<The investment grammar of global VCs has changed>

These days, global VCs are investing first in companies that are looking to incorporate digital assets as strategic assets. Pantera recently created the DAT (Digital Asset Treasury) fund and invested in companies like Cantor Equity Partners (CEP), reportedly seeing returns at a premium of 1.5 times to as much as 10 times the net asset value (NAV).

In the end, a new meta centered around companies and private equity funds has emerged. What we can think about here is which coins these companies will strategically hold as assets in the future.

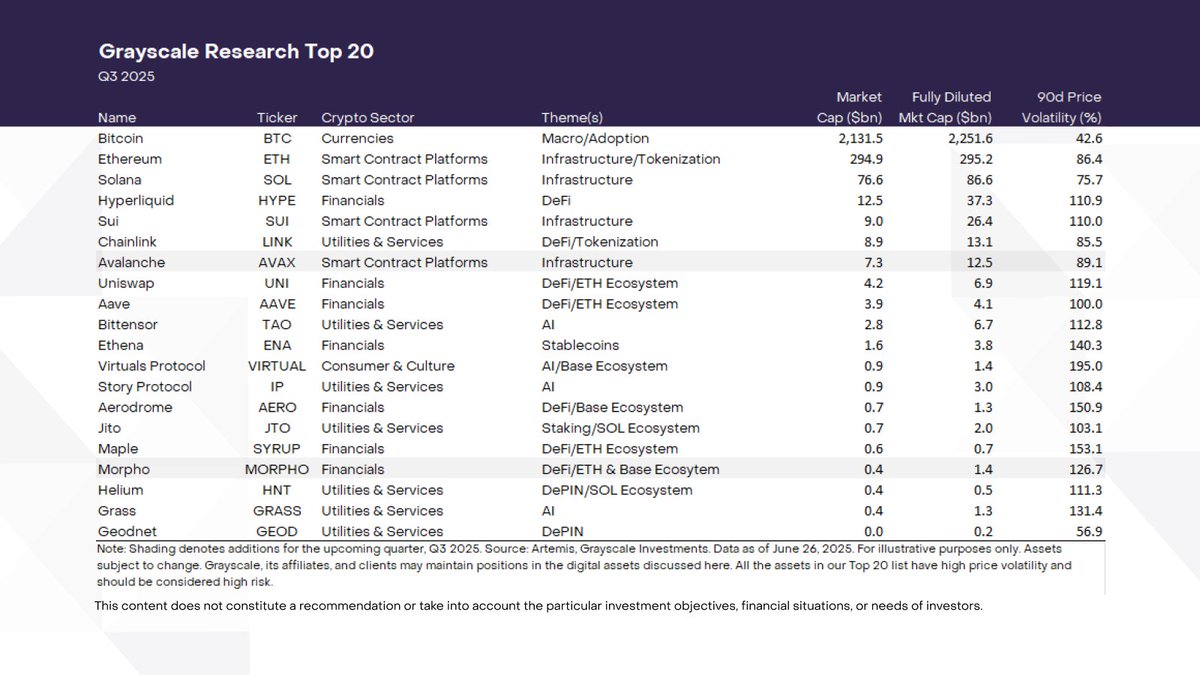

For example, it seems possible that projects like @StoryProtocol could be included in the AI fund managed by Grayscale, and if VCs who are genuinely into AI, like @DCGco, create separate AI ETFs, there’s a possibility they might strategically include AI coins like $IP, $TAO, and $Flock.

Currently, looking at the Pantera case, we see major coins like Bitcoin, Ethereum, Ripple, Avalanche, Hyperliquid, and Sui. However, I wonder if these larger coins have limitations in terms of premium due to their already large market caps?

So, it might be more realistic to look for candidates among mid/small-cap coins that companies or funds could consider as strategic assets.

We have updated the Grayscale Research Top 20. The Top 20 represents a diversified set of assets across Crypto Sectors that, in our view, have high potential over the coming quarter. This quarter's new assets are Avalanche $AVAX and Morpho $MORPHO. All the assets in our Top 20 list have high price volatility and should be considered high risk.

Read the full report:

8.16K

17

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.