<The steadily growing RWA market, BlackRock in RWA and their influence, is the BlackRock BUIDL fund undervalued?>

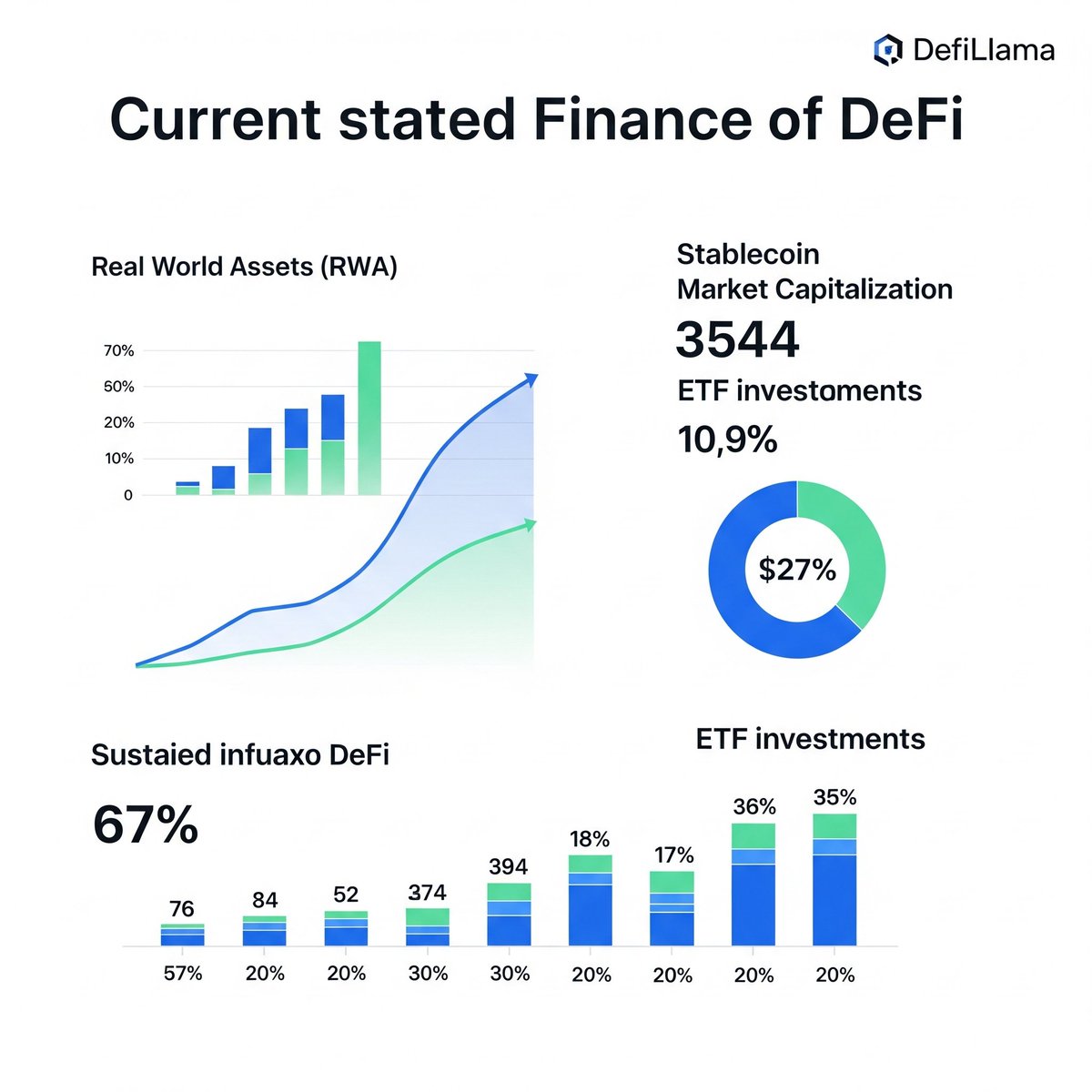

As of July 3, 2025, the total TVL in DeFi is around $150 billion, recovering about 83% of the 2021 peak ($180 billion). This recovery is not just a simple rebound of the existing sector; the key point is the qualitative change in the influx of structural capital.

The recovery of stablecoin market cap, the emergence of real-world income-generating assets, and the acceleration of the flow from TradFi to on-chain liquidity.

And the most important sector we will discuss today is RWA.

RWA: Real World Assets is the fastest-growing sector in DeFi from 2024 to 2025.

January 2024: $4.5B -> June 2025: $12.3B

Approximately threefold growth over two years, with an annual growth rate of +85%...

Although its share in the overall DeFi is still less than 8%, it is rapidly expanding based on institutional participation.

The key driving force behind RWA growth is the overwhelming presence of BlackRock. At the center of this RWA growth is the giant asset management firm BlackRock, which holds a significant share.

BlackRock's BlackRock BUIDL fund occupies an overwhelming first place in RWA TVL, demonstrating their tremendous influence as shown in the table. As indicated in the table, out of a total RWA TVL of $12.8 billion, BlackRock BUIDL accounts for $2.84 billion, and BlackRock's participation significantly boosts institutional investors' confidence in the RWA market.

<Duli thinks this>

Is RWA undervalued or overvalued?

Naturally, based on market capitalization, it is an extremely undervalued sector.

- Based on market capitalization: $12.3B RWA TVL is

▸ 0.009% of the global bond market ($133T)

▸ 0.003% of global financial assets ($400T)→

This can be interpreted as an extremely low market penetration rate.

From the perspective of institutions, I believe they will see this as a market with sufficient merit to diversify capital inflow routes with much lower costs and regulations.

Although liquidity seems to be drying up now, DeFi is gradually evolving and growing.

If BlackRock can prove that this market is a good place to gather money through sufficient profitability (as Tether has done), I believe other institutions will have no reason not to follow suit.

RWA and stablecoins.

I think these two will continue to be long-lasting growth sectors in the future.

They are inseparable structures... it's like Chuberlip itself...

$usdt $usdc $rwa @OndoFinance

Show original

9.48K

2

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.