➿ In The Loop #003

A biweekly digest covering Loopscale strategies, integrations, product updates, and the best yields.

Thread below↓

For the equities enthusiast:

Loopscale now supports @xStocksFi tokenized stocks for leveraged positions (via Loops) and as collateral for borrowing. You can also borrow off your @orca_so xStock LPs.

Live today:

• SPYx

• CRCLx

• NVDAx

• TSLAx

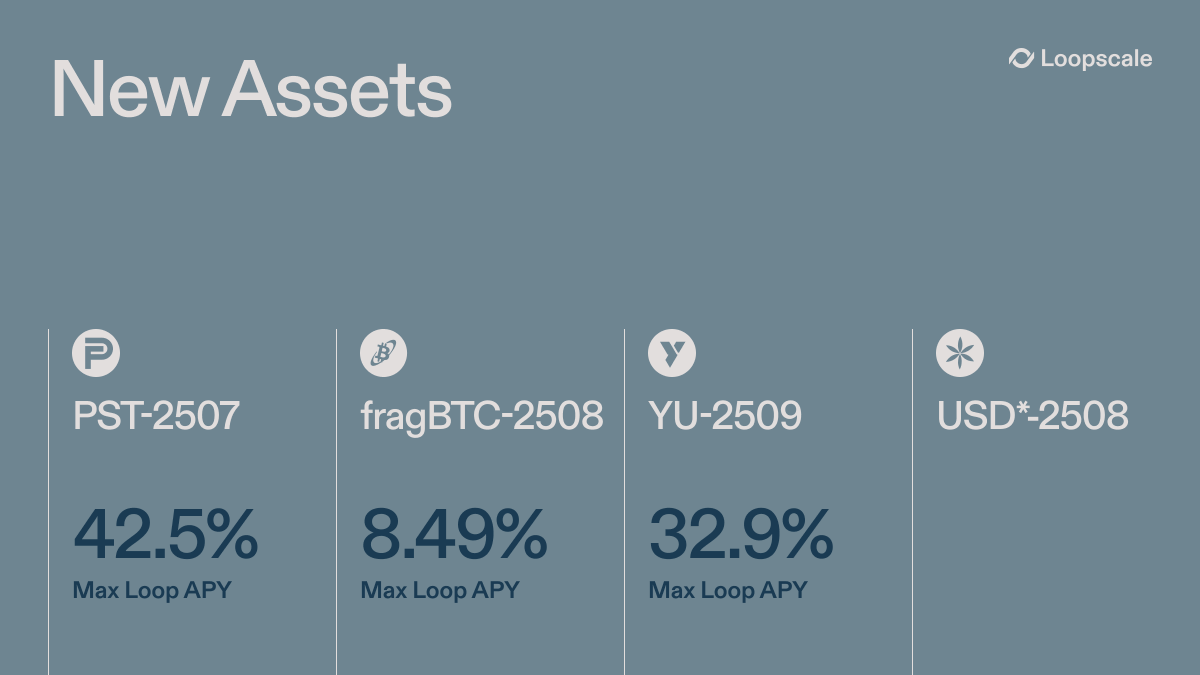

New @RateX_Dex Principal Tokens (PTs) with boosted RateX points recently went live on Loopscale.

Top RateX PT Loops:

- PST-2507 / USDC Loop with 39.54% max APY and $1.19M in deposits

- YU-2509 / USDC Loop with 29.66% max APY and $566.2k in deposits

Here's some alpha from @katexbt where she breaks down her strategies and the difference between lending with Vaults vs. levering up with Loops:

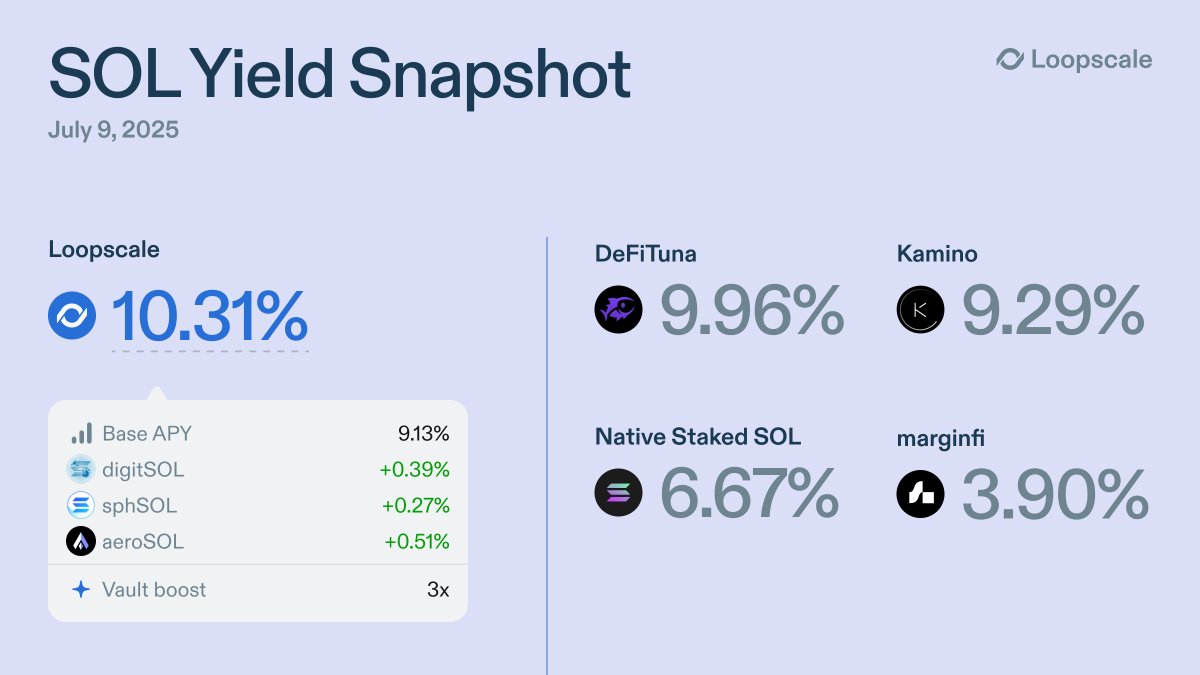

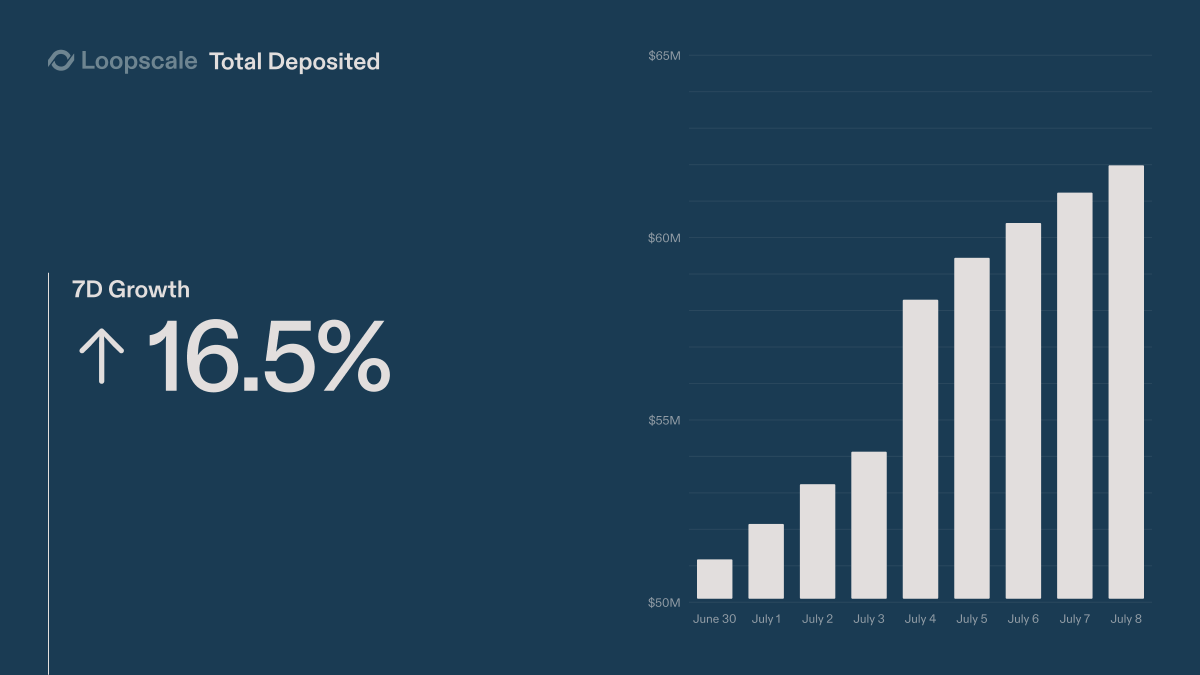

Total deposits continue to grow as we validate the modular, order book-based lending thesis.

Loopscale continues to establish itself as the home of PTs with our new Rollover feature.

Users with PT Loops can now atomically roll over expiring PTs to the next maturity.

Loopscale users can now roll over PT loops to the next maturity, starting with @ExponentFinance PT-fragSOL-10JUL25 (matured at 3pm UTC).

Rollovers make Loopscale the best place to lever fixed yields: Earn yield to the next maturity without closing your Loop.

For best rates, wait until maturity to roll over or close PT Loops.

Many more features are on the way to make Loopscale the leader of lending on Solana. ↓

Over the coming months, we’re rolling out several features that expose core architectural primitives of the Loopscale protocol, each enabling new classes of lending behavior.

Today we launched Loop Rollovers, enabling users to atomically migrate to a new collateral asset without closing or reinitializing their borrow position.

This is enabled by segregated collateral accounts, where assets are neither pooled nor rehypothecated. Instead, collateral is held in a dedicated onchain account, unlocking constraint-aware, programmatic collateral management.

Excited to take this first step towards realizing the full potential of segregated collateral, a foundational primitive for products like cross-protocol margin accounts, LP loops and more.

4.6K

48

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.