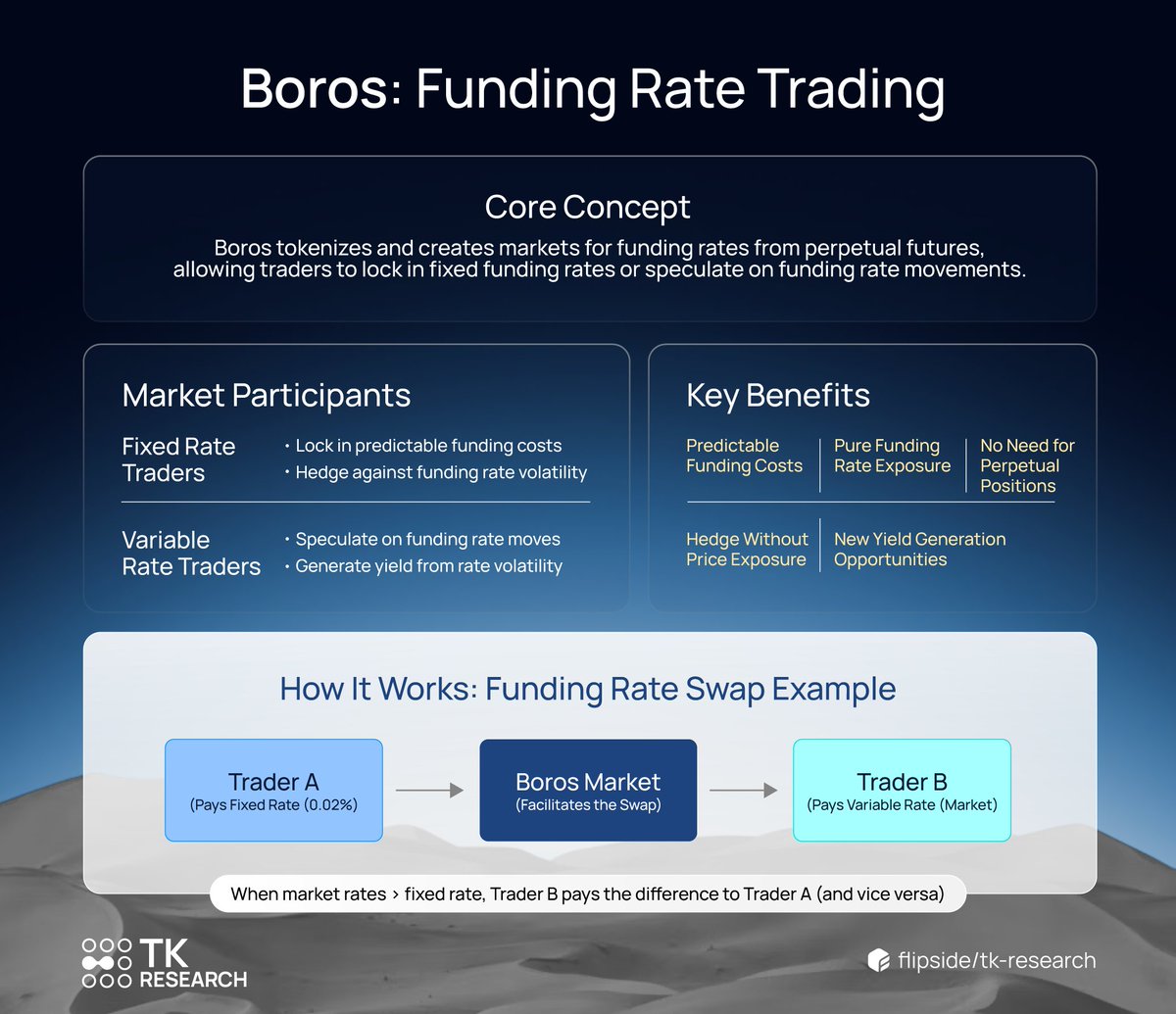

🧵 What if you could trade just the funding rate—without touching perps?

That’s what @boros_xyz — a new product from @pendle_fi — is building.

A new market where traders lock in fixed rates or speculate on funding rate volatility.

Here’s how it works 👇

1/3

Boros creates a funding rate swap market:

🔹 Fixed rate traders hedge against volatile costs

🔹 Variable rate traders earn from volatility

No need to open a perp position. Just trade the rate itself

2/3

Example:

Trader A pays a fixed rate (0.02%)

Trader B pays the market rate

If:

➡ Market rate > fixed → B pays A

➡ Market rate < fixed → A pays B

Boros handles the swap.

3/3

Why it matters:

✅ Predictable funding costs

✅ New yield opportunities

✅ Pure funding rate exposure

✅ Hedge without price risk

A new primitive for DeFi traders.

7.54K

25

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.