XMR is the best-performing coin (market cap >$1 B) so far this year.

Monero is one of the best performing assets of the year and nobody has noticed. (*As of Writing) Monero sits at the top with a ~65% gain, adding $3.8 billion to its market cap in 2025. With a fully circulating supply and $500 million in weekly volume, this is real price action. Why?

we're entering an era of financial repression that will make privacy coins essential infrastructure:

Developed nations are drowning in debt that requires lower rates to service, but the traditional playbook, central bank money printing, now carries immediate inflationary consequences.

Politicians understand the new reality: print money, spike inflation, lose your job. But they still need to finance massive deficits. The solution? Financial repression through "soft" capital controls. Think of it as a forced bid for government debt. Instead of the Fed printing to buy bonds, they'll simply redirect the money already in 401ks.

This playbook has historical precedence as well.. In 1933, FDR seized Americans' gold through Executive Order 6102. In 2022, the G7 froze $300 billion in Russian reserves. During the Canadian trucker protests, authorities froze bank accounts without court orders to "act as a deterrent." The infrastructure for financial control already exists; what's changing is the willingness to use it.

Gold got this trade first as central banks added over 1,000 tonnes in 2024, the second-highest annual purchase on record. China, Russia, and India are hoarding physical metal because, after watching Russian reserves get frozen, they understand that dollar-denominated assets exist at the pleasure of Washington. But gold has limitations: It's heavy, requires physical storage, and smaller nations lack the infrastructure to custody it securely.

Enter Monero. While Bitcoin offers pseudonymity that's increasingly compromised by chain analysis, Monero provides actual financial privacy through ring signatures, stealth addresses, and confidential transactions. In a world trending toward capital controls and financial surveillance, the difference between pseudonymous and private becomes all the more important.

...

Read this insight in full with others in the latest Messari Monthly:

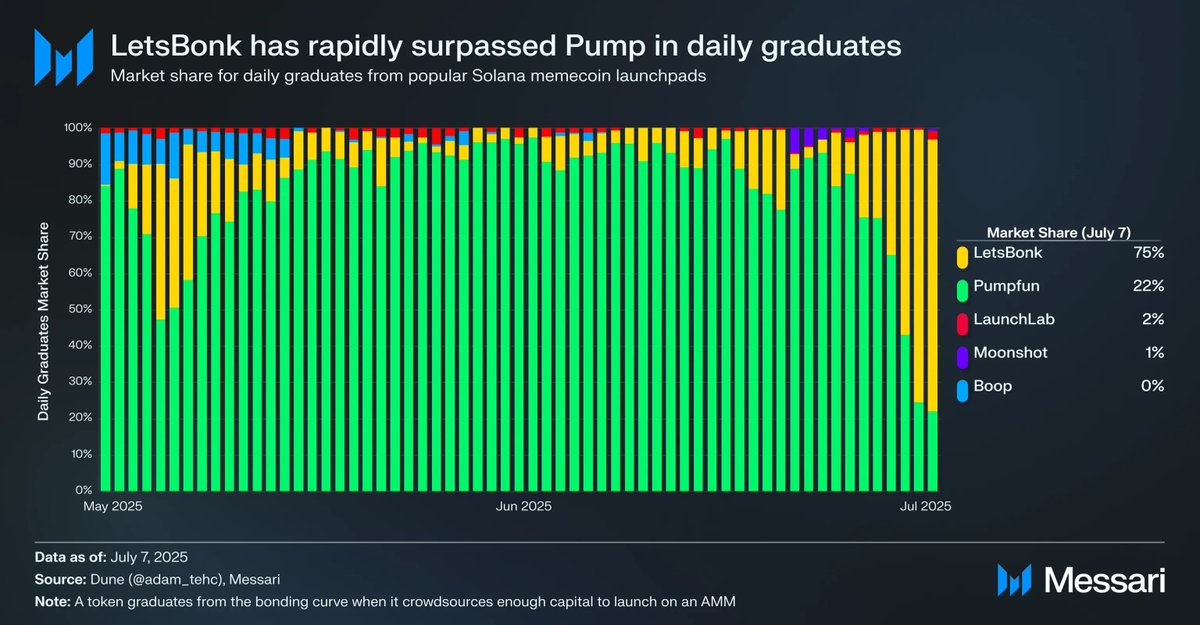

* BONK's hostile takeover of pump fun's monopoly

* Aave's broken yield dynamics signaling something bigger

* EtherFi's neobank ambitions

* wash trading games inflating BNB Chain's volumes

24.75K

33

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.