What is killing three birds with one stone: the gold content and prospects of the TRON microstrategy

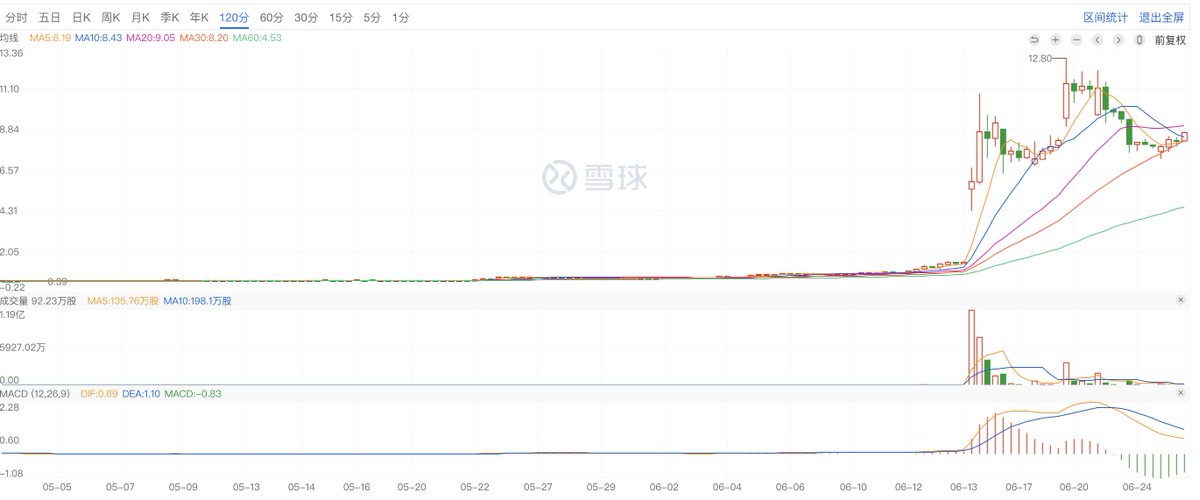

Recently, everyone knows that TRON has reached a reverse merger and listed on the U.S. stock market through cooperation with NASDAQ-listed SRM, and SRM will reproduce the "Bitcoin micro-strategy" model to open the "TRON micro-strategy", and include TRX as a reserve asset in the balance sheet to open the coin hoarding mode. After the news broke, SRM's stock price quickly jumped 11 times to $12.8.

So do you know why it's so crazy?

First of all, I need to explain to you that Bitcoin MicroStrategy is a company called MicroStrategy that continuously increases its holdings of Bitcoin as a long-term corporate asset reserve by issuing convertible bonds and raising funds from equity.

So what are the results of this strategic deployment?

MicroStrategy first bought Bitcoin in August 2020, buying 21,454 Bitcoin for $250 million to open its strategic reserve, and so far MicroStrategy holds a total of 592345 Bitcoin, with a total value of $64 billion and an average cost of $70,681.

It has been nearly five years since the start of the Bitcoin Strategic Reserve, and the stock price of MicroStrategy has risen from $11.78 to a maximum of $543, holding about 2.9% of the total Bitcoin, and the purchased Bitcoin has a floating profit

$22 billion.

It's as if history is playing out again on SRM and TRX

The current stock price of SRM is about $8.7, which is very close to the stock price when MicroStrategy launched the Bitcoin strategy, and both follow the same model, Bitcoin MicroStrategy and TRX MicroStrategy are targeting two different mainstream tokens.

In five years, the stock price of MicroStrategy has risen more than 50 times to 100 billion market value, and the price of Bitcoin has increased 10 times, so will SRM and TRX, which have smaller market capitalizations, create a higher increase myth?

@justinsuntron #TRONEcoStar @trondaoCN

Show original

19.9K

28

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.