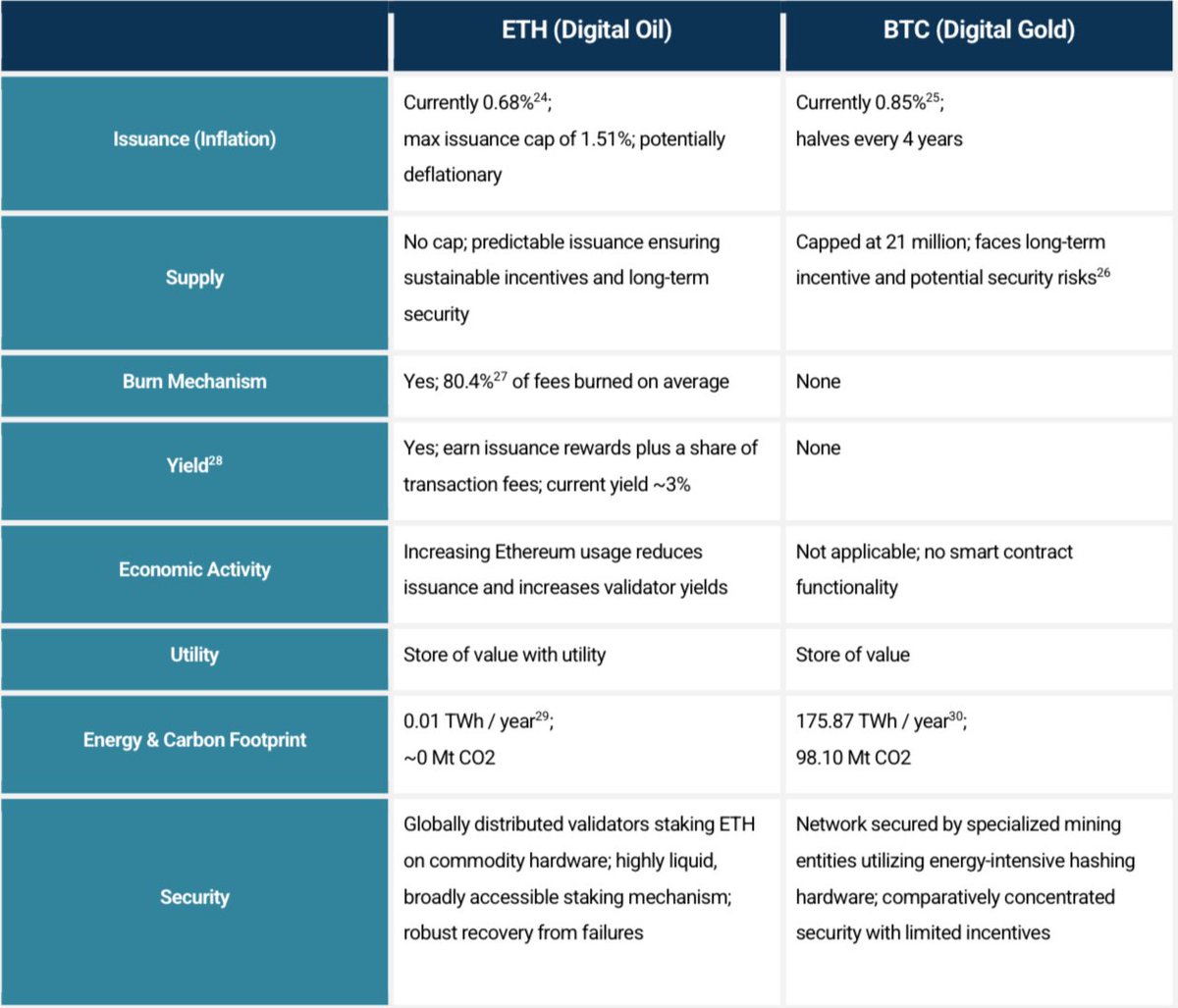

At some point, it will be obvious that ETH will be the apex asset of the on-chain economy, having far superior properties compared to BTC:

- less inflation, long-term deflationary with the accelerating adoption of the on-chain economy (more on-chain activity = ETH deflating)

- generating real yield, 2.3% right now (again, more on-chain activity = more real yield)

- most permissionless collateral to DeFi with low capital costs and high liquidity

When this becomes common sense, we will see 10x inflows into ETH ETFs compared to BTC.

You can bookmark this.

Reminder: we’re just starting the real institutional adoption cycle for Ethereum.

There won’t be only one digital asset store of value. A balanced portfolio will have digital oil—ETH—alongside digital gold.

3.19K

31

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.