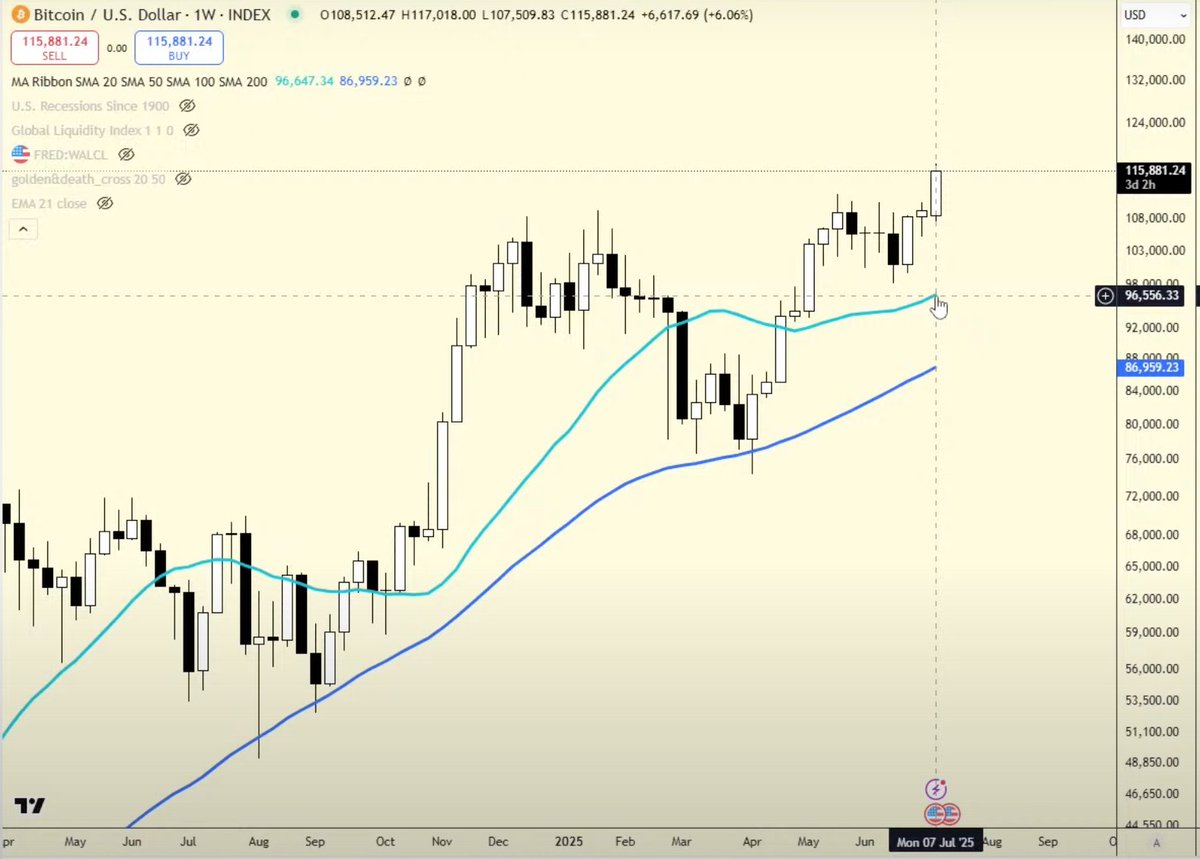

2/x First, Bitcoin’s market structure:

The 50-week SMA (~$87K) is the bull market line. Every dip near the 20-week SMA has been a value buy for 2 years.

✅Above 50W = bullish trend intact.

✅Below 20W = prime DCA zone.

That’s your playbook.

3/x Alt Season? Not yet.

You need a sustained breakdown in $BTC dominance. Not just 2–3 weeks of altcoin pops.

Real alt season = lower highs + lower lows on weekly $BTC dominance.

We’re not there yet.

4/x 📊 The ETH/BTC ratio is finally showing a weekly higher low for the first time since Jan 2022.

🔹If $ETH closes above 0.024 BTC this week = confirmed breakout.

🔹 $SOL is also holding up well, we’re already up 23% using bots.

These are your early alt signals.

6/x The Fed is already moving quietly. Two key signals just fired for the first time in 5 years:

1️⃣ $11B repo injection on June 30.

2️⃣ Proposal to cut the Supplementary Leverage Ratio (SLR) for major banks.

This is stealth QE.

7/x No one’s calling it that yet, but that’s what it is.

They’re laying the groundwork for liquidity expansion without cutting rates directly.

It’s how markets get rescued quietly.

And these shifts often hit crypto before the headlines catch up.

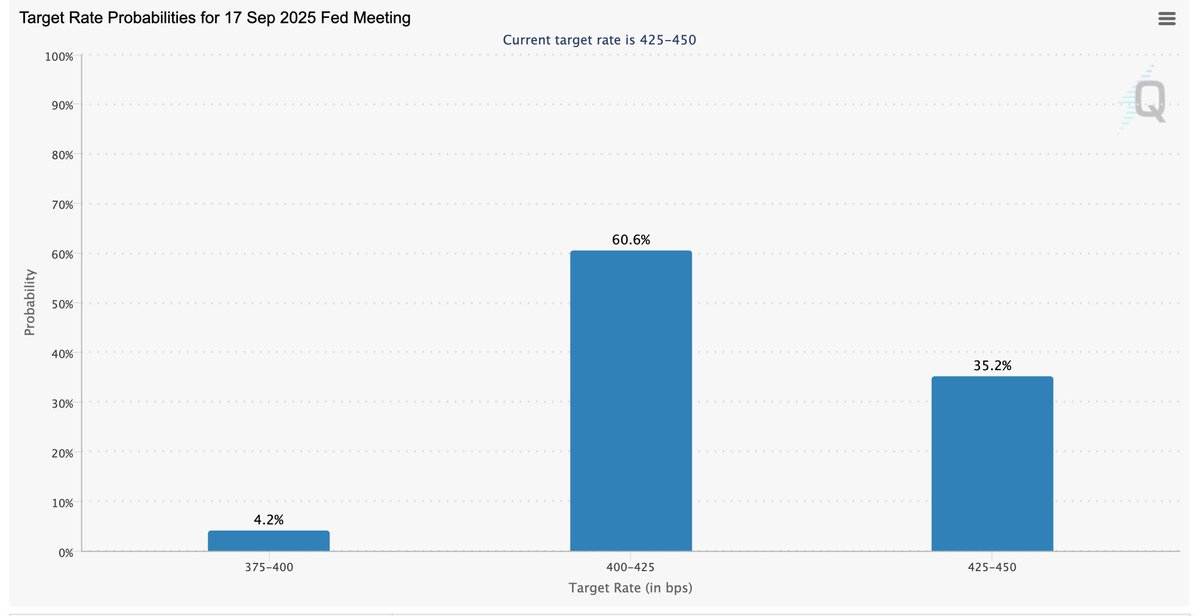

8/x September 17th FOMC is the date to watch. Fed watch tool shows 64% probability of a rate cut in Q4.

By then:

🔹Repo ops may expand.

🔹SLR may be implemented.

🔹QT may pause.

That’s when altseason becomes real.

9/x Here’s how I’m positioned now (and you can copy):

🔹 $BTC bot: $23K liquidation.

🔹 $ETH bot: $600 liquidation.

🔹 $SOL bot: $40 liquidation.

🔹 $XRP bot: $1.45–$6 range.

Safe liquidation levels + long-term entries. All live on Pionex or in my portfolio spreadsheet.

10/x Some higher risk bets that I have bots ready for:

🔹 $TAO: $160–$1000.

🔹 $SUPER: $0.35–$3.50.

🔹 $PEPE: Targeting $25B market cap.

These aren’t moonshots, they’re calculated.

Bot setups let you accumulate smart and auto-exit into strength.

11/x This is not the moment to ape into low caps and pray. It’s the moment to get positioned with patience.

1️⃣ #Bitcoin’s already doing its job.

2️⃣ $ETH and $SOL are waking up.

3️⃣ Liquidity is coming.

Altseason is near but not here yet.

12/x The crypto bull run is building beneath the surface.

But the full rotation? That needs time and confirmation.

So ask yourself, are you rushing the trade? Or are you building for the breakout?

Let me know how you’re positioning👇

75.24K

741

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.