Some guy called @Rightsideonly said "go enjoy vacation no need to post a Pendle Highlight this week"

LOL yeh right...anyway, here's the latest:

- Pendle enables the construction of yield curves (yuge)

- New pools: Yearn aGHO-USDf 25-SEP [ETH] | reUSDe 18-DEC [ETH] | Aave stkaUSDT & stkaUSDC 30-OCT [ETH]

TASTY on Pendle:

- Stables: sGHO [28-AUG] [ETH] @ 21.91% LP-APY | cwgUSD [26-JUN] [BASE] @ 11.15% PT-APY

- ETH: wstETH [25-DEC] [ETH] @ 5.91% LP-APY | superETH [31-JUL] [ETH] @ 4.5% PT-APY

- Trending Markets: sUSDe [25-SEP] [ETH] 7.23% PT-APY | USDe [31-JUL] [ETH] 7.12% PT-APY | sUSDf [25-SEP] [ETH] 10.09% PT-APY

Last week:

- Pendle is 4 years old:

- Pendle back to $5B TVL:

- Pendle LPs can now be used as collateral in Silo:

- Additional thoughts of what Boros is:

- Pendle Print #71:

Wow, ok back to ze holibobs :))

DeFi is no longer in its infancy. We’ve moved past the chaotic Cambrian explosion of experimentation and hype, into what might be best described as the “Silver Age”, a period of growing maturity, structural refinement, and focus on practical economics.

Just as TradFi evolved over centuries, from barter trade to banks, money markets, and eventually interest rate derivatives, DeFi is now undergoing a similar process. Token-to-token swaps which heralded DeFi Summer marked our barter era. Lending protocols like Aave, Compound, Morpho, and Euler formed the bedrock of crypto’s banking layer. And now, the next great leap is underway: the emergence of a yield curve and a functioning market for interest rate pricing and hedging.

At the center of this shift is Pendle, which has pioneered and popularized DeFi fixed yield as well as yield trading, providing the tools for the price discovery of yield.

Price discovery is a cornerstone of financial maturity. It enables capital to flow where it’s most productive, creates the conditions for informed decision-making, and allows both individuals and institutions to manage risk effectively. Without a functioning pricing mechanism, any market remains speculative and inefficient.

Not so long ago in the early days of “Points” meta, ETH and stablecoin fixed yields regularly spiked past 100% APY. But today, yields on Pendle have stabilized into a much more sustainable 3-15% Fixed APY, a shift that reflects a maturing market underpinned by stable, reliable flows and real demand.

Thus, Pendle facilitates yield price discovery on both a microeconomic and macroeconomic level.

1. Microeconomic Level: Democratized Access to Emerging Protocols

With the rise of points and airdrop farming, Pendle has evolved into more than just a yield venue, effectively functioning as a platform for protocols to bootstrap liquidity.

Through YTs, users can speculate on future protocol rewards such as airdrops or points, while PTs offer predictable, fixed yields. This dual-token system allows the market to price yield components separately, offering a rich set of signals to both investors and protocols. In certain cases, users have chosen YT as a form of democratized access to protocol tokens, as it could offer a similar exposure as those heavily gated private rounds only available to venture capital firms or insiders.

With YT, Pendle users can:

- Enter positions at any point in time before maturity, often without lockups or vesting schedules

- Observe and gauge the protocol in action for a prolonged “DYOR” period before deciding to commit

- Buy-in later at a discount as YTs decay toward maturity, allowing latecomers to “catch up” even if they missed the boat the first time, second time, third time…

The result is a dynamic, open marketplace that actively facilitates pricing of project TGEs, unlocking early access to potential upside while enabling hedging and capital efficiency.

In TradFi, the yield curve is considered a leading economic indicator. It helps assess inflation expectations, recession risks, and future monetary conditions. It also serves as the benchmark for pricing everything from bonds to structured debt products.

Now, DeFi has the building blocks to replicate that onchain, providing a new layer of market intelligence far beyond what price charts or funding rates can offer.

2. Macroeconomic: Building the Yield Curve of Crypto

The DeFi yield market is still in its nascent stage compared to its traditional counterpart, but it's a critical piece in nurturing a mature and sustainable financial ecosystem. At a macro level, Pendle is in the process of establishing something DeFi has lacked: a yield curve.

Currently, the most commonly viewed aspects in crypto are:

a) Token prices

b) Funding rates

c) Fear and greed index

In TradFi, the yield curve is considered a leading economic indicator. It helps assess inflation expectations, recession risks, and future monetary conditions. It also serves as the benchmark for pricing everything from bonds to structured debt products. Now, DeFi has the building blocks to replicate this infrastructure.

Pendle’s yield markets enable participants to:

- Lock in yields across various maturities (e.g., 3-month, 6-month, etc.)

- Observe how short-term vs long-term rates evolve

- Infer macro signals like future liquidity tightening or easing

The curve provides a layer of market intelligence beyond what price charts can offer. More interestingly, with the upcoming launch of Boros, DeFi will see the creation of the world’s first funding rate curve, another first for the crypto economy. This curve will chart market expectations of perp funding rates over time, opening the door to a richer, more dynamic layer of yield analytics, strategy construction, and market interpretation.

In TradFi, yield curves shape everything from debt issuance to equity valuations. For crypto to reach its “Golden Age,” it needs similar tooling to support its own growing economy.

Importance of Yield Curve in Crypto

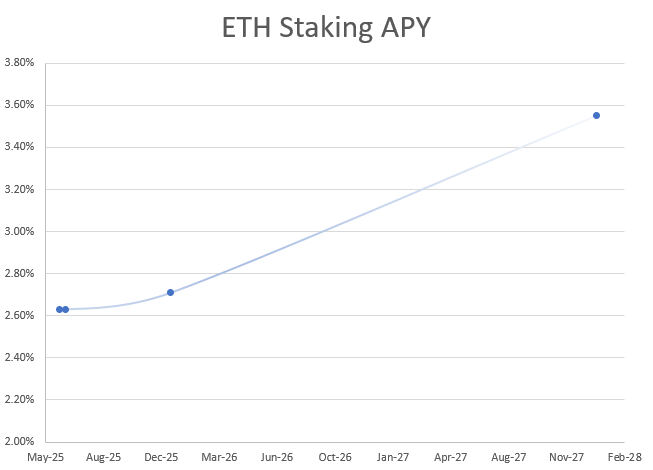

An upward-sloping yield curve of ETH staking APY plotted with Pendle’s stETH markets. The longer-dated maturity pools have higher yields due to greater uncertainty of yield changes over longer periods, which is how a “normal” yield curve would look like.

With the funding rate curve, deeper insights can be gathered on:

1. How the market is pricing various durations of funding rates and how this plays into short and long term market sentiment.

2. Liquidity health across tenures and where demand is greatest during times of market stress.

3. Brand new dynamics which form as more transparency and efficiency is created in the Funding markets

In my previous piece, I argued that stablecoin-denominated fixed yields will form the backbone for onboarding TradFi institutions into DeFi. These institutions are already searching for uncorrelated, attractive returns, and stablecoin fixed yields offer exactly that. But to participate meaningfully, they need more than just raw return figures. They require infrastructure that mirrors the analytical rigor and risk frameworks of traditional fixed income markets.

That’s where Pendle comes in.

Pendle enables the construction of yield curves, the discovery of interest rates, and the tools for institutional-grade risk management. This combination lowers the barrier for TradFi to enter, offering familiar frameworks in a novel, blockchain-native economy.

By establishing yield pricing at scale, Pendle is laying the rails for institutional adoption, ushering in the next “Golden Age” of DeFi, where yield becomes not just an opportunity, but a cornerstone of the new global financial system.

Job’s not done.

16.5K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.